Amass market intelligence and mitigate risk while gaining visibility into all debt origination activities across different originators, regions and teams

More deals evaluated

Increase in deals closed

More capital deployed

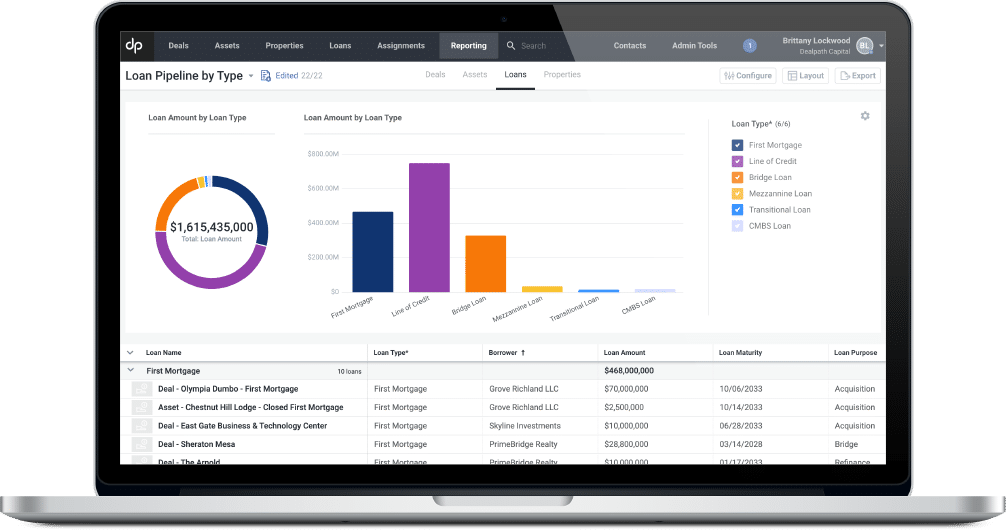

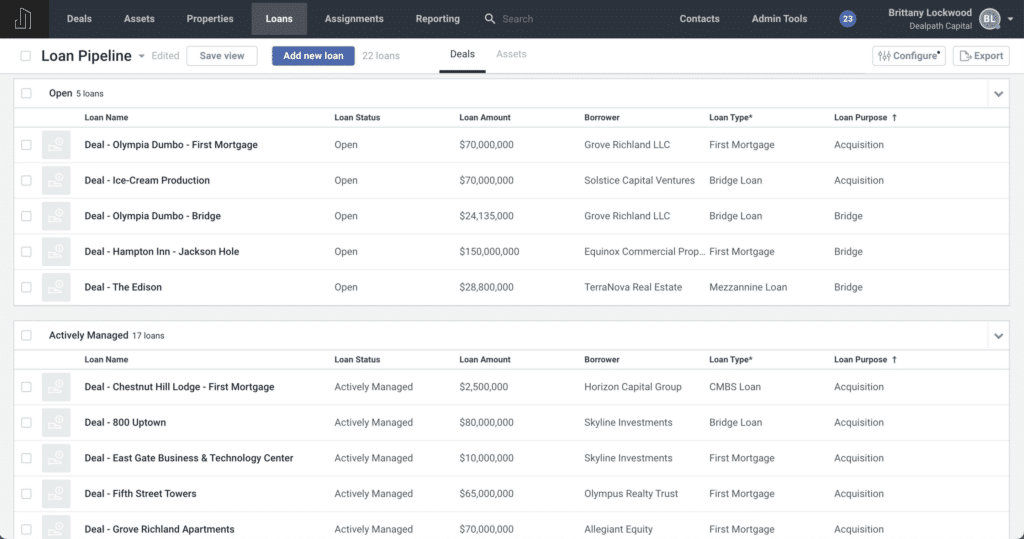

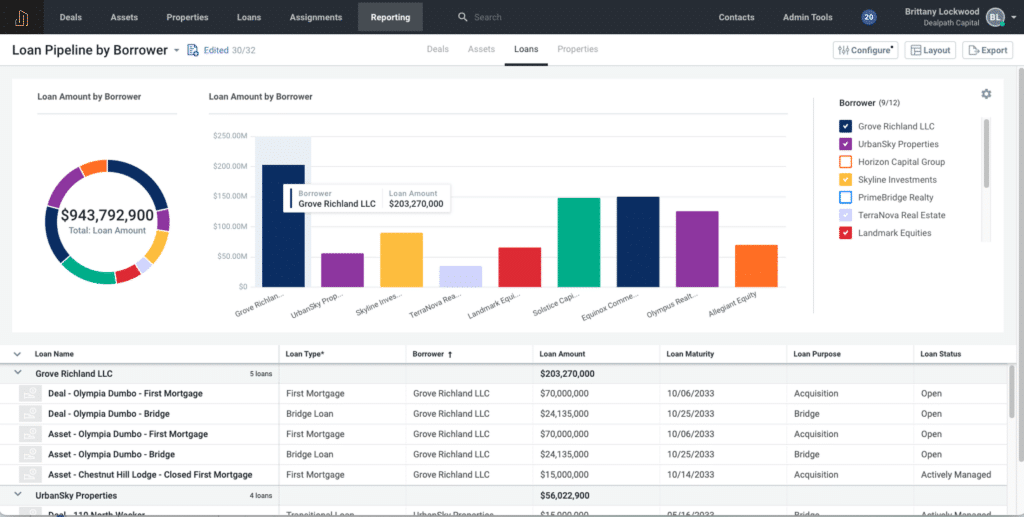

Gain visibility into all debt origination pipelines and metrics across regions and teams

Centralize institutional knowledge across your firm, while improving data-driven screening, underwriting and evaluations

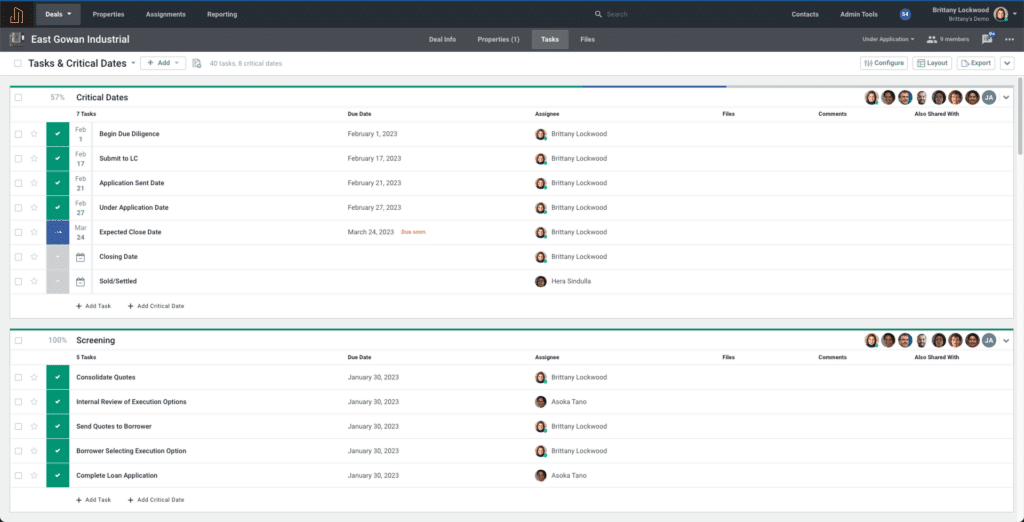

Configurable and automated task management to improve operational efficiency

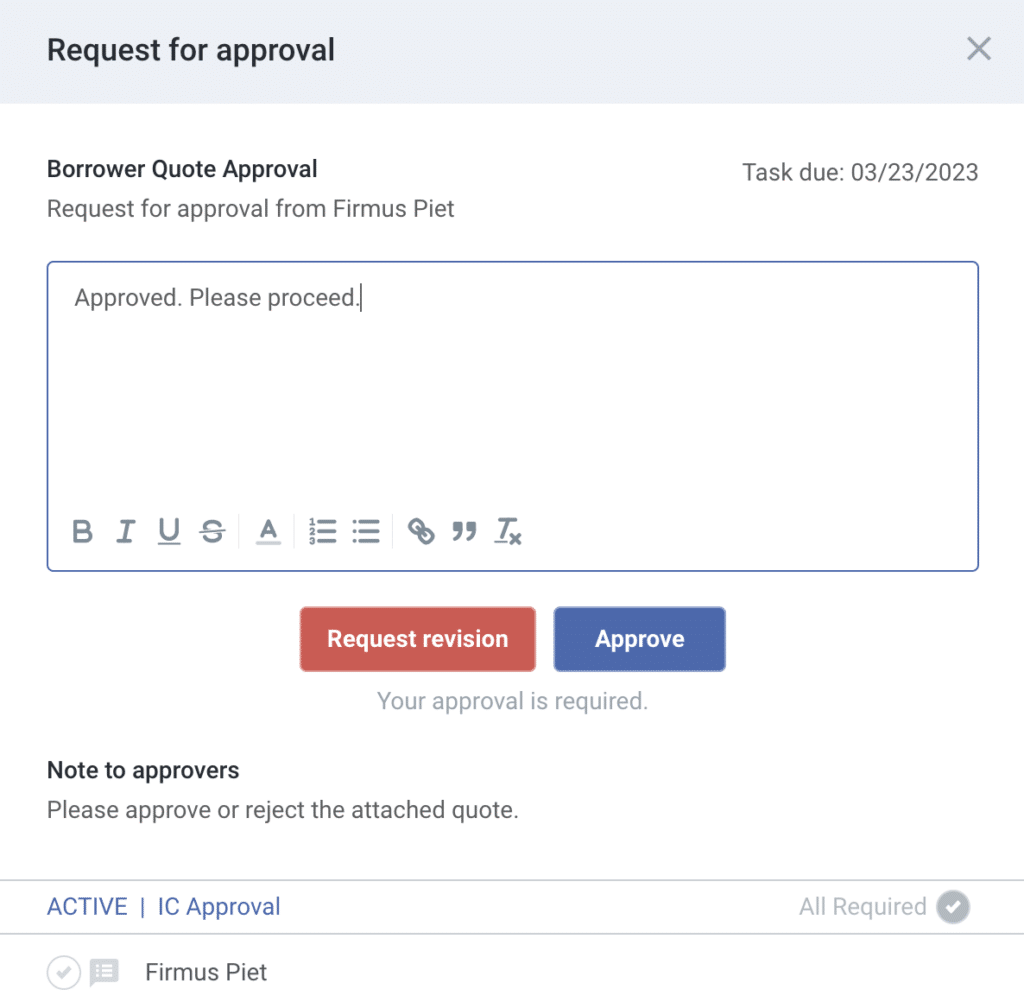

Manage sign-off from multiple stakeholders by assigning, tracking and recording all necessary approvals from loan creation to close in one centralized place

Using Dealpath’s data analysis and reporting capabilities, users have evaluated over $10 trillion in investment transactions and counting.

Dealpath is SOC 2 Type 2 compliant and committed to delivering secure, resilient and highly available cloud-native applications and data services to our clients.

Every day, thousands of professionals from leading investment management firms rely on Dealpath to track real-time deal progress.

Stay in the loop about deal management best practices, upcoming events, industry trends and more.