This blog post was last updated on Wednesday, September 13th.

Investor intuition and market knowledge are invaluable as your firm evaluates deals, but data must be the bedrock of multi-million dollar investment decisions. Every real estate offering memorandum (OM) you review can add value to your investment decision-making–and more broadly, your institutional data advantage– in the form of a commercial real estate comparable, or comp.

Deal teams are tapping into unprecedented insights through proprietary deal databases to outperform the competition in the new real estate game.

Read on to learn how investment managers seamlessly harvest comparables through powerful data analytics and artificial intelligence in real estate investment software.

Jump to:

- Building a Database of Commercial Real Estate Comparables With OMs

- How to Compare New Deals Against Relevant Comps in Dealpath

- What Are Real Estate Offering Memorandums (OMs)?

- What Are Commercial Real Estate Comps?

- What Data Should Be Included in Commercial Real Estate Comps?

Building a Database of Commercial Real Estate Comparables From OMs

Prior to the advent of today’s purpose-built technology, comparable data stored in spreadsheets or shared drives was challenging to tap into, often requiring teams to source new comps as opportunities arise. Now, deal management software has become the gold standard for capturing relevant real estate comp data, enabling seamless analysis.

Ingesting new deals into your deal management platform programmatically builds institutional market expertise with every new opportunity you review. Even deals that your firm immediately passes on can add significant value for benchmarking down the road. Relying on an AI-powered platform like Dealpath Data Ingestion ensures that you can capture this intelligence efficiently and accurately, without draining bandwidth.

As you receive flyers from brokers, your deal management software should offer a way to efficiently upload them. The more opportunities you review, the greater your competitive advantage against firms making bets in similar markets.

When choosing a deal management platform to support data-driven analyses with comps, ensure that your provider has a strong reputation, long runway and can deliver the accuracy required by your firm.

How to Compare New Deals Against Relevant Comps in Dealpath

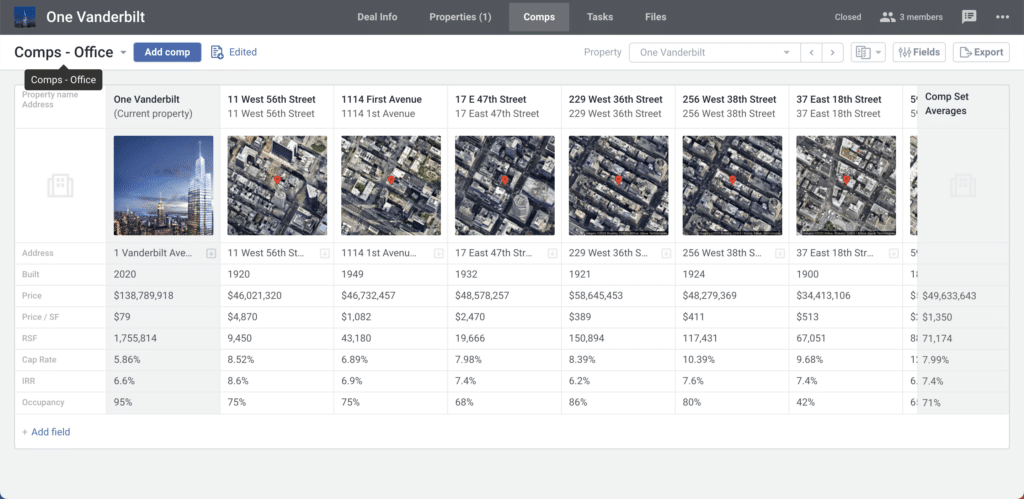

Searchable analytics helps investors find answers to their questions faster and with stronger precision. Whether you’re screening a new deal that just came across your desk for the first time or pulling data to support your thesis in an Investment Committee meeting, Dealpath makes it easy to compare apples to apples.

Search within your own proprietary database for comps in the same market as your new deal, then compare them across criteria like price, size, cap rate and more. You can even customize which data is compared based on the asset type, selecting different criteria for multifamily, industrial and other property types based on your strategy.

For example, an industrial-focused firm managing deals in Dealpath considering an acquisition in Dallas could add comps from past “industrial” deals in “Dallas” to access historical data. After a few simple clicks, you could find everything you need to know about recent deals and past opportunities.

What Are Real Estate Offering Memorandums (OMs)?

A commercial real estate offering memorandum, or OM, is a legal document prepared by brokers to inform prospective buyers about a seller’s property. Real estate OMs provide all of the information buyers need to determine if the deal is worth pursuit. Typically, OMs include:

- A brief summary of the key points investors need to know about a property’s location, financials and more

- A description of the property, including the asset class, zoning classifications, demographic details, and pertinent operational details

- Breakdown of current tenants, including rent rolls, lease expirations and more

- Critical financial details such as profit and loss statements, balance sheets, investor distribution schedules, IRR and more

- Return summaries predicated on varying assumptions

- Property management stakeholder profiles

- Legal information, such as participation requirements and confidentiality agreements

- Photographs of the property to help investors understand the asset

- Local maps to show investors the property’s location and its proximity to amenities and other hotspots

- Lease and sale comparables to provide financial benchmarks for prospective buyers

For the seller, real estate offering memorandums are a fast, simple way to distribute information about a property listed on the market. For potential buyers, OMs help investors to quickly and easily determine if the property is worth pursuing.

As previously mentioned, each real estate OM also adds endless value in the form of comparables and data analytics.

What Are Commercial Real Estate Comps?

Also called comparables, commercial real estate comps provide investors with market intelligence in the form of data, such as prices on similar deals. Comps help investment deal teams to set internal and external benchmarks when screening and underwriting pipeline deals. Consequently, investors can confidently develop a thesis and execute with conviction.

There are two types of commercial real estate comps: sales comps and lease comps. Sales comps are based on recent pricing or sales data, and help investors to learn how a property’s price compares to market value. Leasing comps, on the other hand, are used by asset management teams to project potential ROI. In this blog post, we focus mainly on the value sales comps deliver to investors.

Comps from the same sub-market as a pipeline deal can yield tremendous insight when gauging how a deal is priced according to current market conditions. The closer two properties are when it comes to their size, age, quality, amenities and other variables, the more insight comps lend. However, it’s not uncommon for investors to adjust prices after accounting for size, age or other discrepancies.

What Data Should Be Included in Commercial Real Estate Comps?

Commercial real estate comps are powerful tools, but only when they include data relevant to investment decisions. For maximum value during the screening process, real estate comparables should include:

- The property’s address

- The property’s sale price

- The cap rate

- The projected IRR

- The net operating income

- The asset class or property type

- The names of the firms that bought and sold the property

- The date of the transaction

- The size of the building

- Operational costs

Paid third-party data can prove useful, with some caveats. These datasets are often outdated by the time they are called into question, limiting their utility.

Enter the Next Generation of Investment Performance With AI-Powered Deal Management

Every deal your firm reviews should add perpetual value in the form of competitive intelligence. To learn how AI-powered Dealpath Data Ingestion (DDI) can empower your firm to kickstart underwriting, eliminate manual data entry and grow your proprietary deal database, contact us.

Contact Us