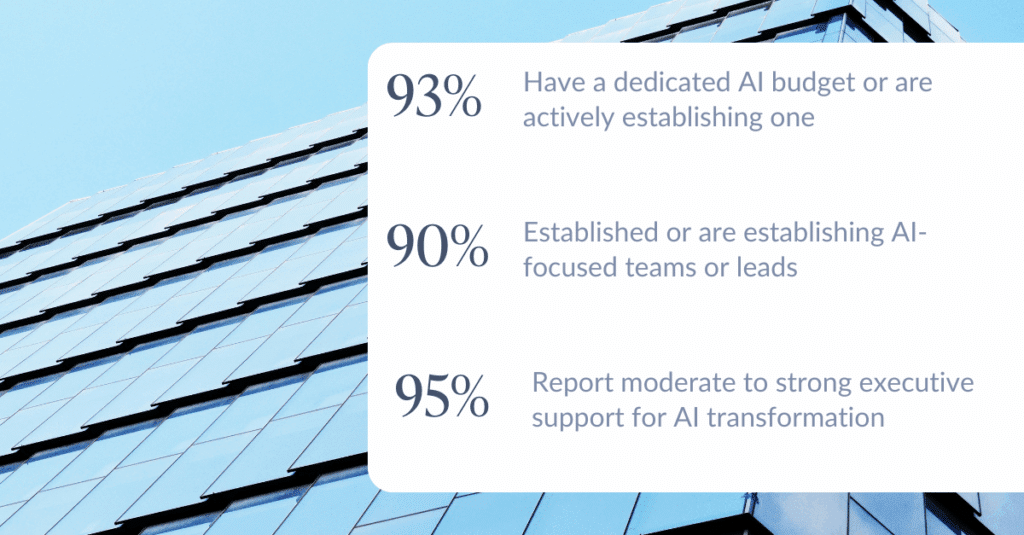

We’ve hit a tipping point with AI in commercial real estate. As emerging technologies continue to drastically change how businesses across industries will function, history has shown that one point remains clear: early adopters gain a lasting advantage. And based on what we’re hearing from the market, CRE leaders know it, too. In CNBC’s Property Play newsletter, we shared survey results showing that 93% of executives in institutional real estate believe early adopters will gain a competitive edge.

A New Inflection Point for AI in CRE

Across industries, innovation is moving faster than ever, and CRE is feeling that acceleration just as much as anyone else. Half of institutional investment firms are already piloting or scaling AI solutions, which means the gap between early adopters and everyone else is widening quickly. Those who start now are already seeing the upside across major parts of their investment workflows: faster screening, better decision-making, stronger asset performance, and even improved talent attraction and retention.

The AI Adoption Curve Is Taking Shape—and It’s Moving Quickly

The real estate industry is no longer in the early exploration phase of AI adoption.

Among leading institutional real estate investors, 90% of firms have established or are in the process of establishing AI-focused teams or leads, and nearly half are already actively scaling AI solutions or piloting bespoke AI tools. This segment only continues to grow, and as firms increasingly mature to adopt AI solutions, artificial intelligence has shifted from “interesting concept” to “operational necessity.”

Interestingly, we’re seeing the biggest traction among larger firms (those with $5B+ AUM). That’s a shift from earlier waves of tech adoption, where smaller firms were often quicker to experiment. But regardless of firm size, one thing is clear: the longer teams wait, the harder it becomes to catch up.

Why Early Movers in AI Will Gain a Competitive Advantage

Like any long-term investment, early adoption unlocks compounding value over time. The sooner firms start, the more your advantage grows.

For example, although every firm we surveyed is adopting or planning to adopt AI, all of them cited fragmented data as a roadblock. Early adopters get ahead simply because they have a head start to clean and connect their data, leading to better results, faster outputs, and more usable insights. Firms that adopt AI earlier benefit from addressing data fragmentation sooner, enabling them to mould their database based on their strategy, including considerations like:

- What data exists and should be captured

- Naming conventions

- How the data is organized

- Relationships among data points

- Other fields and hierarchies

Completing this strategic data exercise early on helps firms surface previously hidden inconsistencies sooner. This helps early adopters unlock the benefits of AI earlier because models can improve faster with the use of cleaner, more standardized data, allowing firms the ability to establish repeatable data workflows before competitors.

The sooner a firm adopts AI, the sooner teams also become more fluent and comfortable with AI-powered workflows. That means less friction, smoother rollout, more time saved, and earlier opportunities to uncover new and better ways to drive results with AI. Instead of spending hours on manual data processing, they can invest time in strengthening human relationships with strategic partners that drive the business forward.

Practical Examples of How to Kickstart AI Adoption

What are low-risk ways for CRE firms to start with AI? If you’re not sure where to begin, you’re not alone. The good news: there are plenty of low-risk, high-value use cases that firms are trying today.

In our recent webinar about practical applications of AI, industry partners shared more on “low-stakes, high-value” uses of AI adoption, like leveraging AI as a coworker and brainstorming partner when drafting investment memos.

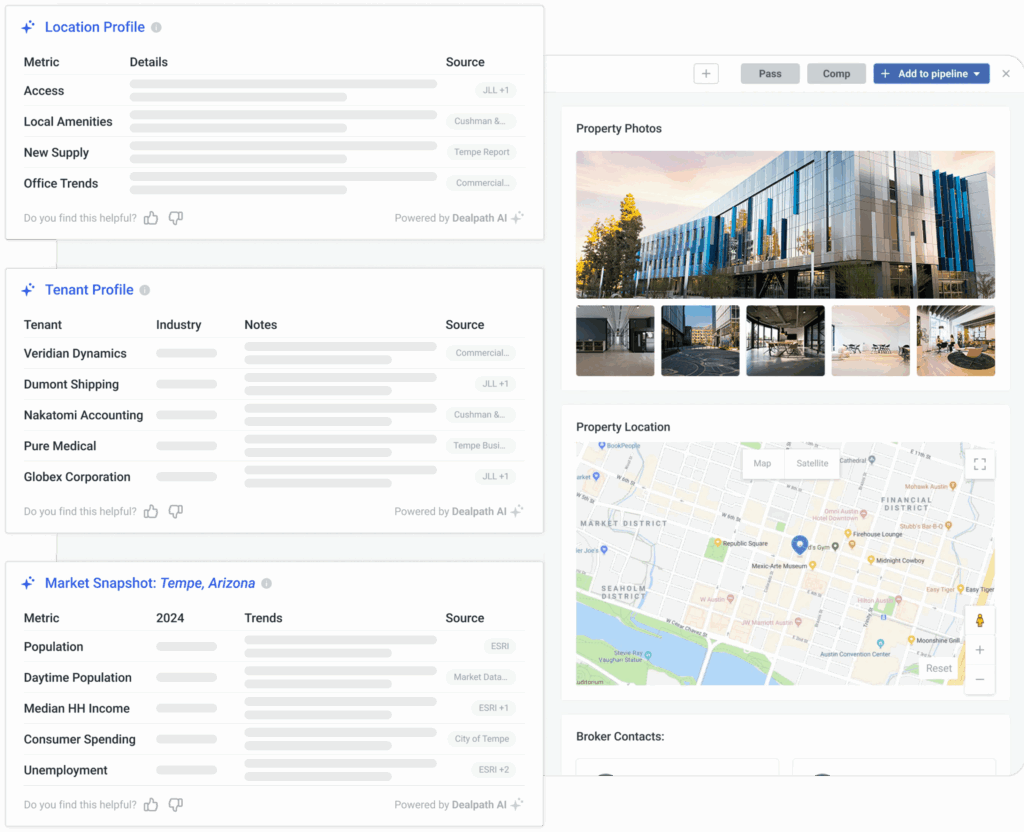

Additionally, we recently launched Dealpath’s AI Studio, offering several examples of low-risk, high-value uses of AI as part of its robust suite of tools to accelerate innovation across the real estate investment lifecycle.

- AI Deal Screening: Generates instant snapshots of a market, property, or tenants, pulling in context into Dealpath Connect (including listings from JLL, CBRE, and others), reducing listing screening time from hours to minutes.

- AI Recommended Comps: Auto-identifies relevant comps based on proximity, price, square footage, and more, helping analysts to benchmark deals, accelerate underwriting, and evaluate more deals faster.

- AI Data Extract (Enhanced): Our OM and flyer abstraction tool now extracts information in under a minute with ~95% accuracy. It’s also expanding to handle debt use cases such as requests for financing, funding, and more, applicable to all major loan types, including acquisition, refinance, construction, and bridge.

- AI CRM Summary: Distills recent interactions into clear, actionable insights, helping your team get up to speed instantly and ensuring critical follow-ups never fall through the cracks.

Unlock Low-Risk, High-Impact AI Efficiencies With Dealpath’s AI Studio

Industry players have reached a clear consensus: AI adoption is no longer optional, and the firms that embrace it now will build a compounding competitive advantage. The costs of waiting are far too high, and the future of commercial real estate will be defined by the firms that choose to move now.

To drive adoption across your organization by targeting low-risk, high-impact use cases, join the AI Studio waitlist.

Join Waitlist