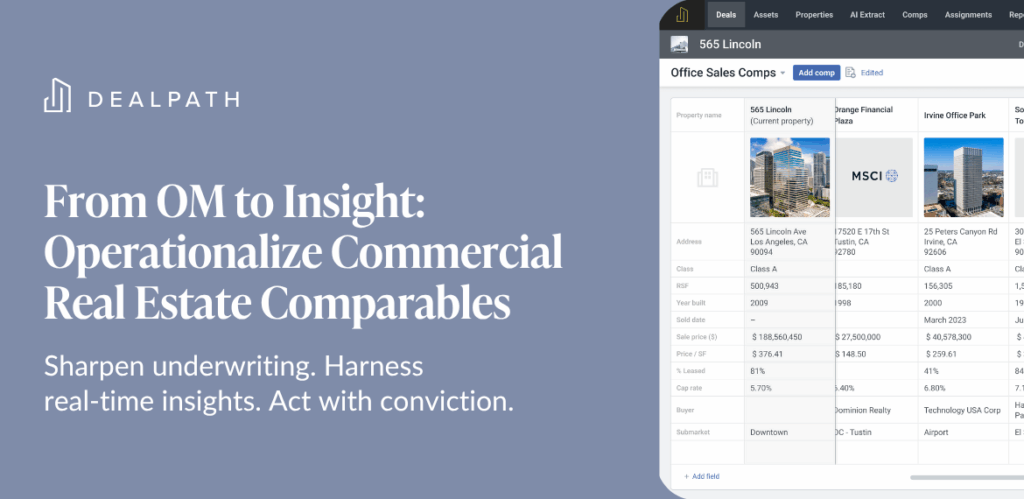

Technology has come a long way in the last decade. We’ve now got smartphones, Google Maps (remember MapQuest?), Twitter, YouTube, cloud storage, and electric cars. Yet, when it comes to the commercial real estate and deal management, things haven’t come along at the same pace. While the processes to find, evaluate, and close deals remain the same, many still use the same tools ten years ago without much improvement.

Investment teams still sort through stacks of paper, use manual checklists, compile and re-compile reports, and status updates are never-ending. With upgrades in software and business processes, these practices should be history.

Deal management itself isn’t complicated but there are some factors to take into consideration when evaluating what is best for you and your investment team. We’ve compiled eight things that you should think about when trying to improve your process. By doing so, you’ll:

- streamline your deal execution time

- reduce errors and risks

- increase deal productivity

- improve actionable data analysis

- build a valuable internal data asset

Ultimately, for any results-driven organization, it is essential to maximize resources (either time or capital) and with the software technology at our disposal, teams should be taking full advantage. If you are interested in learning more about what to look for in deal management software, check out our handy (unlocked) guide here.