Real Estate Acquisitions Software

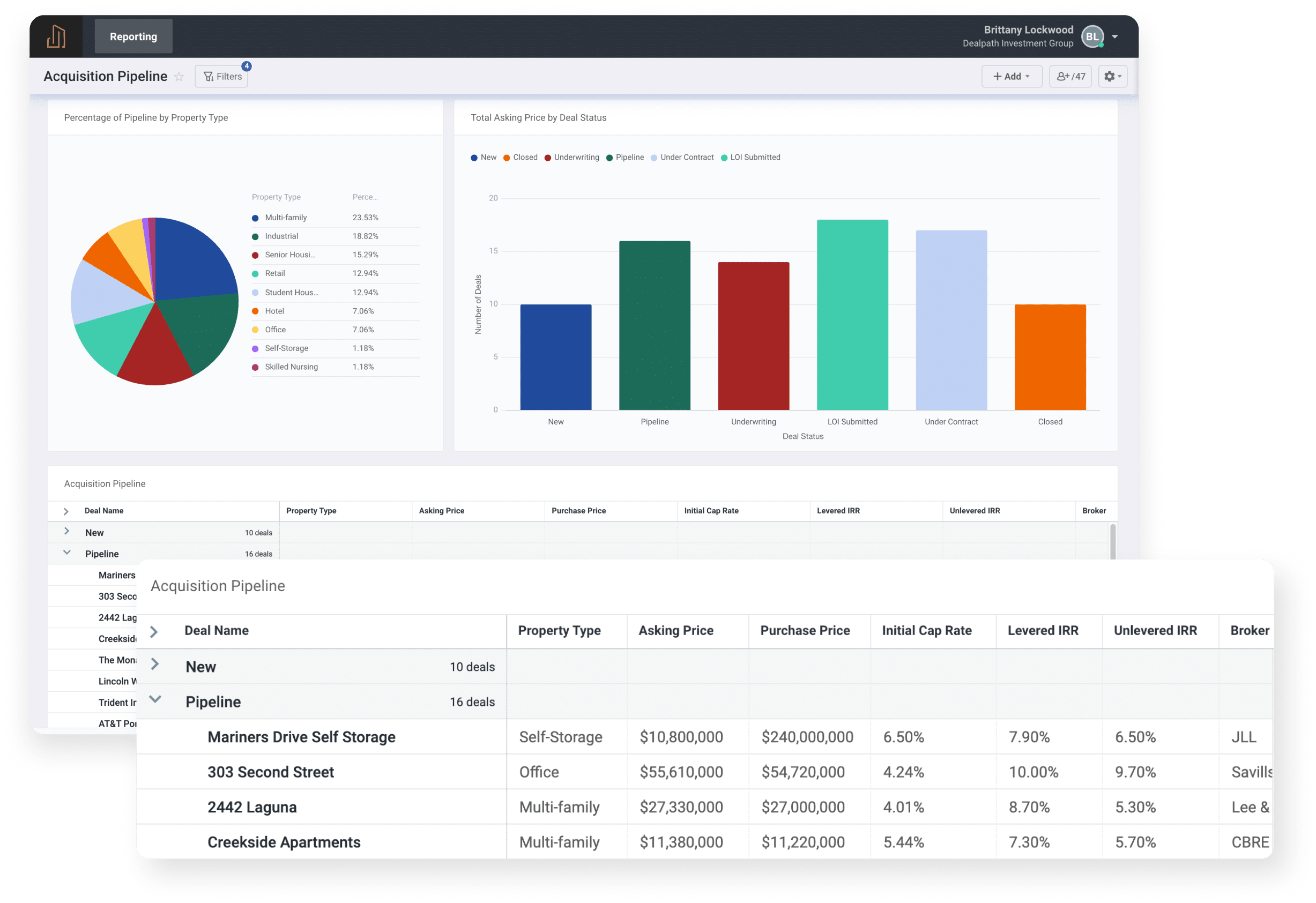

Manage Your Pipeline Across Every Property Type in One Source of Truth

Dealpath is purpose-built to empower investment teams across every property type to strengthen data-driven decision making, build operational efficiencies and enhance real-time visibility.