This blog post was last updated on Wednesday, July 5th.

Before finalizing a new acquisition, development, disposition or lending deal, investors thoroughly vet the deal during due diligence to ensure it aligns with their ideal risk-return profile and identify red flags. Exhaustively investigating the property, financials, zoning, and nearly all other investment criteria creates much-needed confidence before making a data-driven decision to deploy capital.

Read on to learn about the essential items for any comprehensive real estate due diligence checklist, as well as helpful digitization tactics to build operational efficiencies in the late stages of a multi-million dollar investment deal.

Jump to:

- What Is Due Diligence in Commercial Real Estate? Breaking Down the Process

- How Long Does the Commercial Real Estate Due Diligence Period Last?

- Preliminary Checklist

- Site Underwriting Commercial Real Estate Due Diligence Checklist

- Applying for Financing and Conducting Due Diligence In Tandem

- Digitally Systematizing the Commercial Real Estate Due Diligence Checklist

- Creating Visibility and Accountability

- Take Your Real Estate Due Diligence Checklist to the Cloud

What Is Due Diligence in Commercial Real Estate? Breaking Down the Process

Due diligence is an exhaustive, all-encompassing review of a late-stage deal that helps real estate investment teams surface all potential risk before closing. Comprehensive due diligence checklists enable investors to identify financial and other red flags, ensuring the deal is aligned to their ideal risk profile prior to entering a contract.

All firms follow a unique real estate due diligence process shaped by their own pipeline management process, investment strategy and risk tolerance.

For simplicity’s sake, this list will break down the generalized commercial real estate due diligence process into two phases: the preliminary checklist, and the more formal underwriting process that comes later on. While traditionally managed through spreadsheets and Word checklists, more teams are turning to cloud-based deal management software for efficient due diligence.

Residential DD

While this article pertains strictly to commercial real estate due diligence, prospective homebuyers undergo a similar process prior to closing.

Residential purchases are typically less complex, expensive and risky, making the DD process simpler. With the exception of investment properties, the goal of DD when purchasing a home is to make the right decision, rather than deliver ROI. As home sellers are obligated to disclose property defects, buyers do not face the same burden of uncovering each risk.

Nonetheless, homebuyers should diligently vet properties based on their goals and financials.

How Long Does the Commercial Real Estate Due Diligence Period Last?

The due diligence phase typically begins when the buyer and the seller approve the Purchase and Sale Agreement (PSA). The total duration of the commercial real estate due diligence period can vary depending on the buyer’s processes and efficiency, the complexity of the deal and numerous other variables.

Often, the PSA will specify the time period allotted to the buyer to review the asset in question. Typically, though, due diligence lasts anywhere from 30-90 days. It’s not uncommon for buyers to secure a “free look”, giving them exclusive rights to purchase that asset until the period elapses.

Managing due diligence in deal management software like Dealpath can build efficiencies, ultimately streamlining the process through real-time visibility and clear accountability.

Preliminary Checklist

Deal teams work scrupulously to ensure that no stone is left unturned throughout the CRE due diligence process. The preliminary stage is the first round of thorough inspections into regulations, tax implications and other factors that could preclude profitability, as well as gathering all relevant commercial real estate due diligence documents. By surfacing issues early on, investors can pass on unworthy deals before devoting valuable time.

Throughout your preliminary real estate due diligence process, review or address the following items:

- Current title policy, along with other related commercial real estate due diligence documents

- Development and construction plans, including as-built, architectural, engineering, and any other relevant plans

- Property condition report

- All government-issued documentation relevant to the building, including permits, certificates of occupancy, warranties, government notices, special assessments, code violations and unexpired guaranties

- Property tax bills within the last three years, which includes special assessments and incentives

- Energy and utility bills from the prior two years

- All relevant environmental and energy reports, which may involve site consultants

- Capital expenditures

- Documentation of any personal property currently on the land

- Add costs for identified issues to determine total expenses

Following these steps, investors generally understand enough about the property to determine if the property is aligned to their risk profile. If properties pass this phase of the commercial real estate due diligence process and satisfy other criteria, they may move on for a more detailed evaluation.

Site Underwriting Commercial Real Estate Due Diligence Checklist

Further along in the deal lifecycle, investors perform the site underwriting process. This second leg of the real estate due diligence process is the final opportunity for investors to vet the property and learn everything they need to know.

Because the site underwriting process typically involves a deep dive into the property’s legal and financial standings, there are typically multiple parties involved, meaning it can take a month or more to complete.

While underwriting the property, review or address the following items in each category:

Financial & Insurance:

- Recent or past appraisals of the property

- Insurance policies currently in place, as well as any filed claims

- Review up-to-date rent roll including expenses ancillary tenant expenses, such as security deposits, real estate taxes and CAM billings

- Review service contracts to determine if cancellation incurs penalty expenses

- Demographic research and analysis of the surrounding area

- Perform a competitive analysis

- Compare selling price against deal comps from similar opportunities

- Compare lease financials against similar deals

- Perform a year-over-year cash flow analysis

Title, Zoning & Surveys:

- ALTA (American Land Title Association) survey, as well as other topographical surveys

- Review the zoning compliance certificate

- Current liens

- Encroachments from neighboring properties

- Review any binding legalities governing how the property can be used, including covenants, conditions, restrictions, reservations and easements

- Interviews with the local municipality

Legal:

- All impending and in-process litigation that could impact the future property owner

- Review the property’s legal description

Documents:

- Letter of intent and client authorization letter

- Review the purchase contract

Property:

- Site inspection to investigate the property’s location within the market, accessibility, and to gain first-hand perspective into unknown variables

- CAM (common area maintenance) recommendations for how tenants should contribute to building fees

Tenant/Leasing:

- Review pro forma information

- Review current tenant leases and abstracts, including amendments

- Request a profile of the existing tenant or tenants, which includes their credit ratings

- Review SNDAs (subordination non-disturbance and attornment agreements) currently in effect, unless the property is a multifamily unit

- Review tenant sales report, aged receivables report and a list of security deposits

- Interviews with current tenants

- CAM (common area maintenance) recommendations for how tenants should contribute to building fees

After exhausting this list, investors generally know everything they need to in order to make a final determination on the deal’s risk and return profile before closing. Meticulous attention to detail may prolong underwriting, but diligent risk analysis is typically worthwhile. Documenting these details affords deal teams greater credibility when pitching deals to investors.

Applying for Financing and Conducting Due Diligence In Tandem

The beginning of the commercial real estate due diligence period often coincides with the early stages of the financing process. This timing enables prospective buyers to move forward with a purchase after analyzing risk during DD, rather than wait for approval.

In fact, prospective lenders may have specific requirements for borrowers related to due diligence. Submitting financing applications while conducting due diligence offers buyers the opportunity to preemptively satisfy these requirements, such as providing specific environmental reports. It’s also common for lenders to request information from the commercial real estate due diligence checklist.

Digitally Systematizing the Commercial Real Estate Due Diligence Checklist

Real estate due diligence checklists were once based entirely in Excel spreadsheets. This frequently presented bottlenecks for teams without a clear process for memorializing investment data. Analysts had no choice but to request due diligence information from external third parties, like legal counsel, then manually record it in a spreadsheet.

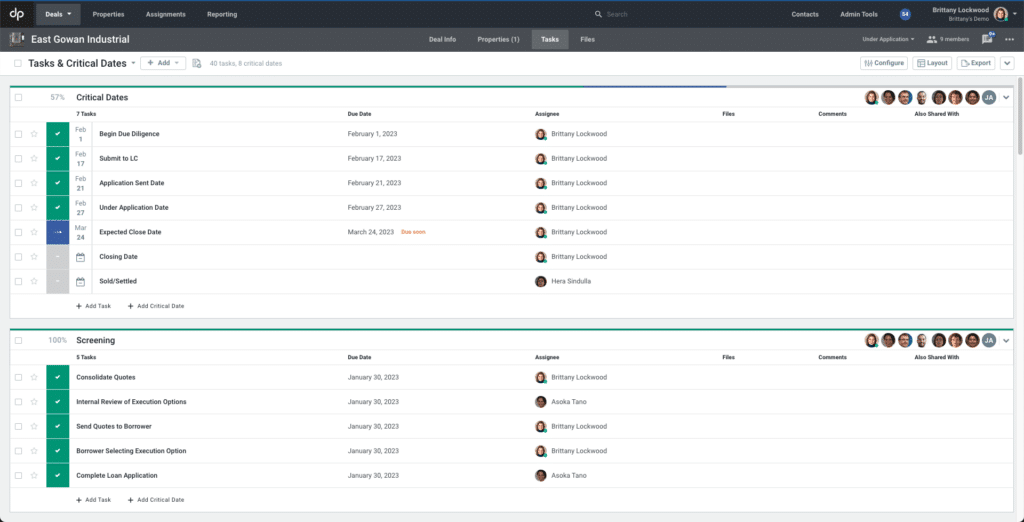

Deal management software like Dealpath simplifies how deal teams track real estate due diligence checklists by eliminating spreadsheets, email workflows and other systems of record. To streamline the process, firms can create standardized real estate due diligence checklists within investment software. Beyond building operational efficiencies through easy repeatability, this process also optimizes risk mitigation by documenting accountability in one source of truth.

As you research solutions, these are five of the critical considerations you should make.

1. Real-Time Visibility Into the Latest Updates & Progress

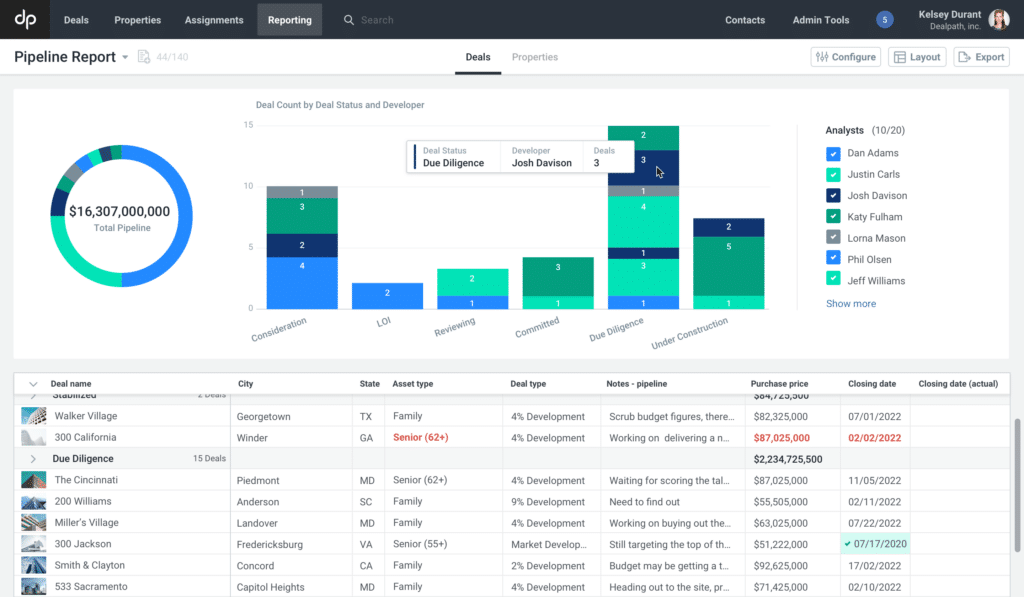

Prior to the advent of modern software, teams frequently worked from outdated or inaccurate information due, in part, to disparate spreadsheets. In today’s fast-paced market, teams must remain aligned around the latest data and information. Deal management software that updates in real-time empowers teams to collaborate in lockstep, keeping the latest data and information at their fingertips and preventing costly mistakes, such as relying on dated capital expenditures data.

2. Standardize Due Diligence Checklists Based on the Deal Type

When relying on old-fashioned checklists, it’s not uncommon for tasks to slip through the cracks–especially when a step might only apply to certain deal types. Deal management software is eliminating that risk with efficient templates and clear accountability.

Assigning each task to an individual–or better yet, based on a team member’s role–prevents the possibility of missing a mission-critical task.

For example, if Erin is the analyst that will always be responsible for past appraisals, the task template will reflect that–while reinforcing deadlines with clear reminders.

3. Automate Deal Communications During Due Diligence

While the broader deal team may not need an update for every box in the real estate due diligence checklist, it’s important for team members to complete each step punctually and alert stakeholders as needed. Automating alerts and communications ensures that all team members stay up-to-date on high-priority deals, eliminating administrative work so teams can prioritize value-add work.

Rather than requiring time-strapped team members to send emails with updates, rely on a deal management platform that automates these communications. For example, Dealpath alerts team members when key tasks are completed or when deals are ready for next steps based on custom notification criteria.

4. Track Approvals on DD Tasks

Beyond collecting an array of documents and data, analyzing these points is a critical part of the commercial real estate due diligence checklist. If stakeholders must weigh in throughout the process, then how are you documenting approvals?

Tracking task approvals is a simple way to empower more efficient collaboration for deal teams. Approving mission-critical tasks directly in deal management software ensures crucial considerations never slip through the cracks. In three weeks or years, team members can look to these records for clarity.

5. Report on Tasks

While viewing which information has been shared and approved at the deal level is valuable, it’s also vital for management and senior leadership to keep a pulse on tasks that remain outstanding. Deal management solutions that offer configurable reporting can help stakeholders to audit current, upcoming and outstanding tasks to keep timelines on track.

In a pinch, leadership can divert team members to cover urgent priorities and prevent fire drills, like missing an earnest money deposit date.

Creating Visibility and Accountability

From clear visibility to optimizing risk mitigation, standardizing due diligence checklists builds efficiencies in numerous ways.

After data is passed from the acquisition team to another team, deal management platforms retain deal data for firmwide access. In many instances, third parties can also access the software to directly input information they’re accountable to obtain. If an analyst leaves for vacation in the middle of the due diligence phase, executives and teammates can simply check the task list to easily find remaining tasks. When new analysts come on board, this standardized checklist clearly articulates required tasks.

By standardizing due diligence checklists in a deal management platform, your team can work faster, more collaboratively and efficiently, without fear that information will die in silos.

Take Your Real Estate Due Diligence Checklist to the Cloud

Due diligence is inevitably a collaborative process, but many teams without modernized technology struggle to piece together data and checklists across various systems. Nonetheless, like all other steps throughout the investment process, maintaining clear visibility into deal progression is crucial.

Download this e-book to learn how modern deal teams mitigate risk and build operational efficiencies by managing due diligence in a cloud-based tool.

Download Free E-Book