Connor Mortland Fireside Chat: Doubling Deals Reviewed & Under Contract

Across debt and equity groups, enterprise and lean investment firms, and all markets, deal management software has proven its mettle in the real estate world as a driving force behind top-line revenue growth. With real-time pipeline visibility and standardized workflows, firms can make faster, more efficient data-driven decisions. One such firm is Avanath Capital Management, […]

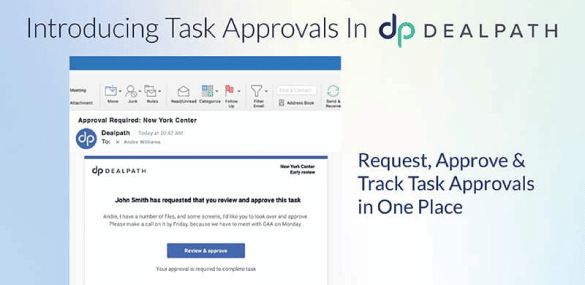

Introducing Task Approvals: Request, Approve & Track Tasks in Dealpath

Real estate deal teams are tasked with managing sophisticated workflows throughout the deal lifecycle, including numerous approvals from various stakeholders. With Dealpath’s new Task Approvals feature, teams can now request, approve and track tasks, all in one place. Read on to learn more about how managing Task Approvals directly in Dealpath empowers deal teams to […]

Building a Baseline in Dealpath: 7 Metrics that Matter

Portfolio growth is one of the clearest signals of success for commercial real estate investment managers, but it’s far from the only metric that you can look to for performance insights. You can’t manage what you can’t measure, which means firms that are reliant on generic project management tools and Excel for pipeline tracking often […]

Hiring a Real Estate Transaction Coordinator: 6 Things to Consider

Managing numerous pipeline deals at any given time, investment deal teams are bogged down with data entry, appointment scheduling, permitting and other detail-oriented and tedious–yet essential–pieces of the broader puzzle. Some firms experiencing these constant fire drills hire real estate transaction coordinators to reduce administrative workloads. While having another set of trained eyes can create […]

8 Real Estate Pipeline Management Bottlenecks to Eliminate

What do the most successful real estate investment firms do to drive smart investment decisions?

DACS: The Deal Management Framework for Exponential Portfolio Growth

At Dealpath, we work with leading institutional real estate investors that manage high-volume pipelines to achieve exponential portfolio growth. Through implementing software solutions tailored to unique enterprise needs, we’ve identified a framework of deal management best practices that firms have followed to drive optimal business performance and unlock maximum portfolio value. Deal management software is […]

ESG in Real Estate: 9 Things Investors Must Know [Guide]

As the pandemic has shined a brighter spotlight on environmental and social equity concerns, commercial real estate investors have joined a rapidly growing coalition of institutions shifting toward sustainable, community-driven practices and policies. ESG real estate considerations have become a top priority for investors at every stage in the asset lifecycle– from screening prospective acquisitions, […]

5 Ways to Streamline & Scale Commercial Real Estate Deal Flow

Reviewing more opportunities at a faster velocity is key to effectively growing your firm’s portfolio with lucrative investments. However, doing so takes a strategic, disciplined and volume-driven approach. Scaling and streamlining deal flow not only drives efficiency, but positions your firm to succeed by helping you uncover profitable opportunities before competitors. In this blog post, […]

External Collaborators on Dealpath: 5 Things You Must Know

Among other goals, Dealpath’s aim is to help deal teams build efficiencies by standardizing processes. There might be dozens or hundreds of boxes to check on a single deal, from early vetting to due diligence and underwriting, but not all of that work rests on your team’s shoulders. External deal stakeholders like brokers, environmental teams […]

A Day in the Life of a Managing Director With and Without Dealpath

Leading real estate investment management teams is no simple task, especially when you depend on team members for reports with valuable market intelligence. When your data is fragmented across siloed systems, obtaining the information you need to make decisions about investment strategies, forecast transactions, and report to stakeholders can be a lengthy process–which may not […]