CAPTURE

Data

Eliminate manual data management as you amass market intelligence and prepare your data for the age of AI

AI Extract

Database

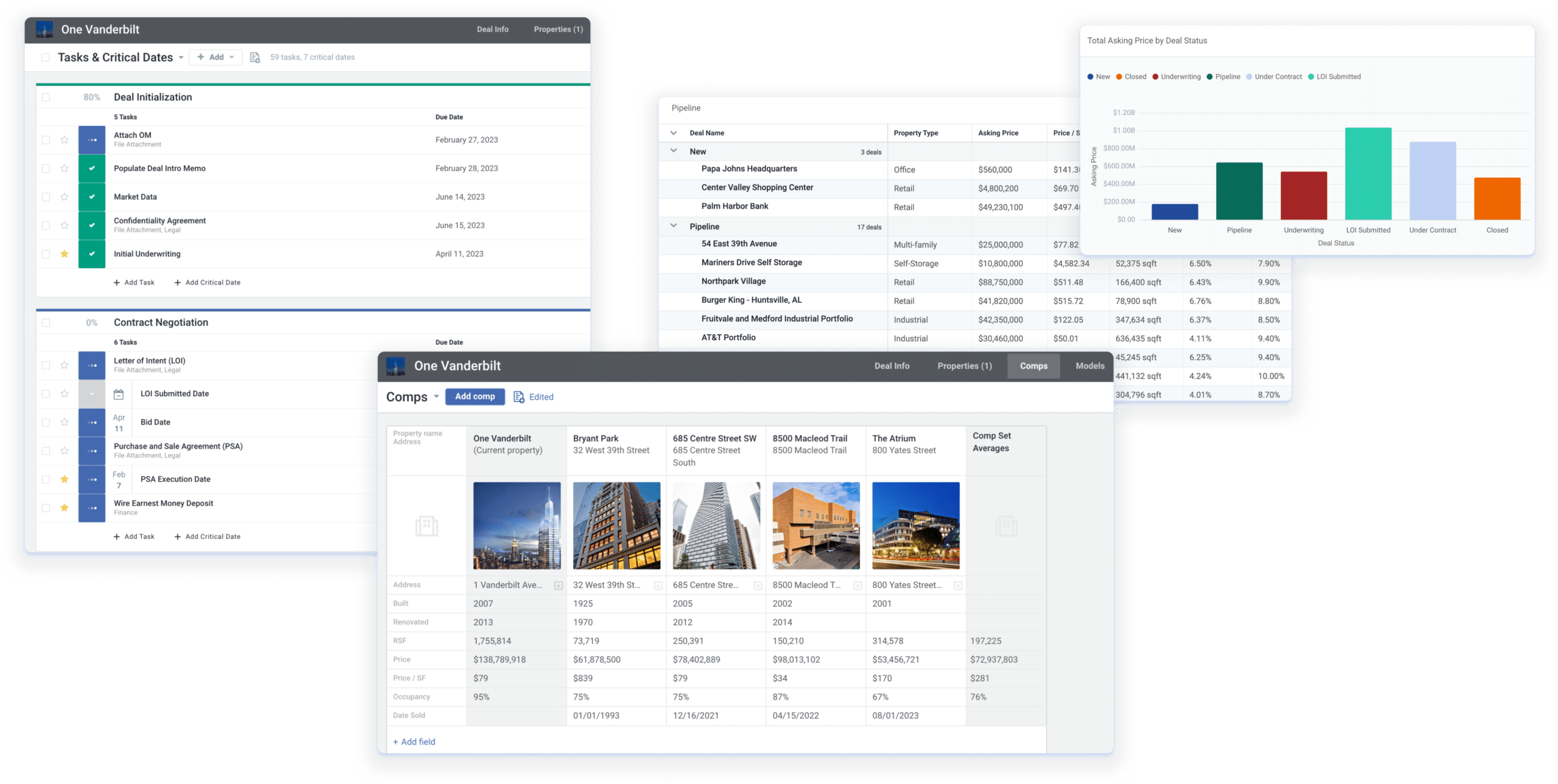

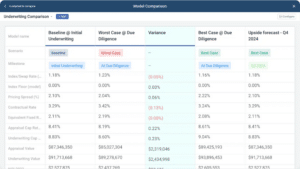

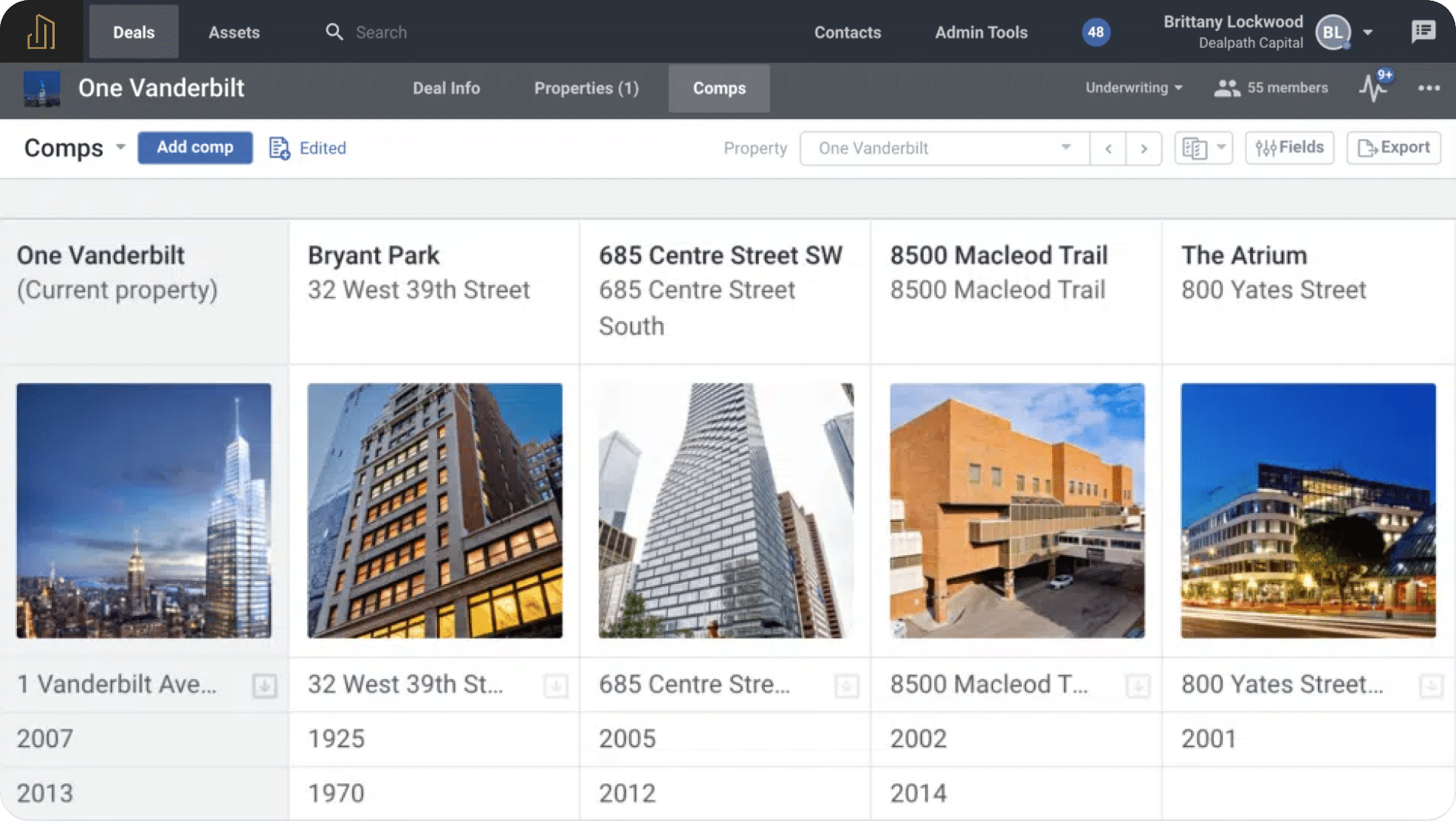

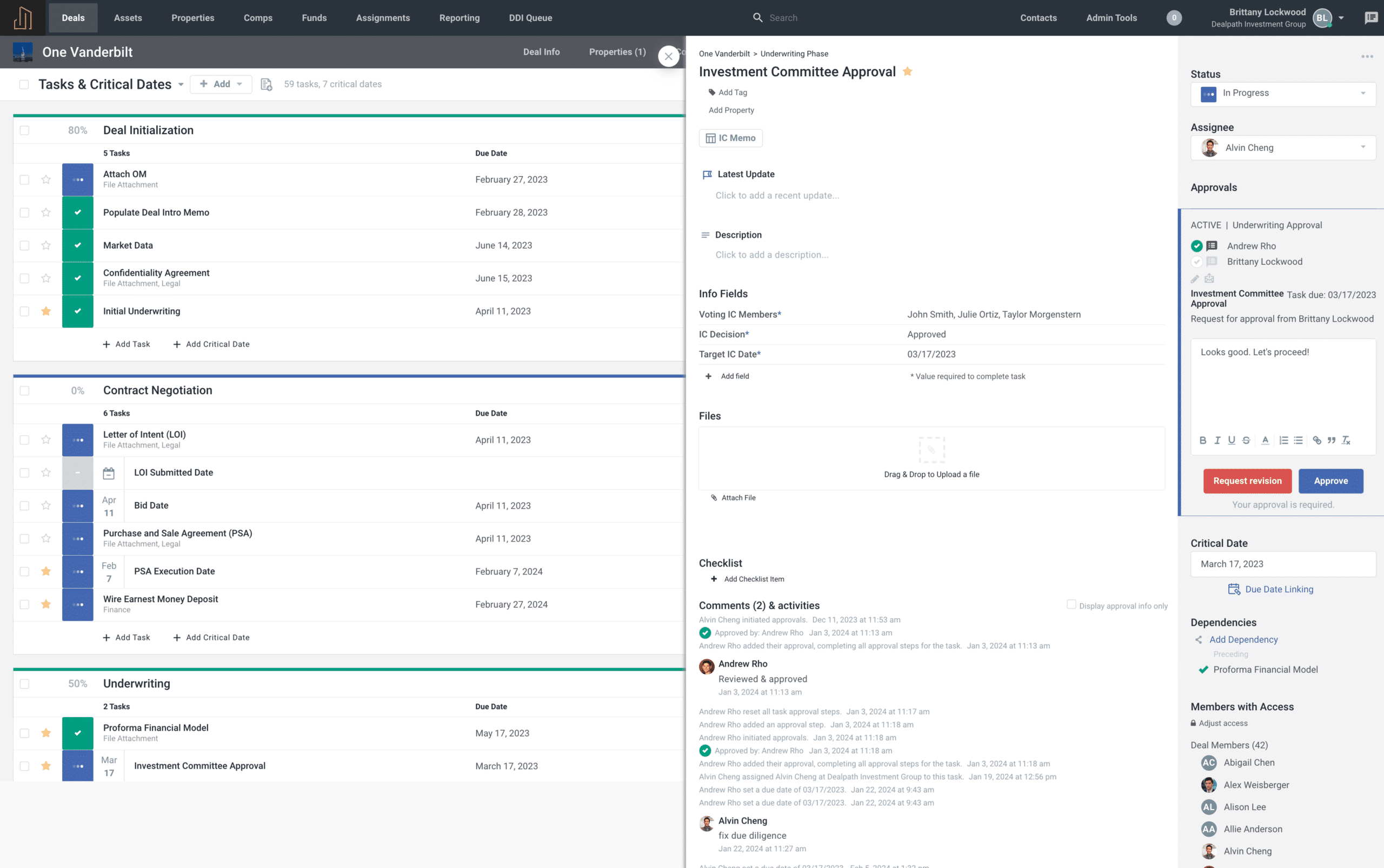

Deal Data Hub

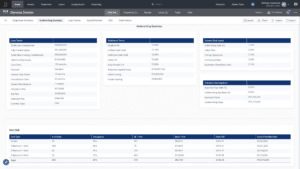

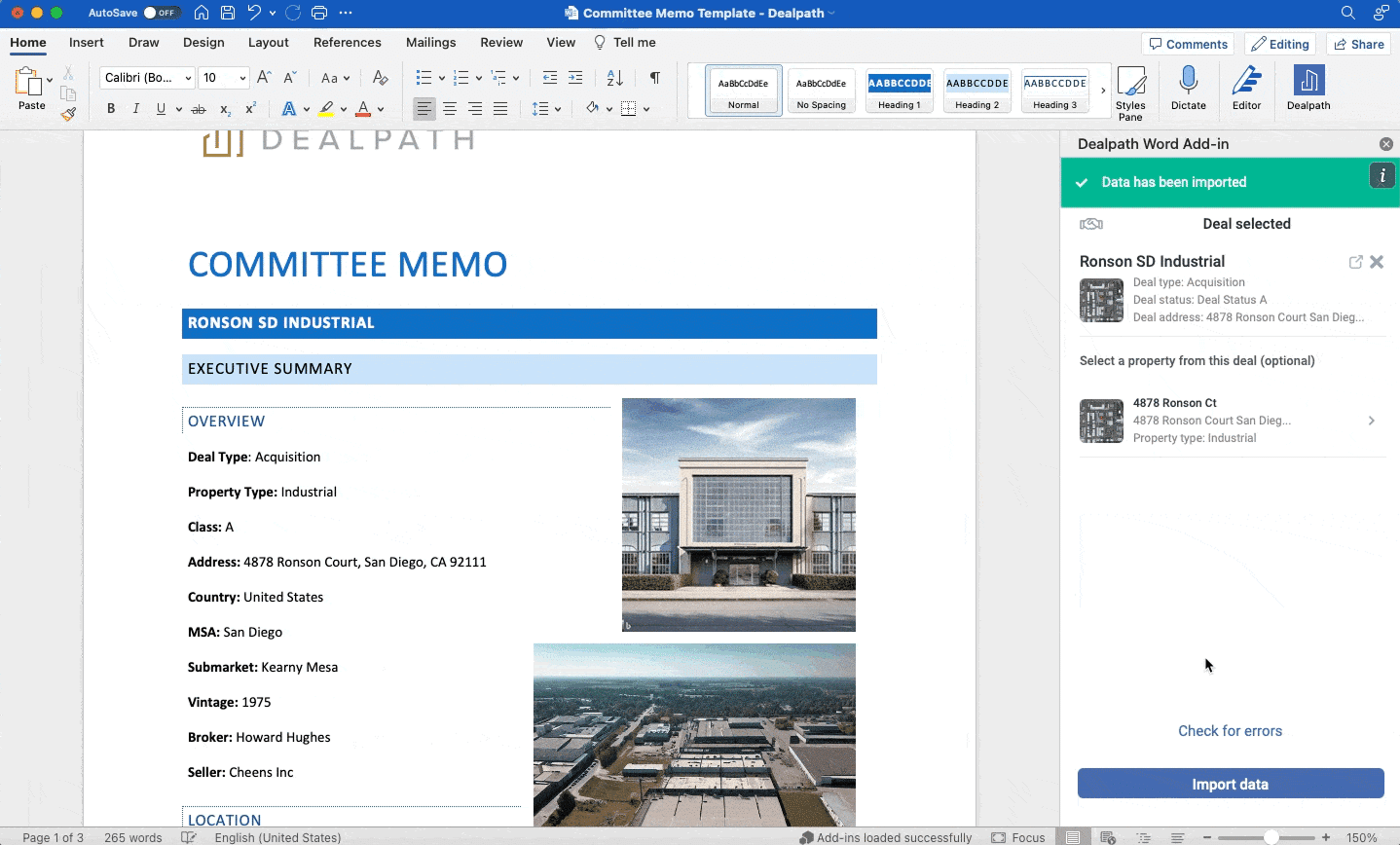

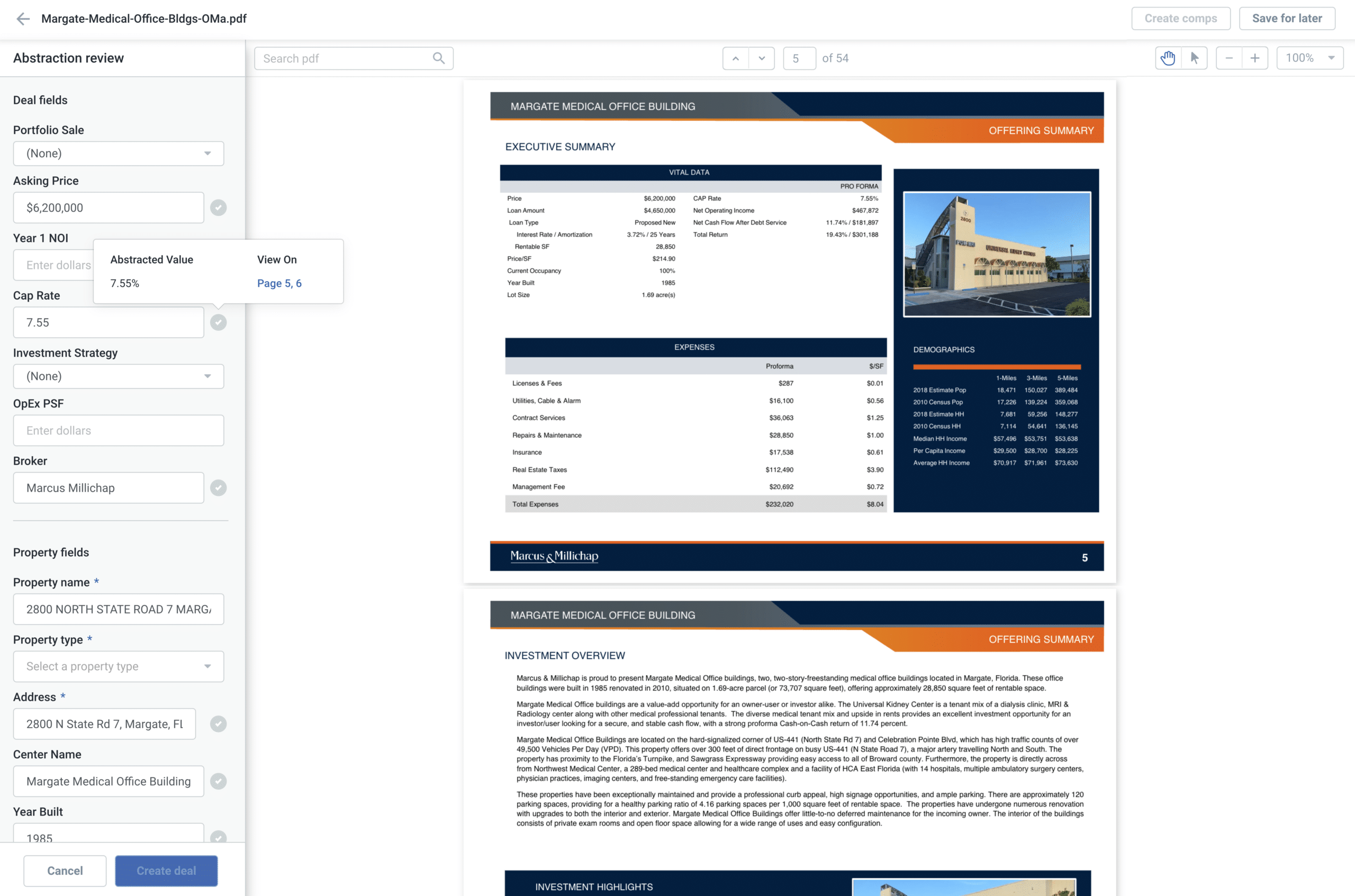

AI Extract

Extract data from OMs and flyers with an AI-powered tool so you can evaluate more deals and build a proprietary property database to inform decisions

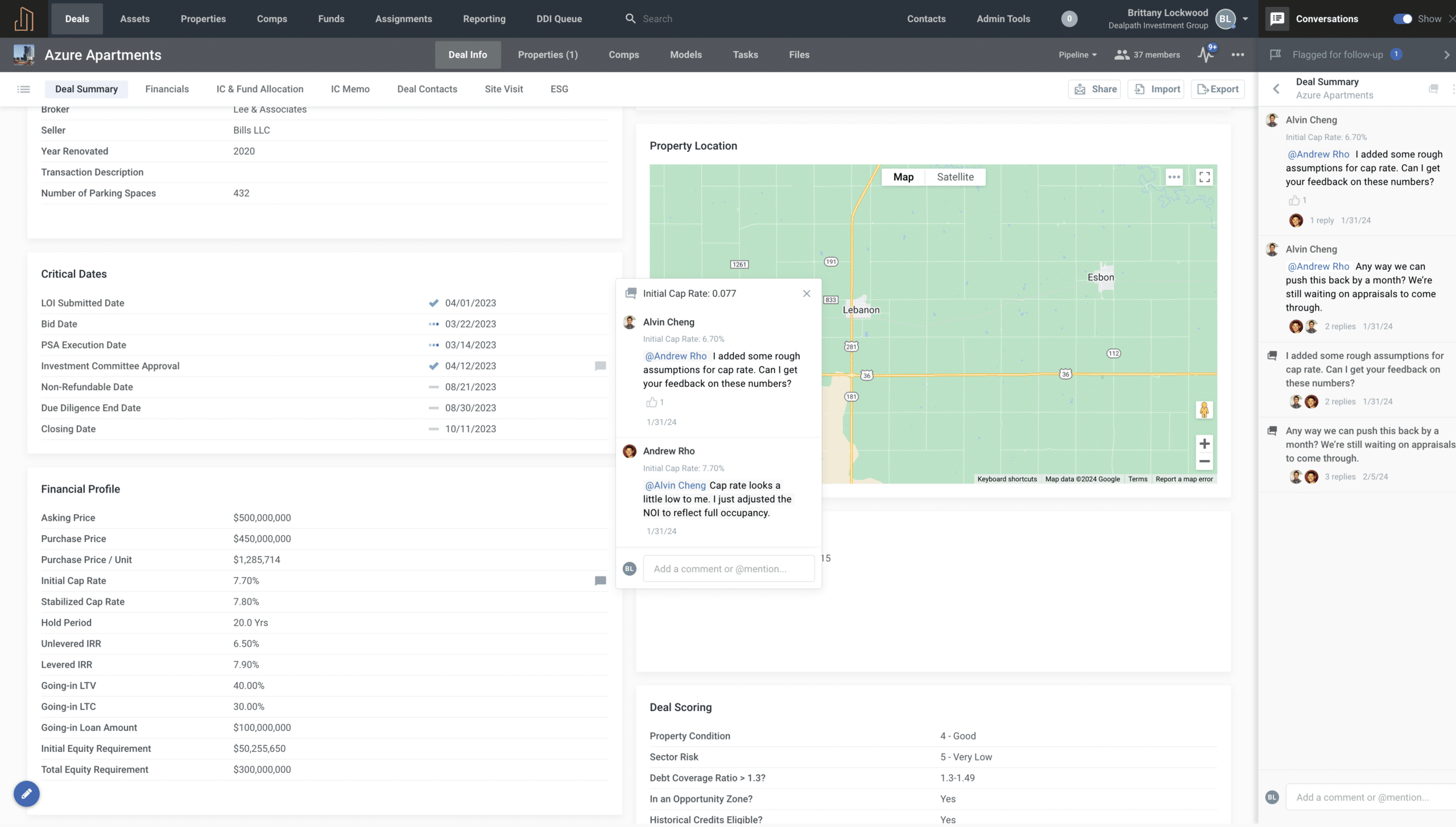

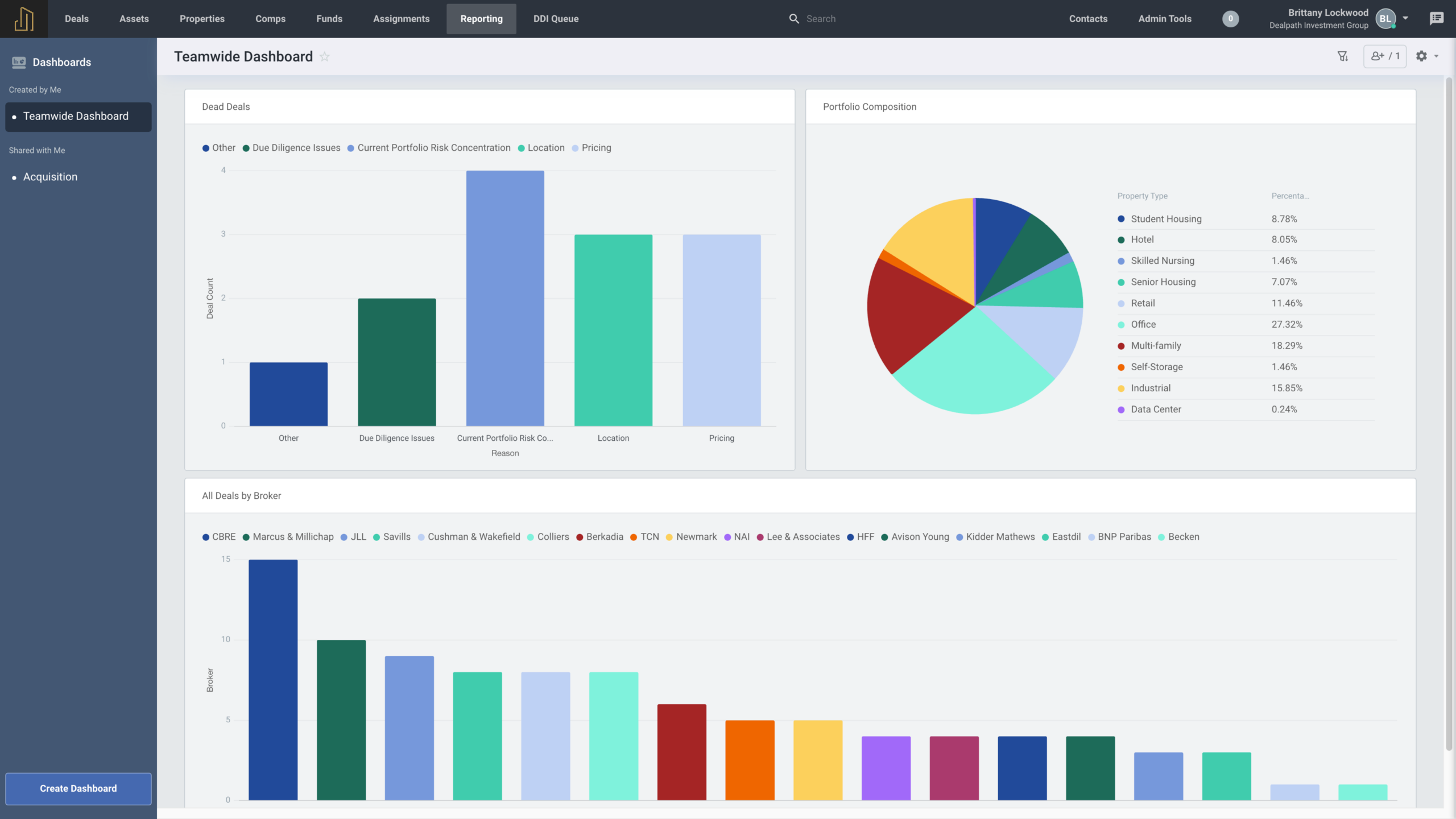

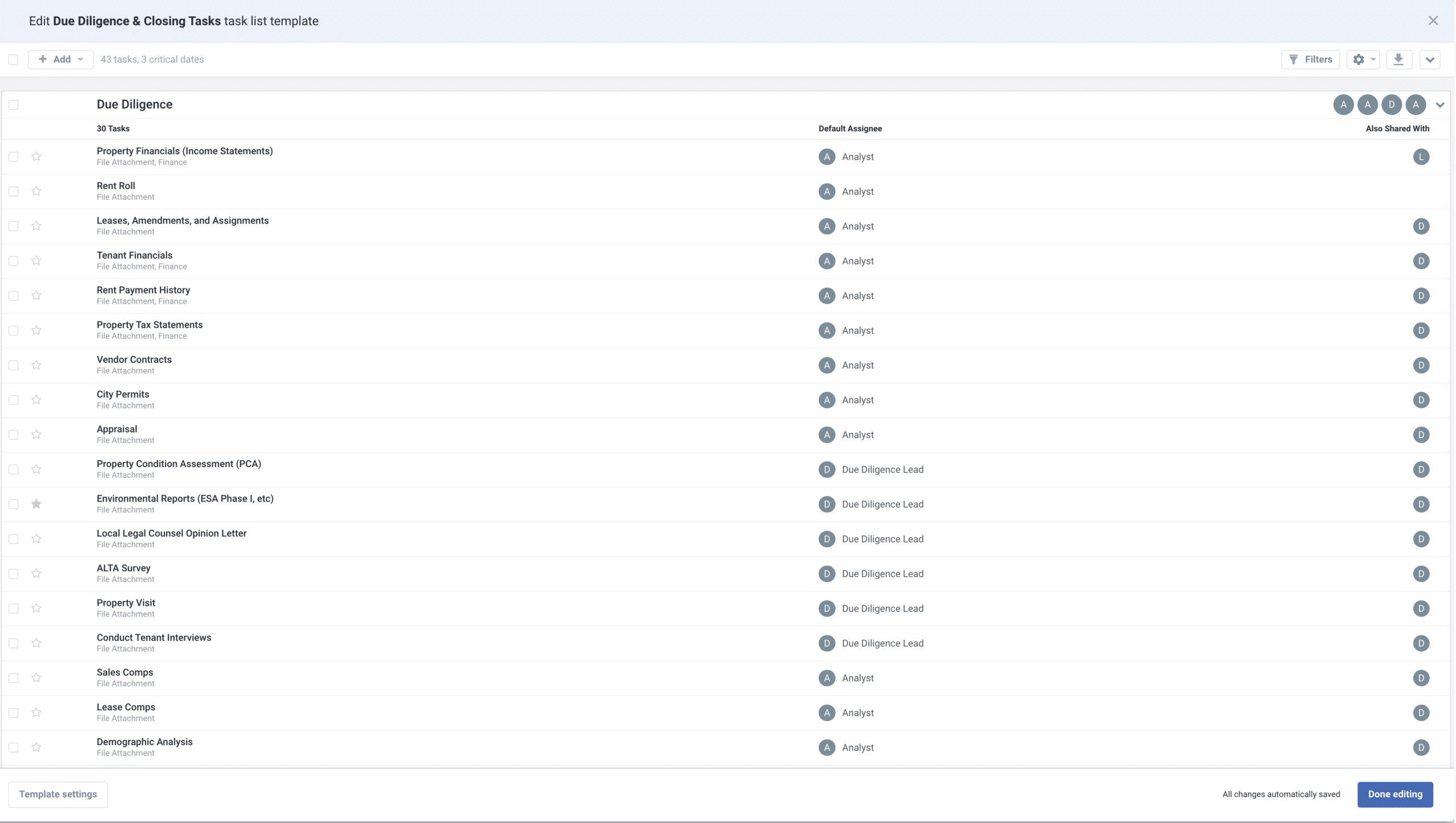

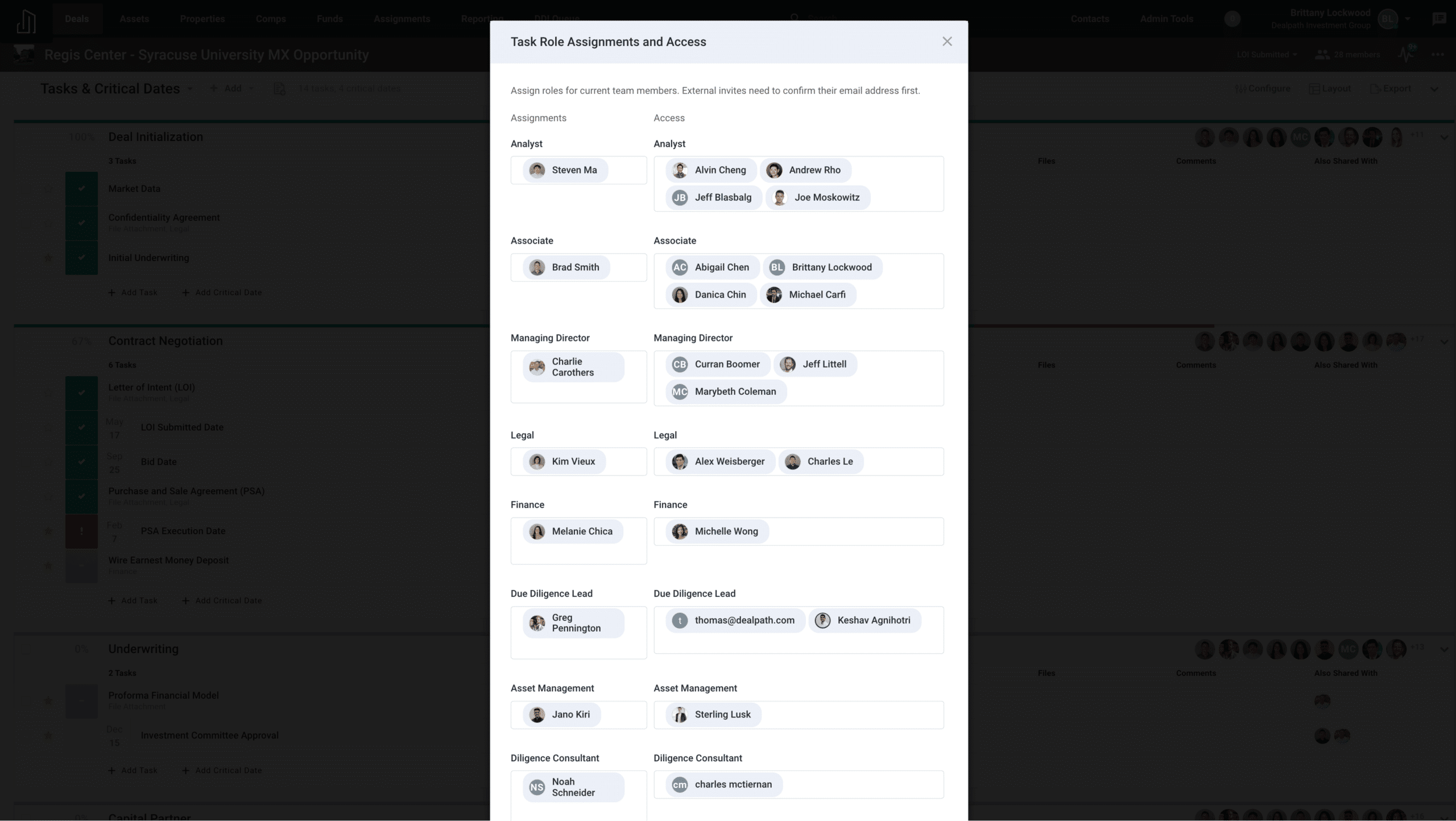

Database

House all property, deal, and asset data in a centralized source of truth with consistent data structures aligned to your strategy

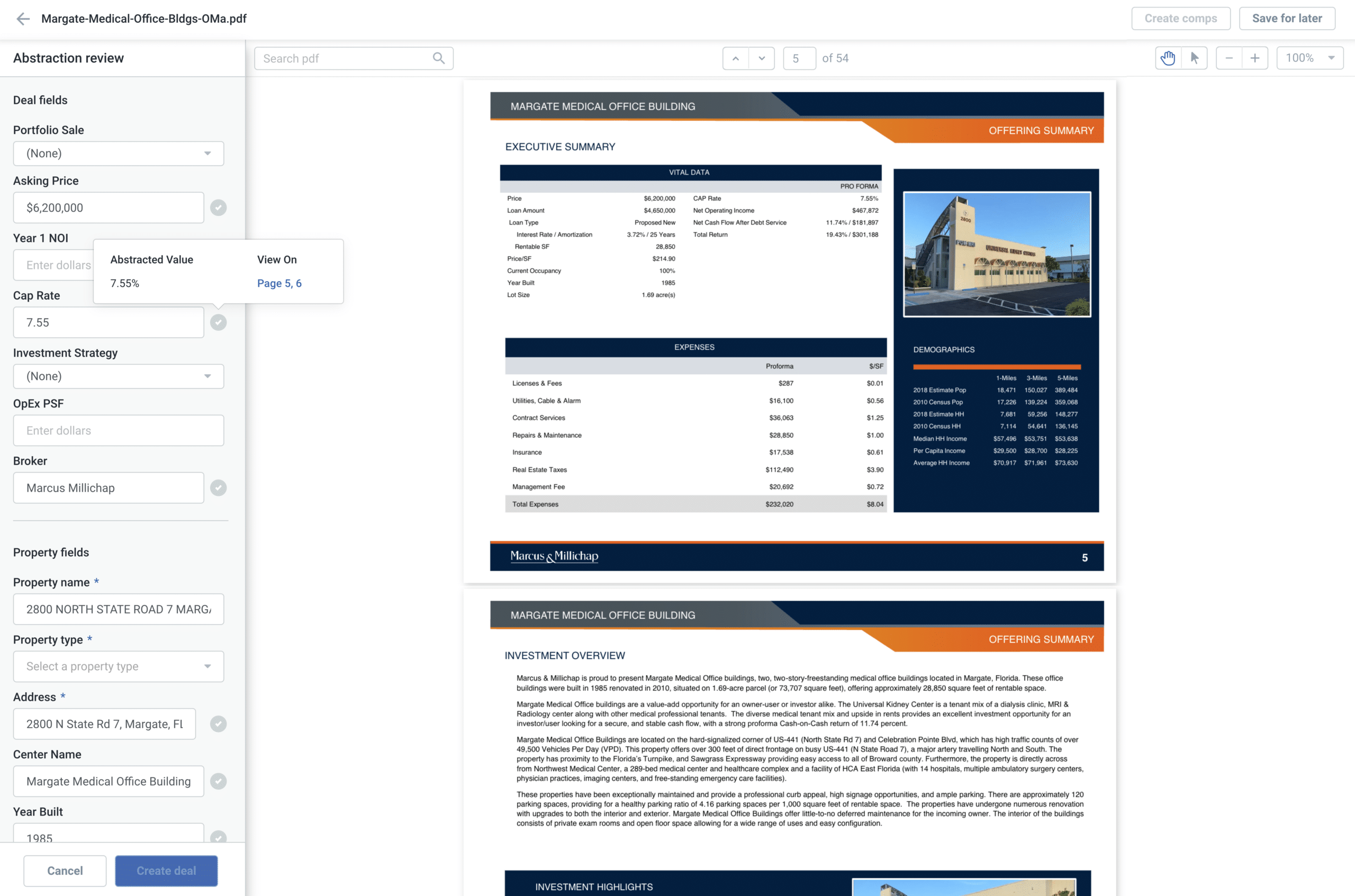

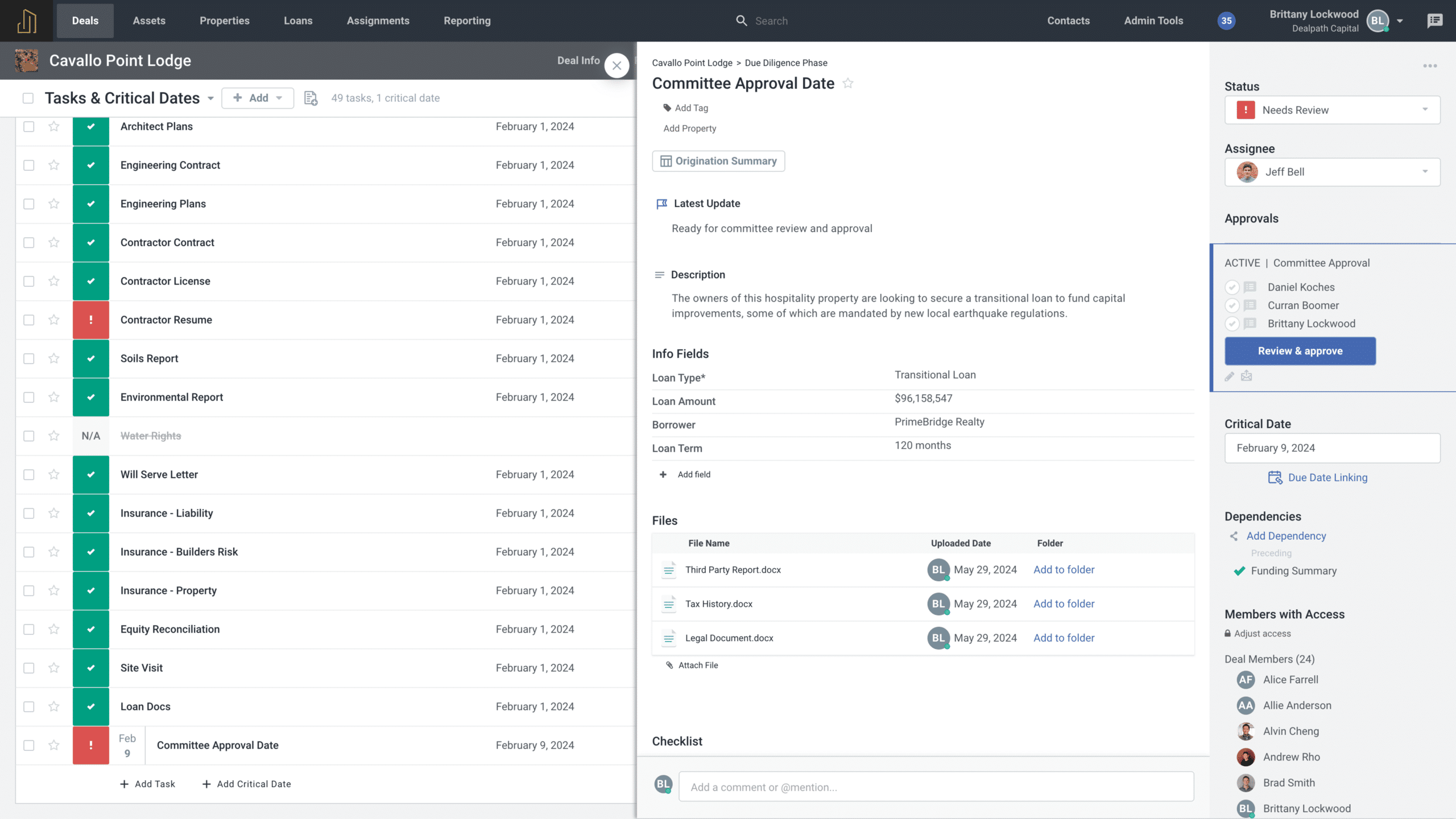

Deal Data Hub

Centralize all the deal data about a single deal in one place to easily surface information in 3 months or 3 years, including property data, financials and more