Data is charting the future for the winners and losers in real estate’s next chapter. Winning firms don’t just collect data, they operationalize it to build conviction, act quickly, and adapt their investment strategies.

Proprietary data alone is no longer enough to make defensible investment decisions. To succeed, CRE firms must benchmark proprietary deal data with reliable third-party comps. But that’s only possible when trustworthy data is centralized in one platform.

That’s where Dealpath’s integration with MSCI Real Capital Analytics (RCA) comes in. It empowers teams to enrich their proprietary dataset with MSCI’s extensive transaction and property records, surface relevant comps based on deal criteria, and run side-by-side comparisons against verified transactions. This integrated approach expedites market benchmarking and underpins your data strategy.

This blog explores more about why unifying internal deal data with external comps is essential in today’s market, how leading CRE teams are applying this strategy, and how Dealpath makes it possible.

Why It’s Time to Rethink How You Store and Access Comps

Although third-party sale comp data is more accessible than ever, many investment firms still rely on old-school tracking tools. When comps live in spreadsheets, PDFs, or external tools, teams can’t see the complete picture. Critical insights are siloed from the broader deal evaluation process and slow down decision making.

Even when comps are available, they may not be accessible. The lack of integration between proprietary deal data and market intelligence databases makes it difficult to validate assumptions confidently. Teams often toggle between tools or rely on research support, introducing delays and increasing risk.

In today’s market, the cost of this fragmentation is high. Capital markets remain volatile, with deal flow inconsistent and pricing harder to pin down than in years past. Without a centralized, connected view of the data informing each opportunity, firms risk mispricing, delays, or missed deals altogether.

The Power of Connecting Proprietary and Market Data

Firms accumulate valuable data in the course of deal evaluations. Internal comps, forecasted cash flows, tenant profiles, and market positioning are useful for understanding institutional strategy and local expertise. However, on their own, they don’t offer the full story of what’s happening in the market.

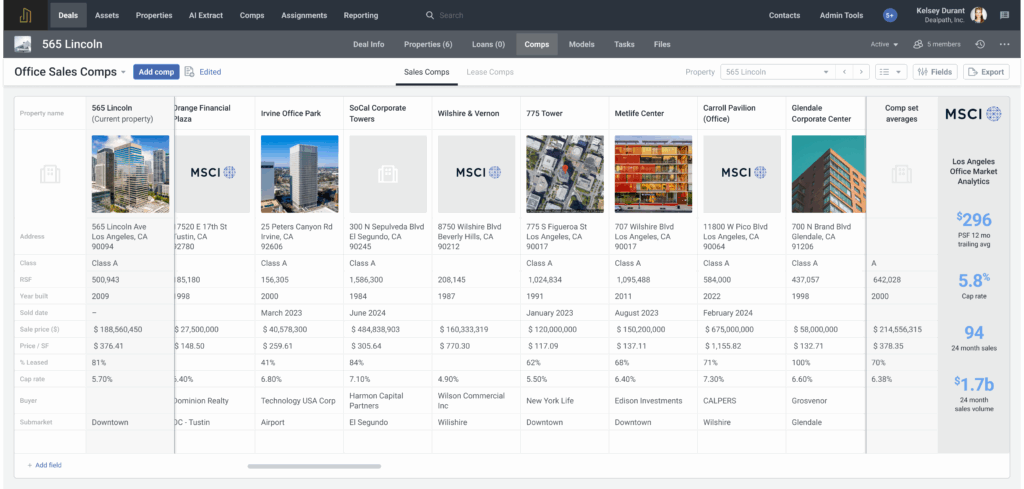

Third-party comps, like MSCI’s RCA sales data, help complete that picture. These comps provide verified transactions with sale price, property size, cap rates, and buyer and seller information. Backed by the largest collection of verified commercial real estate sales transactions, this data allows teams to benchmark price per square foot and cap rates for any asset type in any market against real-world market activity. With this validation, teams can refine assumptions, surface pricing shifts, and improve analysis.

Together, these two data sets give investment teams a more complete and real-time understanding of market positioning helping them to:

- Validate assumptions using credible, real-time benchmarks

- Build stronger conviction around bid strategy and valuation

- Align teams with a shared, consistent data set

Dealpath’s MSCI Real Capital Analytics (RCA) Integration

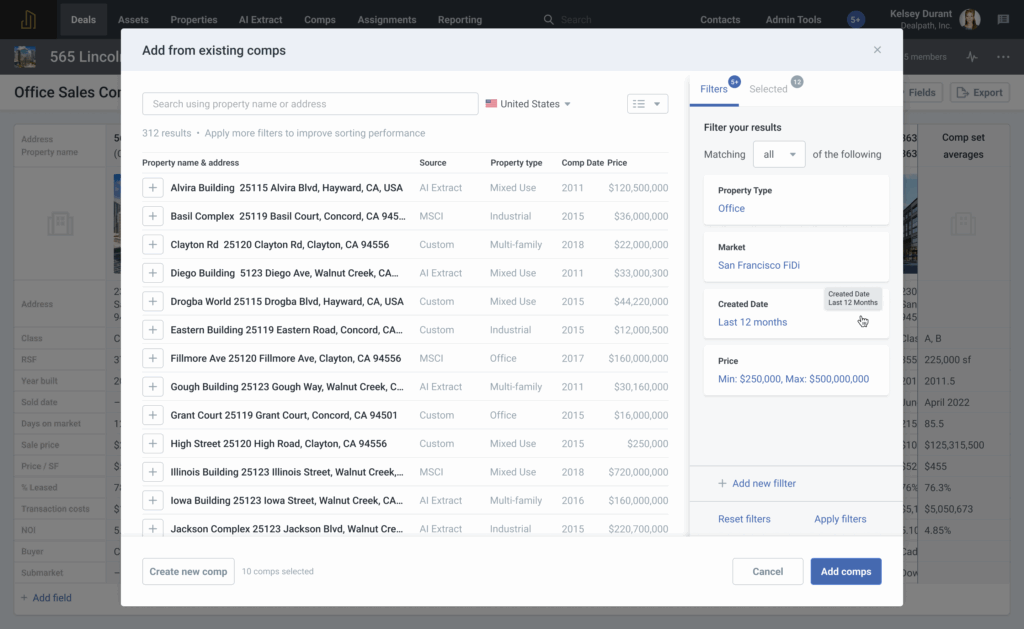

The MSCI Real Capital Analytics (RCA) integration brings verified sale comps directly into Dealpath, eliminating the need to switch between platforms or rely on external spreadsheets to log new comp data. By combining MSCI’s industry-leading sales transaction data with your internal records, investment teams gain timely, trusted market insights that strengthen pricing decisions and enhance underwriting confidence. Relevant comps are automatically surfaced based on mapped property types and geographies, enabling teams to compare deal attributes to real-world transactions.

The integration allows you to:

- Expand your database: Augment your internal comps with MSCI Real Capital Analytics’ extensive database of commercial properties, transactions and participants

- Surface relevant comps: Automatically identify relevant comps based on mapped property types and geographies

- Run side-by-side comparisons: Benchmark your deal attributes against recent, verified transactions

How Dealpath Supports a Unified Comps Strategy

Dealpath enables real estate investment teams to centralize and operationalize their comps strategy by integrating internal and external data in one platform. With purpose-built workflows, teams can manage comps consistently and collaboratively without leaving their deal management platform.

Inputting Comps into Dealpath

Teams can add comps through multiple channels to build a complete and searchable database:

- Integrations such as MSCI’s Real Capital Analytics (RCA) or Compstak

- AI Extract for automatically parsing comp data directly from offering memorandums

- Dealpath Connect for adding comps information directly from broker listings

- Manual or bulk upload for proprietary or one-off entries

Lease Comps vs. Sale Comps

Sale comps are typically used to benchmark acquisition pricing and inform valuation strategies. Lease comps, however, are fundamental to understanding ongoing income potential, tenant risk, and portfolio stability. Leases represent the foundation of CRE revenue, and lease comps provide a view into what similar properties are achieving in the market.

Dealpath gives CRE teams a centralized place to track both. Users can input, manage, and compare lease comps alongside sale comps, all tied to the relevant property. With this functionality, teams can:

- Analyze rental income and operating assumptions

- Monitor expiring leases, renewals, and concessions

- Compare in-place rents to market comps to identify upside

- Assess exposure to tenant and industry concentration

Dealpath’s lease comps functionality is purpose-built for commercial property types like office, industrial, and retail. Comps appear alongside property data in a dedicated tab, support configurable field views, and enable export-ready reporting on rent PSF, escalations, charges, and more.

In Dealpath, teams now have the choice to add deals they’ve reviewed to their sale comps database, key in important transactional details as they work, or add verified third-party sale comps via the MSCI Real Capital Analytics (RCA) integration.

The Benefits of Using Proprietary Deal Data With Real-Time Market Intelligence

Investment teams that combine internal data with verified third-party comps gain the ability to sharpen analysis, improve decision-making speed, and benchmark performance with greater accuracy:

Gain a Complete View of the Market

Blend trusted market comps with your firm’s historical and opportunity data to understand how comparable deals have priced and performed. This perspective improves market awareness and supports data-driven decisions.

Expand How You Think About Comparables

Don’t stop at closed transactions. Internal data from previously screened or passed deals can offer meaningful context. Combined with verified sale comps, they reveal patterns that inform acquisition and pricing strategies.

Accelerate Investment Committee Preparation

Quickly filter, select, and export curated comps from both internal sources and RCA into investment committee materials. This reduces manual effort and ensures alignment around consistent, verified data.

Benchmark Actuals to Expectations

Compare forecasted metrics like cap rate, rent PSF, and operating expenses to real outcomes. With RCA comps and internal deal data in Dealpath, teams can validate assumptions and refine models over time.

Putting Your Comps Strategy to Work

When comps data is fragmented, deal teams spend more time hunting for information than using it. By combining historical deal context with the scale and credibility of MSCI’s RCA sale comps, firms can strengthen pricing decisions, accelerate deal workflows, and bring data-driven clarity to investment strategy.

To learn how Dealpath can help you centralize your comps strategy, contact our team or request a demo today.

Request Demo