Systematize execution from LOI to close with automated workflows, real-time collaboration, and audit-ready documentation, so deals progress without delays or surprises.

From underwriting and IC approvals to diligence tracking and final documentation, Dealpath brings every step of execution into one collaborative platform.

Without standardized workflows, every deal is a one-off. Dealpath enables consistent, repeatable processes that reduce risk and scale as your pipeline grows.

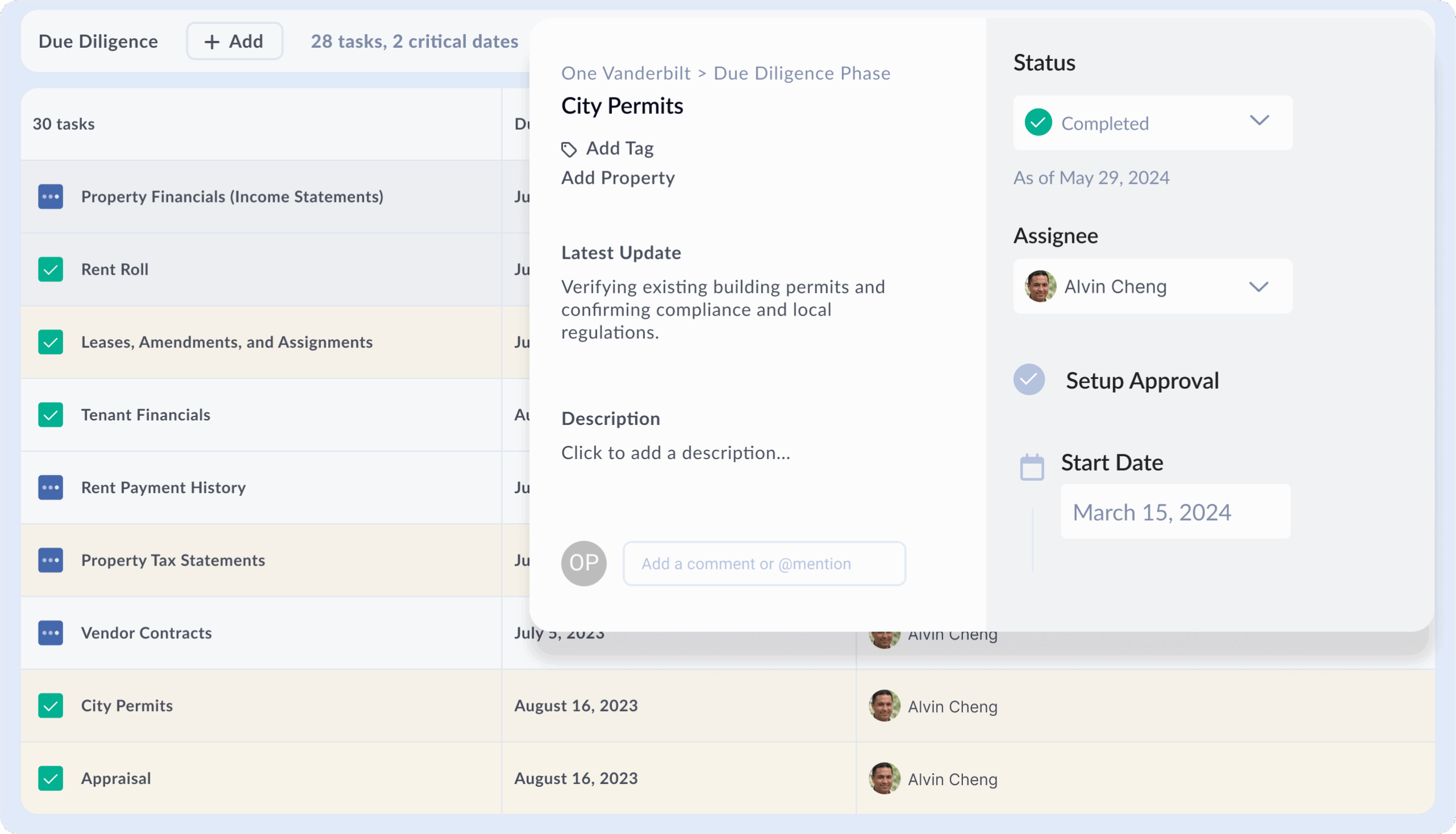

Email threads and shared folders make it challenging to find critical deal updates. Dealpath gives teams real-time access to the status of due diligence, documents, and ownership all in one place.

With structured, reportable assumptions and versioned models in Dealpath, you can present clean data and move with confidence.

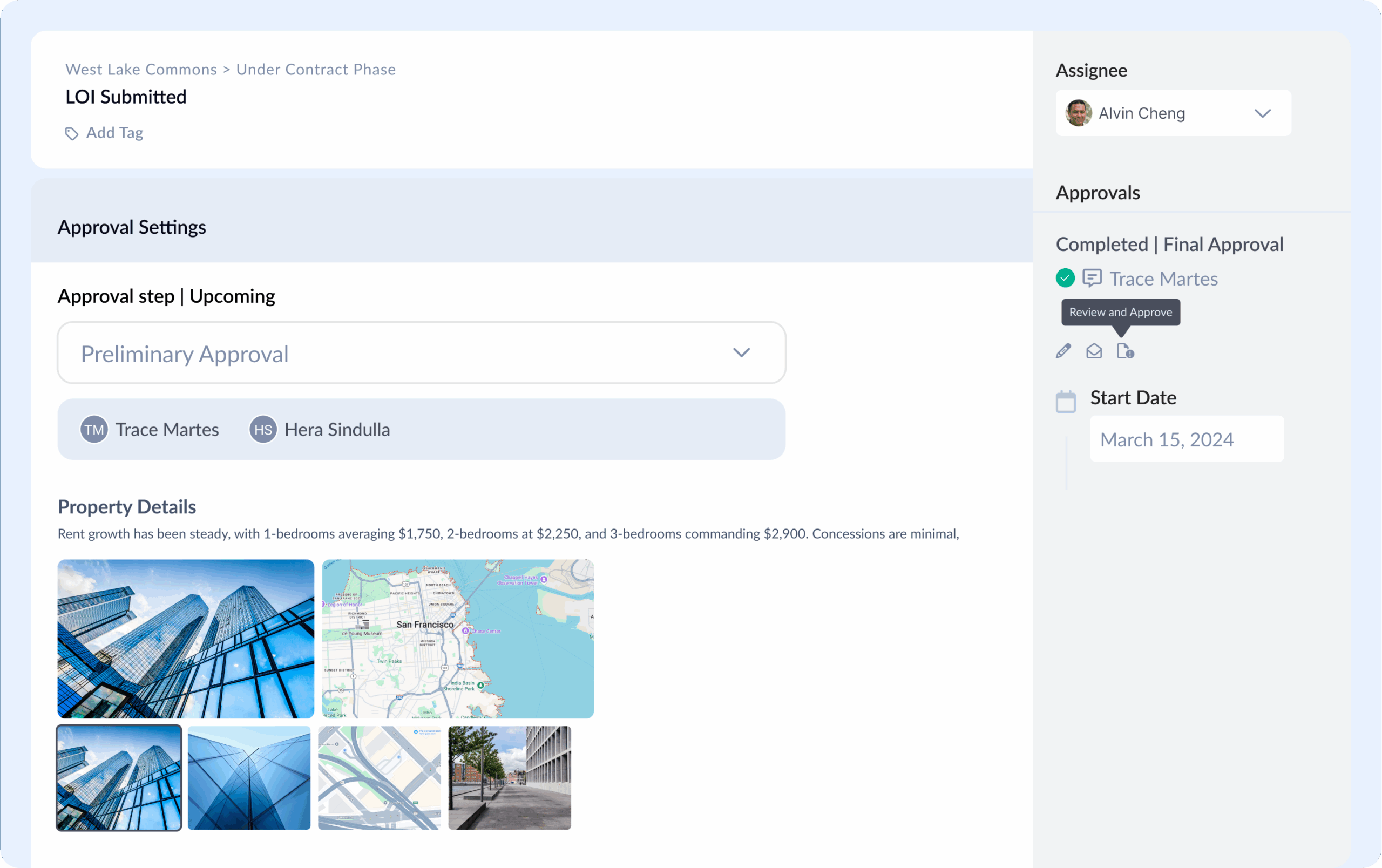

Execution starts with capturing every opportunity in a structured, collaborative pipeline. From there, teams can upload and version underwriting models, map key assumptions, compare scenarios, and log decision criteria all in one place to align stakeholders and prepare for investment committee review.

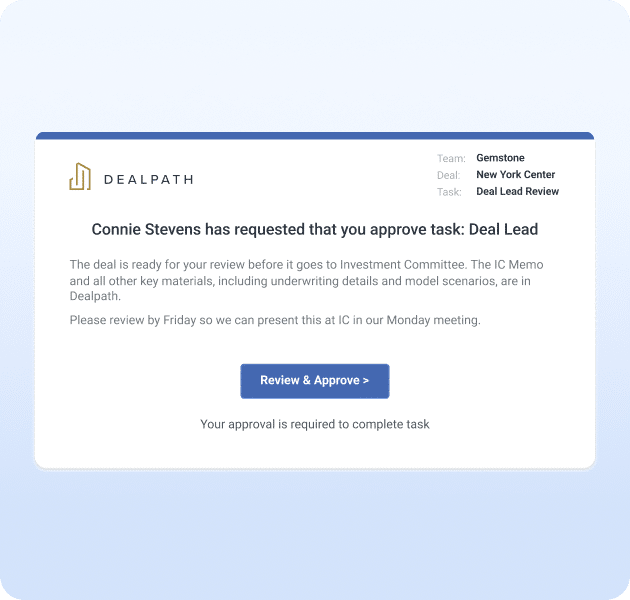

Create clear, repeatable processes by assigning the right tasks to the right people at the right time. Keep deals moving with automated handoffs, smart reminders, and built-in approval steps. Generate investment committee teasers and memos directly from live deal data.

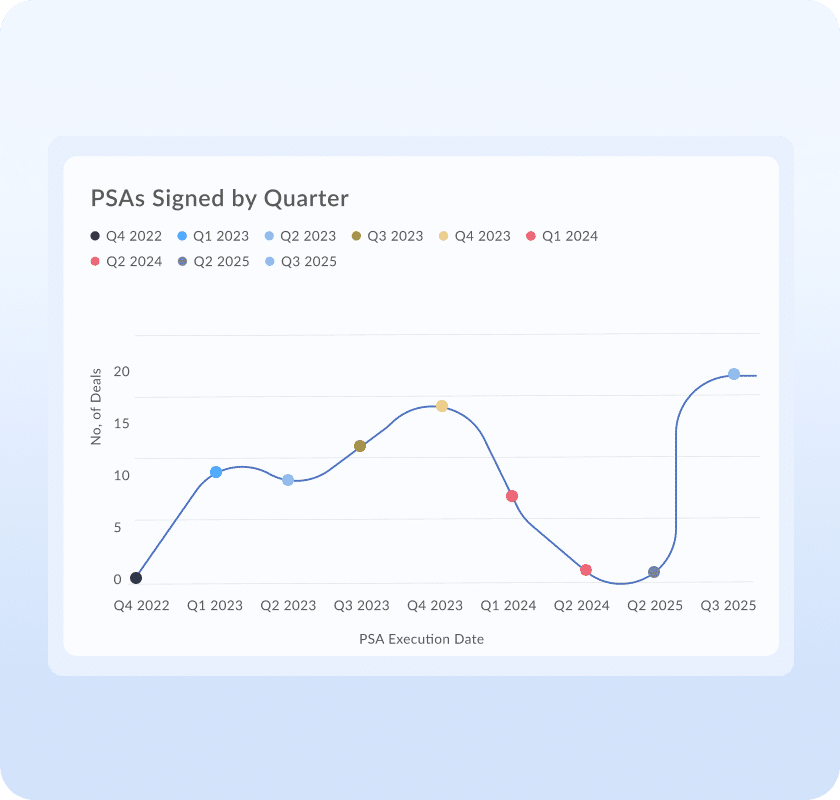

Manage due diligence tasks, documents, and deadlines in one place. Track critical dates and transaction milestones, including PSA execution, with clear ownership, smart reminders, and visibility into what’s ahead. Move faster from LOI to close while building trust with key stakeholders and capital partners.

Eliminate bottlenecks and reduce execution risk with centralized workflows, structured approvals, and real-time visibility from LOI to close.

Eliminate bottlenecks and reduce execution risk with centralized workflows, structured approvals, and real-time visibility from LOI to close.

Stay in the loop about deal management best practices, upcoming events, industry trends and more.