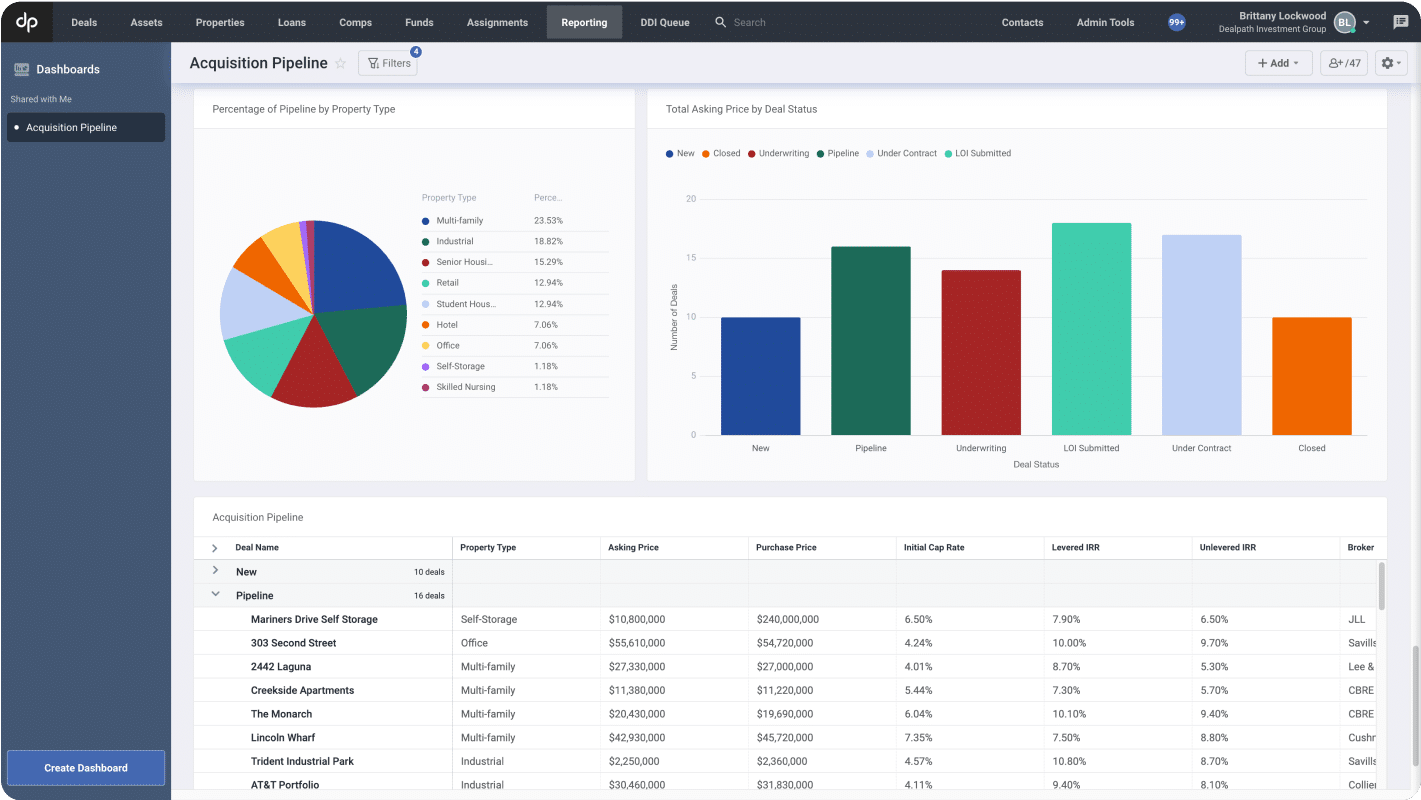

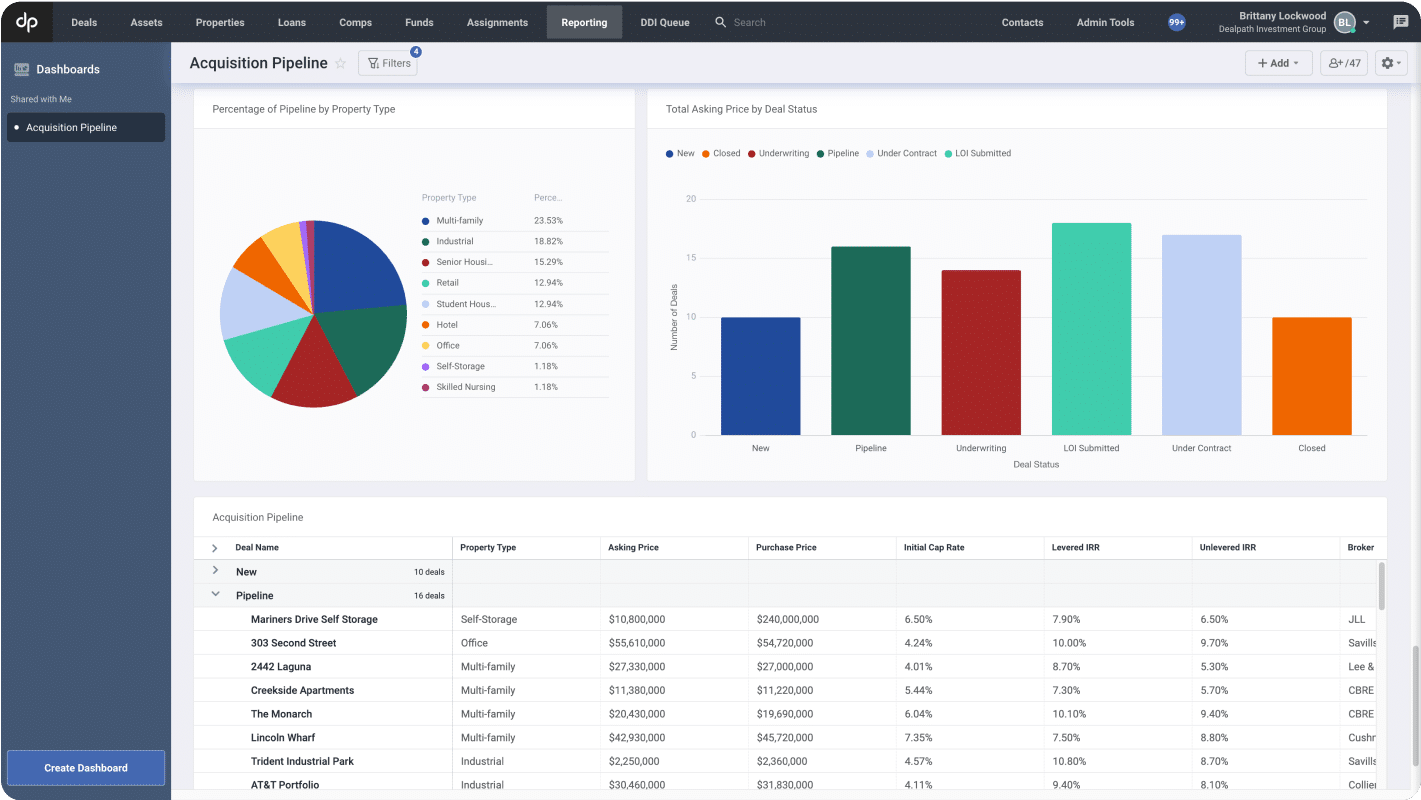

Real Estate Acquisitions Software

Dealpath for Acquisitions

Modernize decision making across your acquisitions pipeline with data-driven conviction and AI-powered efficiency.

Modernize decision making across your acquisitions pipeline with data-driven conviction and AI-powered efficiency.

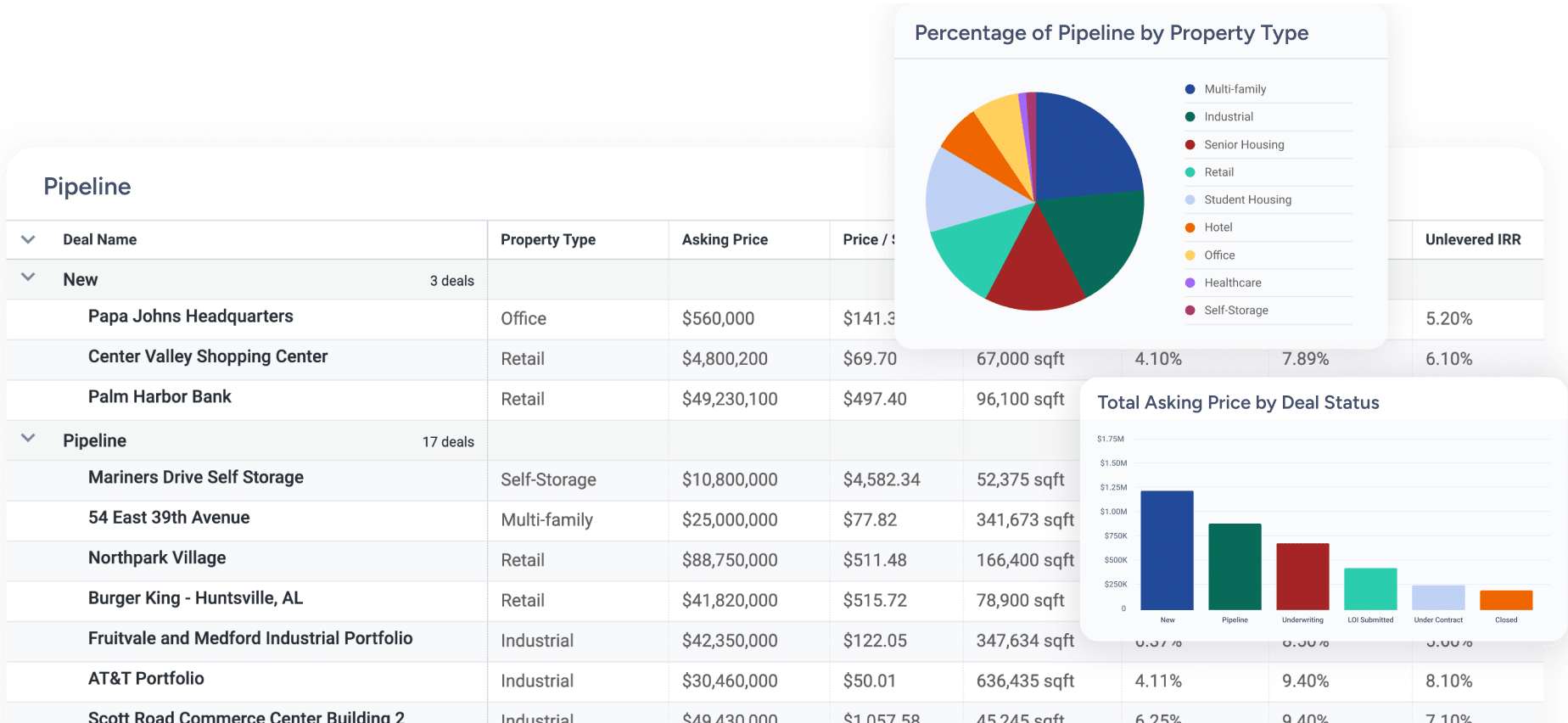

Eliminate conflicting systems of record with a centralized command center. Scale your investment program and create repeatability with role-based workflows to ensure accountability and minimize risk.

Investment management firms and acquisitions teams rely on Dealpath to eliminate manual work and maximize their impact throughout the deal lifecycle.

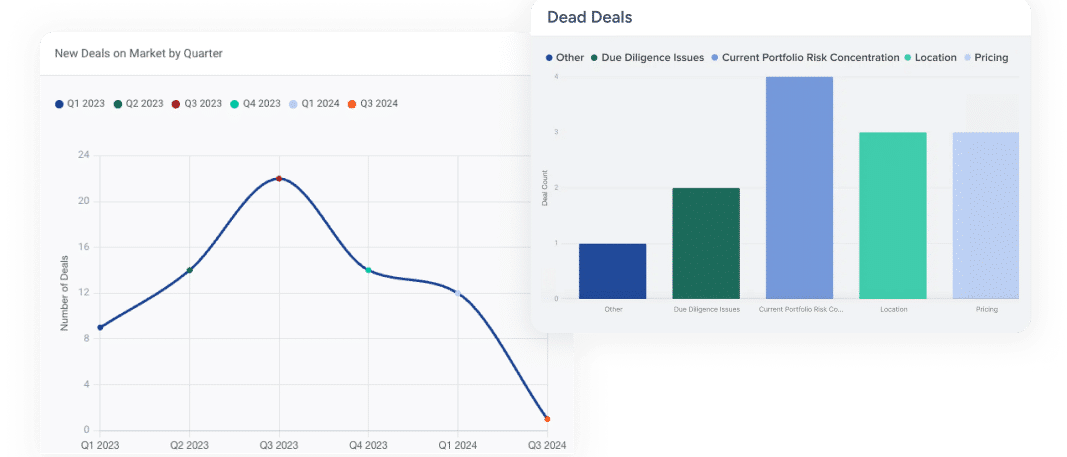

Evaluate more deals and eliminate manual data entry

Capture data from OMs in minutes with AI Extract to expedite deal evaluation and retain market data, whether or not you pursue a deal.

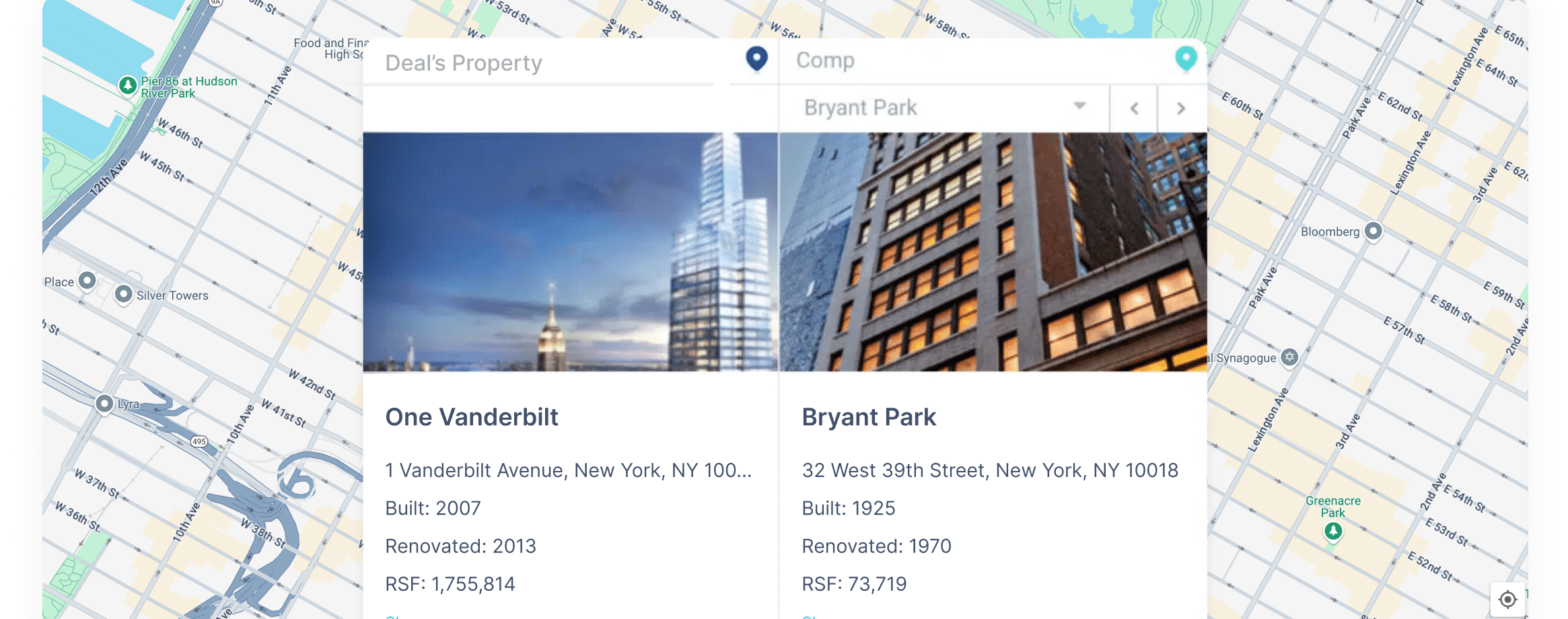

Evaluate deals with next-generation data analysis

Unearth relevant comparables to validate model assumptions and determine if the deal matches your target risk profile based on evolving conditions.

Formalize diligence with institutional rigor

Collaborate, share documents and track approvals with internal and external teams to better manage risk, memorialize decisions and prevent missed deposits.

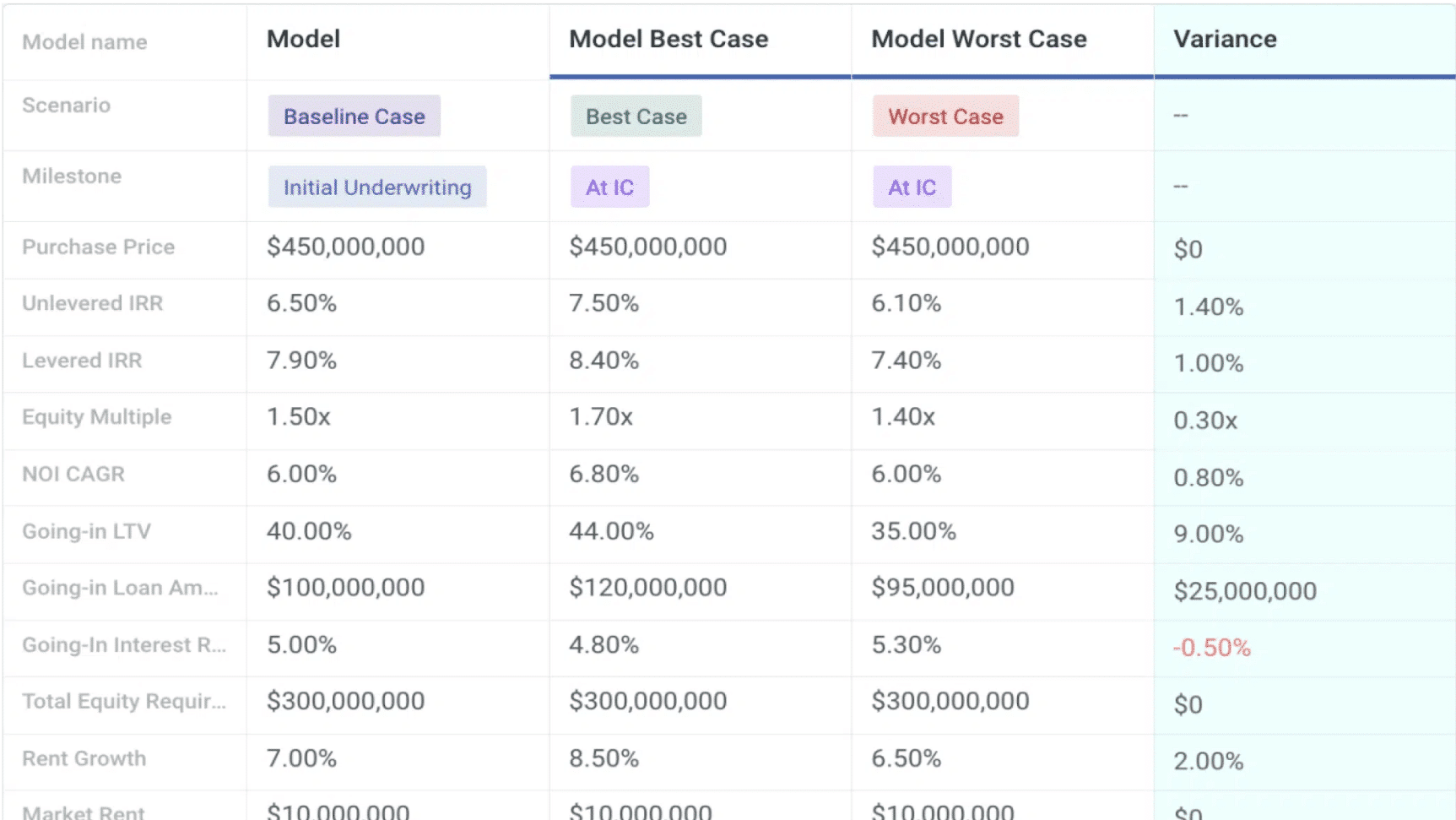

Close with a clear audit trail

Surface empirical evidence to support investment committee pitches, automate IC memo creation and record deal closing details to share with portfolio and asset management teams.

Stay in the loop about deal management best practices, upcoming events, industry trends and more.