2025 was a landmark year for Dealpath, marked by relentless innovation, record growth, and new milestones in our mission to drive real estate investment performance. Last year, we also saw change throughout the industry as hunger for pragmatic AI technology skyrocketed. The Dealpath team was thrilled to have the opportunity to partner with our industry-leading clients as we explored new possibilities in AI and unlocked value together.

This year, we fortified relationships with our 300 existing institutional clients and welcomed over 50 new real estate debt and equity investors to the platform. Throughout 2025, our team advanced the platform and launched expanded, AI-powered offerings that help clients source and act on deals faster and with greater precision.

Growing Our Client Base and Deepening Strategic Relationships

Our clients are at the core of everything we are building at Dealpath. We are proud to have developed trusted and longstanding relationships with over 300 clients, ranging from global industry leaders like Blackstone, Nuveen, CBRE IM, LaSalle, and MetLife, to mid-market firms, regional powerhouses, and everything in between.

In 2025, we continued to grow our client partner base. Throughout the year, we added over 50 new clients across the real estate debt and equity spaces, including Morgan Stanley Real Estate Investing, Dwight, Kilroy, BH Properties, Meritage Homes, Foxfield, and two PERE Top 20 global investment managers with over $330B in combined AUM.

Expansion of Dealpath Connect

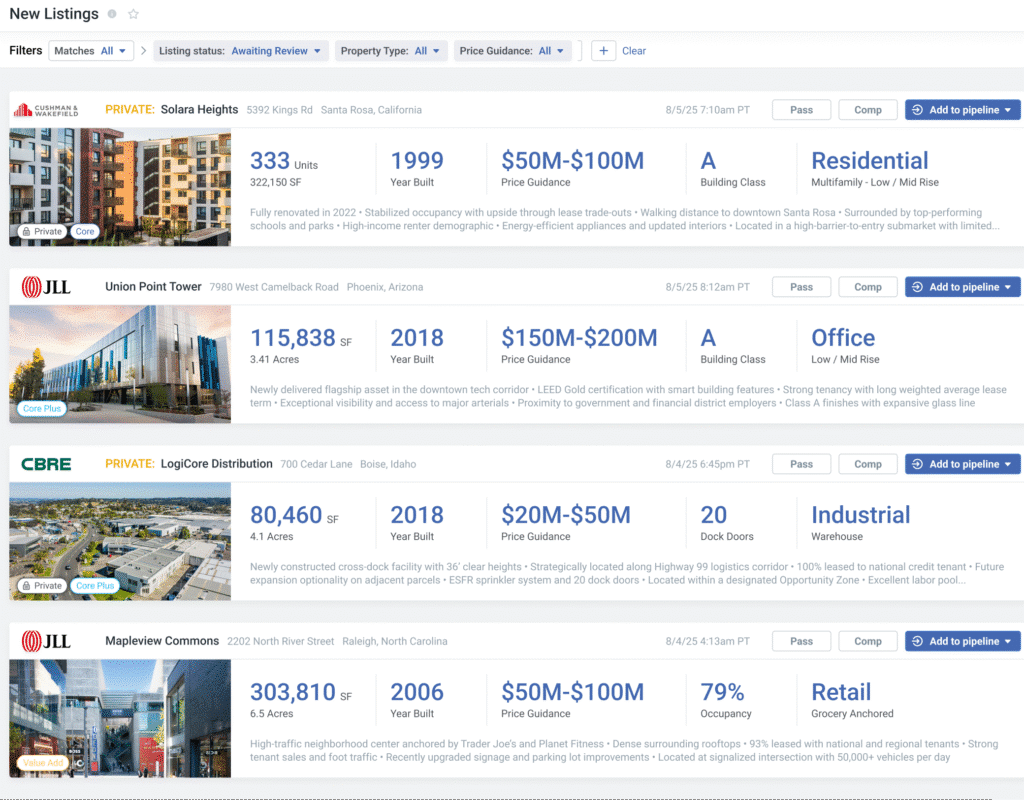

In late 2024, we unveiled Dealpath Connect, the private exchange for real estate listings, effectively connecting the buy- and sell-side of real estate into a first-of-its-kind platform. 2025 was the year for expansion and growth for Dealpath Connect.

After launching with JLL in late 2024, we onboarded CBRE and several other brokerages in 2025. Today, top firms are actively publishing both public and private equity and debt listings, with more global and regional firms joining in early 2026.

Dealpath Connect was purpose-built to solve a longstanding challenge in real estate: fragmented, manual deal distribution from brokers to buyers. By creating a normalized, digital view of listings directly within real estate’s investment operating system, Connect ensures visibility into relevant deals for qualified buyers, accelerating time to underwriting, simplifying deal sourcing, and strengthening market tracking.

For buyers, the platform gives them assurance that they are seeing every relevant deal from broker partners, allowing for a steady flow of new, relevant opportunities without requiring additional staffing or manual data entry. For investment sales brokers, Dealpath Connect brings high visibility to relevant deals and reduces transaction time by getting opportunities directly into buyer pipelines for screening and underwriting.

We’re proud to note that since its launch, Dealpath Connect has rapidly expanded its coverage, now powering access to over 65% of on- and off-market institutional listings directly into their pipelines. To date, nearly 19,000 deals have been created on Dealpath Connect, representing an aggregate value of $930B for buy-side clients. Buyers are also able to screen deals over 50% faster compared to traditional methods.

Launching AI Studio, Expanding CRM, and Expanding Access to Trusted Comps

AI Studio

AI remained a strategic priority in 2025 as we built on Dealpath’s foundation of structured, AI-ready data. With AI Studio, we delivered tools embedded directly into the investment workflows that are already helping clients operate with greater speed, clarity, and precision.

Launched in October, AI Studio is a comprehensive suite of purpose-built, AI-powered capabilities designed to offer pragmatic applications that deliver real-time insights and drive faster decision-making. We launched four distinct tools as part of AI Studio, with more capabilities forthcoming:

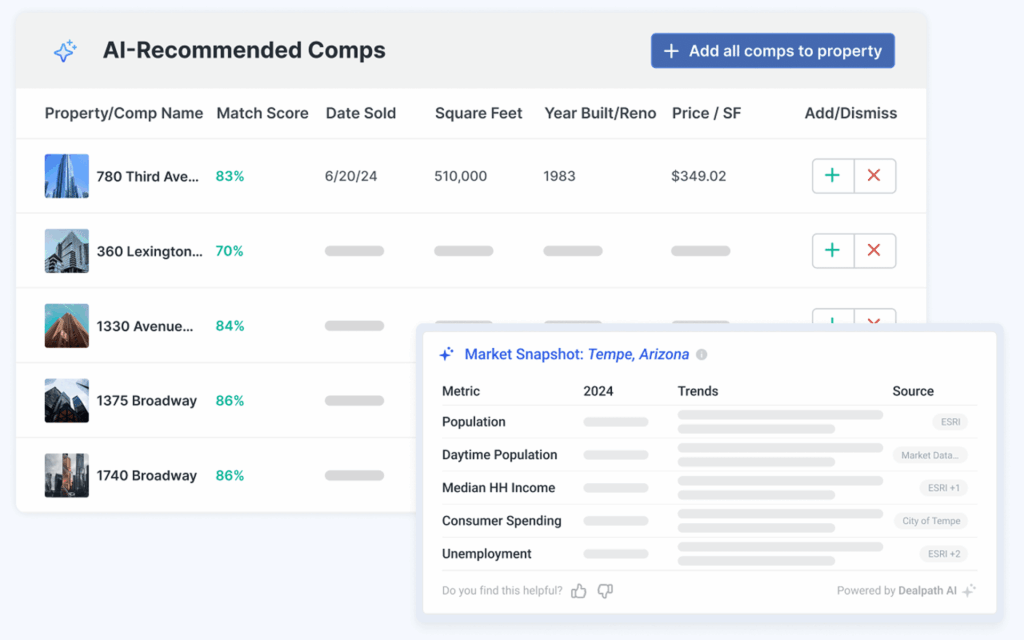

- AI Deal Screening, which generates instant market, tenant, and property insights for deals sourced through Dealpath Connect, providing teams with context-rich intelligence at first review.

- AI Recommended Comps, which helps teams benchmark deals and accelerate underwriting by automatically identifying comparables from their proprietary database or third-party market intelligence based on key criteria, such as proximity, price, and square footage.

- AI CRM Summary, which distills recent interactions into clear, actionable insights, helping users ensure critical follow-ups never fall through the cracks.

- An enhanced version of AI Extract, a Dealpath offering initially launched in 2024, which automates offering memorandum (OM) and flyer extraction to accelerate deal creation and screening.

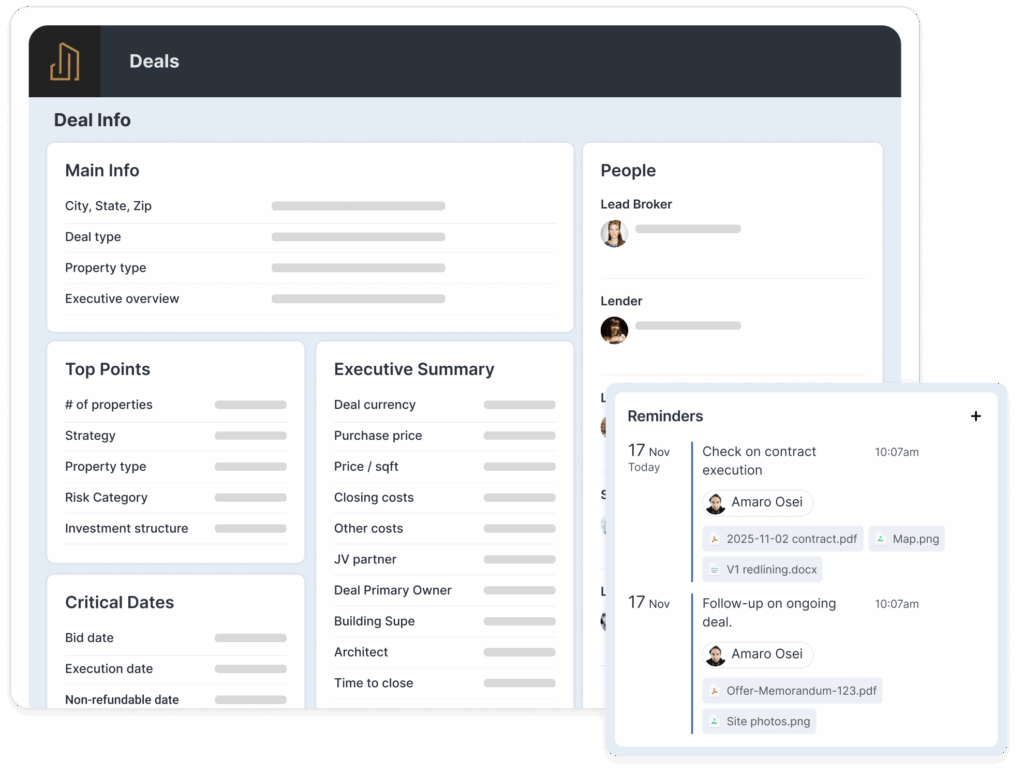

Enhancing CRM Functionality

Another platform enhancement we are particularly proud of is our enhanced CRM functionality. Launched in September, our new CRM functionality is purpose-built for real estate investors, enabling clients to track broker, lender, and capital partner relationships directly within their deal management platform. Investment teams can unlock a more complete, data-first view of relationship-driven deal flow, empowering professionals to systematize off-market deal sourcing and analyze relationships with brokers and capital partners.

Strengthening Our Bond With MSCI

Last year, we built upon our longstanding relationship with our trusted partner MSCI by bringing comparables from Real Capital Analytics (RCA) directly into the Dealpath platform. This integration allows investment teams on the platform to review trusted market intelligence alongside proprietary comps. Now located on the same platform in which deals are evaluated, these insights empower users to move from insight to action with greater speed and confidence.

Enhanced Insights With Our Inaugural AI Survey

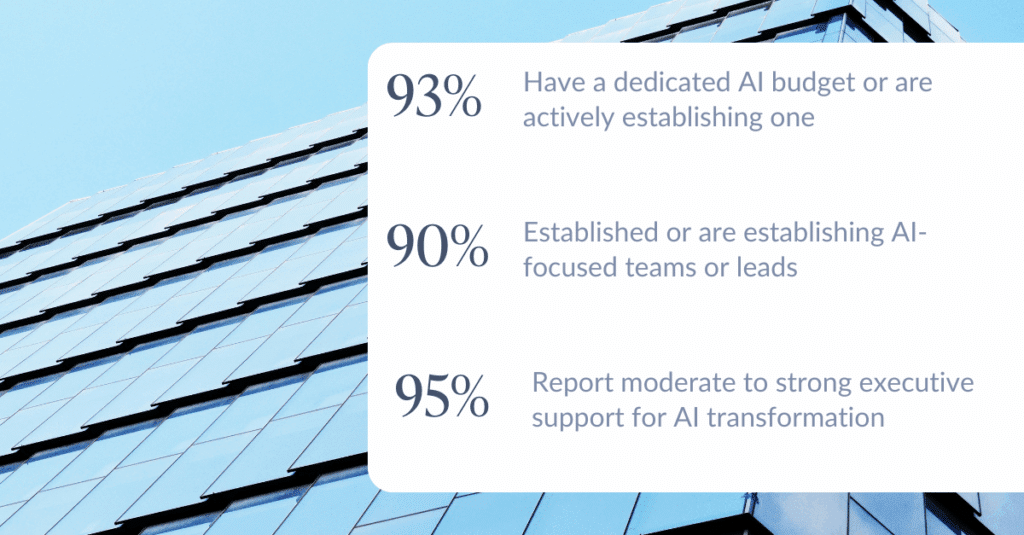

We also conducted our first-ever survey, analyzing how institutional investors are utilizing AI, what they hope to gain from AI usage, and the obstacles they face. The survey polled leaders from top investment firms across the country, the majority of which have over $5B in AUM. The results of the survey, which we released in October, were fascinating and paradoxical.

We learned, among other key insights, that despite 93% of those surveyed believing that early adopters of AI would gain a competitive advantage, 93% also reported significant barriers. The largest barriers uncovered were a lack of internal expertise (43%), regulatory/compliance concerns (42%), budget constraints (39%), and decentralized data (36%). Additionally, the survey revealed that improving data systems for AI is a top 24-month priority for 98% of institutional investors. These findings have allowed us to further refine our usage of AI in our product offerings to best meet the needs of our clients.

Awards and Team Wins

Lastly, I want to take a moment to shout out our talented team who made all of our success in 2025 possible. I want to specifically shout out some of our award-winning team members, including:

- Daniel Koches, Senior Vice President of Revenue, who was named as one of GlobeSt.’s Aspiring Leaders of 2025

- Gary Kao, Managing Director and Head of New York, who was named on the New York Real Estate Journal’s 2025 Ones to Watch – Industry Leaders List

- Pei Hung, Chief Financial Officer, who was named as one of GlobeSt.’s CRE Women of Influence 2025

- Wally Khan, Senior Product Manager for AI Strategy & Products, who was named on the New York Real Estate Journal’s 2025 Innovator in Commercial Real Estate List

- And our Customer Success Team, which was named as one of GlobeSt.’s Influencers in CRE Technology

Command Your Data and Compound Portfolio Value in 2026

Our success in 2025 would not have been possible without the help of these talented individuals, as well as the larger Dealpath team, our trusted partners, and clients, new and old. Thank you all, and we are looking forward to building on this success in 2026!

To learn how your firm can identify the best opportunities, execute confidently, and maximize returns by harnessing your data, request a demo.

Request Demo