For many commercial real estate investment firms, Salesforce has long served as the default tool for managing contacts, relationships, and deal pipelines. But as teams grow, markets shift, and execution becomes more complex, a question often emerges: Can Salesforce really support how our deal team works as a commercial real estate CRM—or is there a better way?

Now, with new CRM capabilities in Dealpath, teams have a purpose-built alternative that combines relationship tracking with powerful execution tools.

Whether your company is fully committed to Salesforce or still figuring out how to scale your tech stack, CRM systems will have some strengths and several shortcomings.

In this article, we break down why purpose-built deal management platforms like Dealpath have become essential for tracking your deal pipeline and gaining real-time insight into asset performance and market activity.

The Role of CRM Systems, Like Salesforce, for Commercial Real Estate Teams

Salesforce is a powerful Customer Relationship Management (CRM) platform. It’s used broadly across industries to help teams manage contacts, record touchpoints and track leads. In CRE, it’s often used by acquisitions teams to maintain broker and investor relationships.

CRMs are valuable for:

- Tracking who you talked to, when, and what was discussed

- Centralizing contact details and logging calls, meetings, and emails

- Supporting relationship-driven processes like fundraising and LP outreach

The Limitations of Salesforce for Commercial Real Estate

Once a deal enters the execution phase—when real estate-specific workflows, documents, and deal details matter—commercial real estate CRMs begin to show their limits.

They lack support for real estate specific data, documents and reporting. There’s no way to track properties, due diligence workflows, financial models, or task approvals without significantly adapting the system. Reporting becomes a patchwork of Excel exports and manual data transfer, making it difficult to gain visibility into deal status or team performance.

Customizing a CRM to handle this work takes serious investment—and still likely won’t meet the team’s needs.

CRM Systems Can Be Customized for CRE Teams—But at What Cost?

It’s tempting to try and make Salesforce fit any and all needs. With enough time and money, you can build out custom fields for properties and configure workflows to resemble commercial real estate processes. But this comes with a steep price tag—and long-term tradeoffs.

Many firms spend months working with third-party consultants, only to end up with a system that’s expensive to maintain, and still involves manual work in Excel and email for deal execution. A shift in strategy, process or technology often means re-scoping the entire system—ballooning timelines and costs to two or three times that of an off-the-shelf solution.

Firms often spend six figures customizing Salesforce—only to return to spreadsheets for tracking IC approvals. And when adoption lags, all that customization becomes a sunk cost.

If your CRM is acting more like a workaround than a solution, it’s worth asking: Are we investing in the right system for the job?

The Risks of Relying on a CRM Alone for Deal Execution

Relying solely on a CRM platform like Salesforce can create real gaps for commercial real estate teams. While CRMs are great for managing contacts and tracking communication, they aren’t built to handle the complexities of deal management, evaluation, and execution.

Without a structured way to manage properties, perform due diligence, execute tasks, and track approvals, teams often fall back on spreadsheets, shared drives, and email threads—creating silos and duplication of data.

Over time, this leads to limited pipeline visibility, fragmented data, and inconsistent processes. Customizing a CRM to bridge these gaps can be expensive, slow, and difficult to maintain. And when the system doesn’t match how the team works, adoption drops and data goes stale, creating decision making risks. For teams executing deals, a purpose-built platform does more than organize contacts—it supports the real work of informed deal management.

Where Deal Management Platforms Fit In

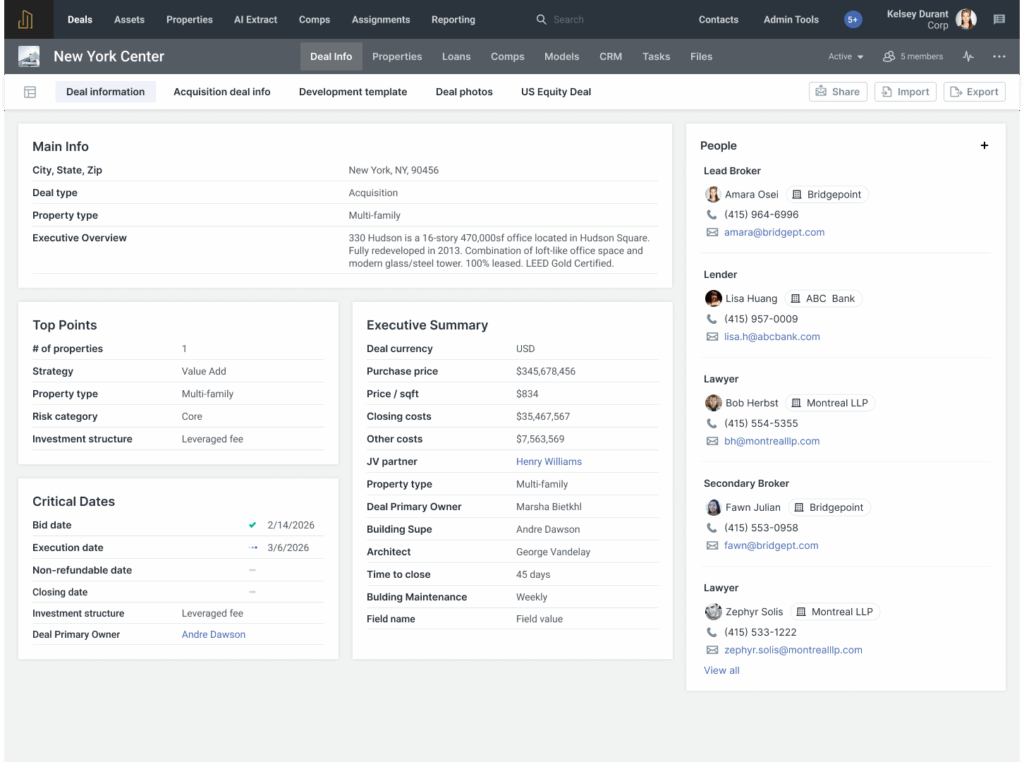

Purpose-built real estate investment platforms, like Dealpath, give teams a centralized hub to manage every step of the deal lifecycle, from source to close, with real estate-specific data, integrations, and workflows. Reporting can be tailored to your specific needs.

Rather than trying to bend a CRM into something it’s not, these platforms are designed for how real estate teams actually work. You can:

- Track deals and properties with structured, standardized CRE data

- Manage tasks, diligence, and internal closing approvals

- Collaborate on documents and underwriting in one place

- Report on pipeline by submarket, deal stage, asset class, fund, or risk level

- Build a searchable database of all deals—past and present

- Automatically pull in listings from leading global brokerages and move them straight to your pipeline

- Import data into the platform by scanning OMs with AI

- Gain market intelligence that fuels smart investment decisions by amassing comparables

- View and manage contacts in a centralized database, including filtering by firm, title, or tags

- Track activity like calls, emails, and meetings at the contact level, alongside relevant deals

- Analyze partner relationships to understand capital partner activity and broker sourcing success by region, asset type, or deal size

Dealpath has evolved beyond deal analysis, management and execution alone. Our real estate deal management software now includes purpose-built CRM features that allow teams to view and manage all contacts in a central database, track contact-specific activity like calls and meetings, and analyze key relationships with capital partners, brokers, and others based on deal volume, asset class, and region. This gives deal teams a more complete picture of relationship-driven performance without leaving the platform.

Real Estate Deal Management Software Vs. CRM: Key Differences

CRMs like Salesforce and real estate deal management platforms like Dealpath serve different functions. Salesforce excels at relationship management and tracking broker or investor communications. Integrations with email platforms like Outlook automatically log emails and meetings. However, Salesforce isn’t designed for deal execution.

While contact tracking in Dealpath requires some manual updates and is deal-specific, the platform excels in its purpose-built real estate functionality. Highlights of the platform include real-time reporting, Excel model integration, and a proprietary comps database. Out-of-the-box workflows are designed with CRE-specific roles, tasks, and deadlines in mind. Analysts can automatically import data from OMs using AI Extract and save time, removing manual data entry. Additionally, teams receive broker listings directly into the platform using Dealpath Connect—eliminating the need to re-enter deal information from emails or PDFs.

The table below outlines where each platform shines:

| Capabilities | Salesforce CRM | Dealpath Deal Management Platform |

| Primary Use | Contacts, relationships, sales pipeline | Acquisitions, development, debt, dispositions, and portfolio management |

| Contact Management | ✅ Robust, CRM-native | ✅ Centralized contact database with activity tracking and tagging |

| Deal & Property Tracking | ⚠️ Requires customization | ✅ Native. Structured for CRE data like deals and properties |

| Workflow Automation | ⚠️ Generic and requires customization | ✅ Built-in CRE-specific |

| IC Memos & Document Generation | ⚠️ Manual or custom-built | ✅ Auto-generated from deal data |

| Automatic OM Import | ❌ Not supported | ✅ Data imported in under a minute with AI Extract |

| Excel Integration / Model Mapping | ❌ Not supported | ✅ Drag-and-drop with structured field mapping |

| Comps Database | ❌ Not supported | ✅ Filterable, firmwide comp library |

| Real-Time Pipeline Reporting | ⚠️ Requires buildout or external tools | ✅ Dashboards by market, deal status, team activity |

| Broker Data Feeds | ❌ Manual entry from email or spreadsheets | ✅ Direct listings from broker platforms flow into Dealpath |

| Track Partner Relationships | ⚠️ Available but requires customization to associate with deal-specific info | ✅ Track top capital partners and brokers by sourcing volume, asset type & region |

Integrating Salesforce and Dealpath: How They Work Together

For teams that rely on Salesforce across departments, replacing it isn’t always the answer. That’s why many firms integrate Dealpath instead—keeping Salesforce for typical CRM use cases like contact tracking, while managing, evaluating and executing deals in a purpose-built platform.

Here’s how the integration works:

- Create deals & properties: When an opportunity in Salesforce progresses to a specific stage (e.g., “Letter of Intent”), a corresponding deal and property is created in Dealpath. This automates the process, saving time and reducing errors.

- Ensure data continuity: After creating a deal in Dealpath, you can use the Dealpath API to extract data from Salesforce and populate key fields in the Dealpath deal and property records. This ensures that all necessary information is accurate and immediately available.

- Update Salesforce with Closed Deal Data: Once a deal is closed in Dealpath, relevant data is sent back to Salesforce, keeping your CRM updated for firmwide reporting and visibility.

Real-World Example: Accelerating Acquisitions With Salesforce + Dealpath

A medical office real estate acquisitions firm integrated Salesforce with Dealpath to boost close rates and shorten deal timelines. Brokers and relationships are managed in Salesforce, while signed LOIs trigger automatic deal creation in Dealpath via API.

The integration lets the team focus on execution without losing valuable CRM context. Data flows back to Salesforce and their data warehouse, enabling real-time visibility and performance tracking across the deal lifecycle.

When to Augment or Replace Salesforce With a Deal Management Platform

Not sure which direction to go? Start by asking your team:

- Is Salesforce actively used for deal management—or just a place we store contacts?

- Do we manage tasks and deal workflows in spreadsheets or email?

- Does reporting require extra steps, exports, or data cleanup?

- Are deals being duplicated across multiple systems?

- Is Salesforce offering insights that help us make better informed decisions?

- Is our CRM driving execution—or getting in the way?

If Salesforce is not meeting execution needs for your CRE deal process, replacing it with Dealpath could reduce complexity and improve visibility. On the other hand, if it’s embedded across teams, integration may be the better path.

How Dealpath Supports Integration or Data Migration

Whether your team is planning to integrate with Salesforce or fully transition to Dealpath, you’ll have experienced support along the way.

From day one, Dealpath’s onboarding team works closely with you to ensure the platform reflects your team’s structure, process, and goals. We’ll help import historical deal data, configure your workflows, and advise on how to connect Dealpath with the systems your team relies on.

Dealpath also supports the import of contacts and relationship data as part of onboarding, making it easy to migrate from spreadsheets or legacy CRM systems and begin tracking activities in one place.

For teams looking to maintain Salesforce, Dealpath offers an open API that enables firms to connect pipeline, property, and deal data between platforms. This gives you the flexibility to build an integration that fits your internal tools and reporting needs—without forcing your team to duplicate work. Our team is here to support the planning, configuration, and rollout.

The result? A platform tailored to your CRE processes, built to support collaboration and clarity at every stage of the deal–without relying on workarounds.

Deal Evaluation and Execution Requires the Right System

Salesforce is a robust CRM—but managing commercial real estate deals isn’t its strength. Real estate teams need systems designed to track properties, coordinate diligence, and move deals forward. That’s what Dealpath was built for.

Whether you integrate or replace, the most important thing is giving your team the tools they need to execute with clarity and speed.

Ready to learn how Dealpath can support your team? Request a demo to discuss whether replacing or integrating is right for you.

Request Demo