This blog post was last updated on Thursday, February 9th.

In recent years, real estate investment managers have transacted at a higher volume and velocity than ever before. Ever-growing access to data–and powerful new platforms to harness this competitive intelligence–have played no small role in this transformation. Armed with real estate data analytics software driven by proprietary data, investors are systematically underwriting and evaluating with greater speed, scale and precision using deal management software. Now, investors can screen deals in as little as minutes–a lengthy process that may have once taken hours.

In this blog post, we’ll outline how deal teams are turning data into answers by breaking down the 5 key insights and value drivers behind real estate data analytics.

Jump to:

- What Is Real Estate Analytics Software? Understanding the New Age of Proprietary Data

- 5 Key Insights to Uncover With Real Estate Data Analytics

- The 5 Key Drivers of Modern Real Estate Analytics in Property Technology

- The Proptech Companies Powering Commercial Real Estate Analytics

What Is Real Estate Analytics Software? Understanding the New Age of Proprietary Data

In short, real estate data analytics offer investors new ways to visualize data intelligence to make faster, better-informed underwriting and investment decisions.

It takes significant time to collect, maintain and analyze data–time that’s better spent evaluating more deals and scaling deal flow. Real estate analytics software, like deal management platforms, are simplifying how deal teams tap into this intelligence, whether they’re making equity investments, evaluating development projects or originating debt deals.

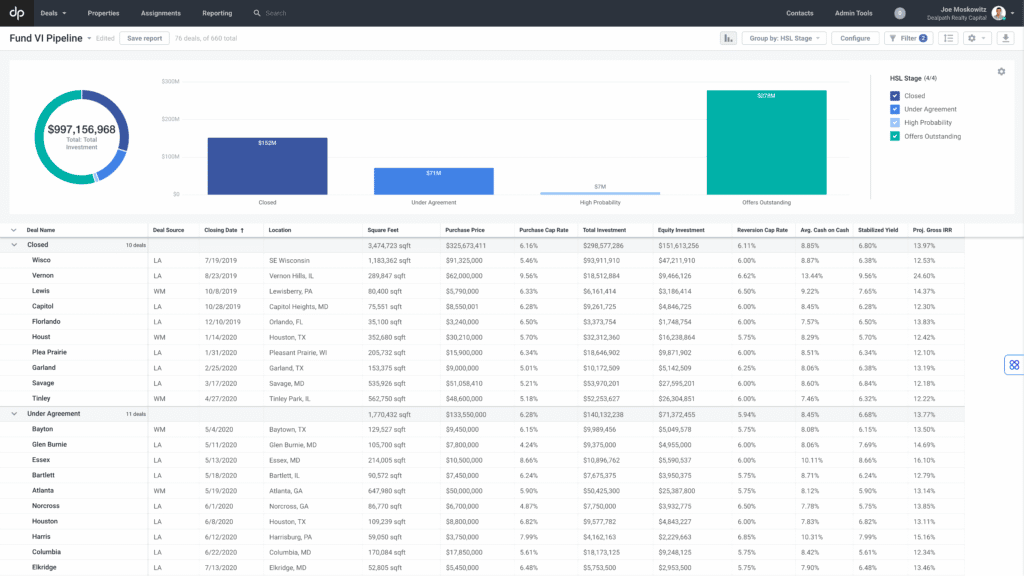

As institutional investors manage their pipelines, real estate investment analysis software programmatically adds corresponding deal data to an ever-growing proprietary database. Fueled by historical comps, real estate data analytics platforms allow firms to screen and underwrite deals with greater speed and precision–making data a key competitive advantage. Real-time visibility empowers investors to act more confidently based on up-to-the-minute information in a market where the fastest players win.

5 Key Insights to Uncover With Real Estate Data Analytics

1. Real Estate Comparables Data: Transactional Data, Rent Rolls & Other Proprietary Information

The more deals your firm ingests into its pipeline, the more comparables you’ll have when evaluating future opportunities. Investors now rely on data analytics for real estate to harvest intelligence from underwriting models, like rent rolls and transactional data, faster and more precisely. With seamless access to actionable data, you can scale your pipeline to create stronger investment optionality and surface more deals.

Centralizing and visualizing this information in a deal management platform allows you to systematize data-driven investment decisions by slicing and dicing data from a reportable deals database, informing underwriting assumptions. Even deals that die immediately can offer benchmarks in the form of comps, priming your firm to make data-driven decisions on future deals. Dealpath’s deal management platform includes an integration with CompStak, allowing your firm to seamlessly access key sales and lease comps.

Whether you’re screening a new deal, underwriting an opportunity or validating a deal to the IC, real estate data analysis tools offer the intelligence and confidence you need to act.

2. Owned Portfolio Data Analytics

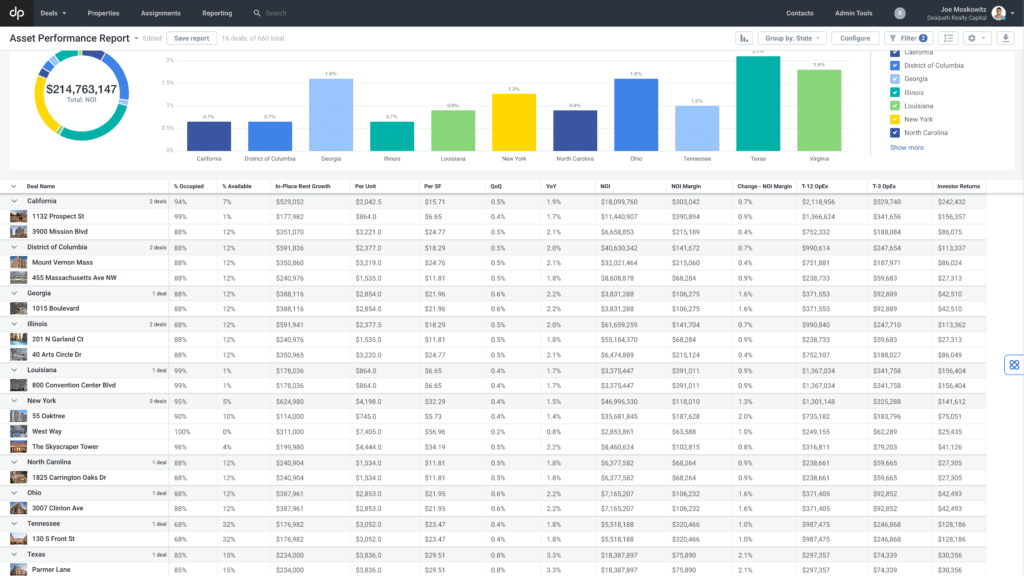

Beyond passed and dead deal data, how do current pipeline deals measure up against your owned portfolio assets? Deal teams managing their pipelines in deal management software now compare underwriting models from current opportunities against owned assets.

In just a few clicks, you can evaluate deals against portfolio benchmarks to see if they meet your target risk and return profiles. Marrying owned portfolio analytics with proprietary market data can fuel a powerful digital deal advantage.

3. Pipeline Performance Analytics and Strategic Insights

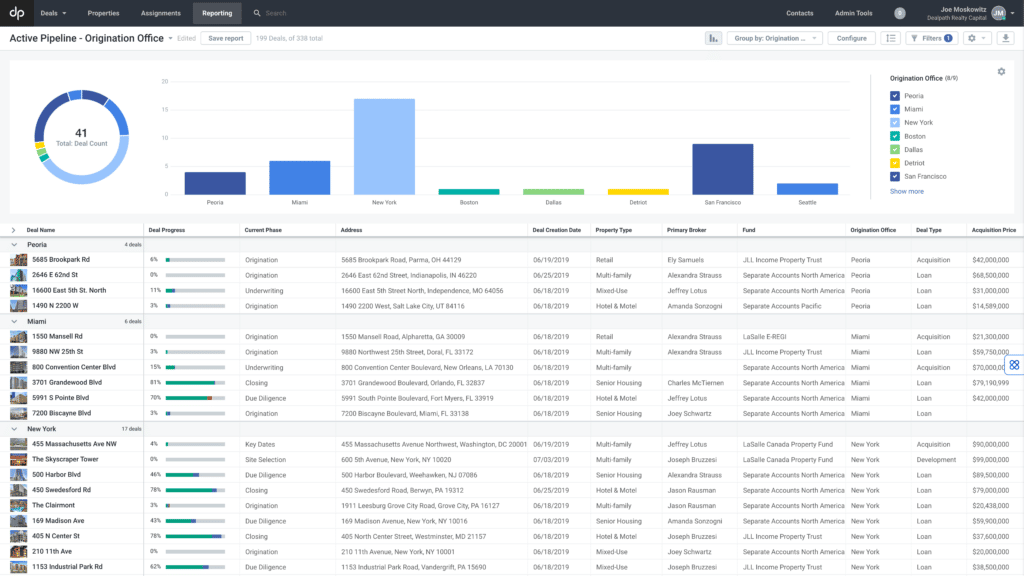

How are deals in your pipeline performing? Are deals sourced from certain brokers or in specific markets closing faster? These questions–which might have previously imposed hours of spreadsheet work–can now be answered via turnkey reporting.

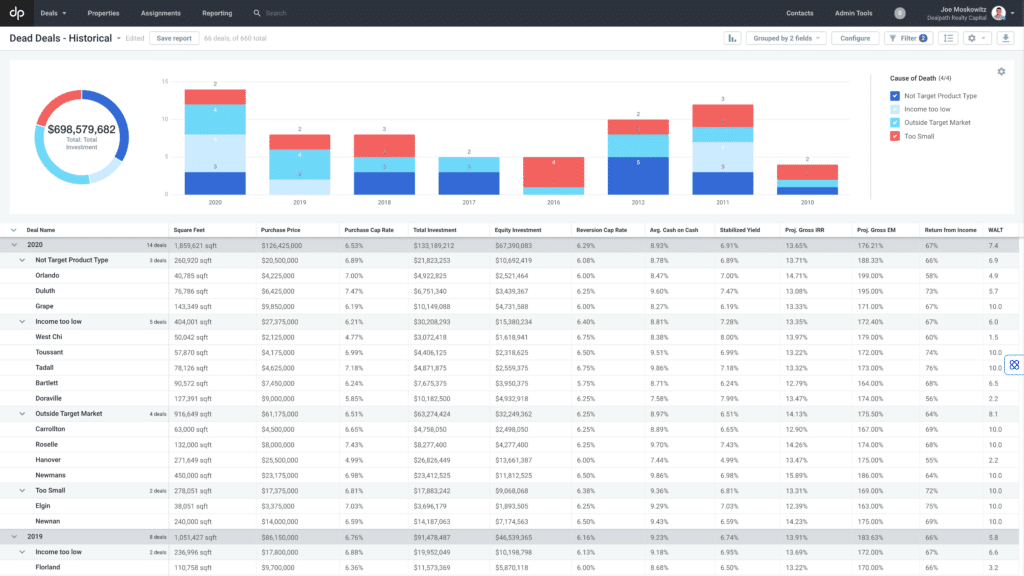

As you execute and reject deals, real estate data analytics within deal management software can provide strategic insights about your investment strategy’s performance. For example, running a dead deal analysis report might confirm that industrial deals die more frequently than multifamily ones. Or, that office deals in Atlanta rarely move beyond screening.

Understanding your investment pipeline’s performance is critical as your firm strategizes to accelerate deal velocity and deploy capital efficiently.

4. Market Data Analytics & Intelligence

In today’s fast-moving market, there are better ways to stay abreast of trends than reading industry newsletters. Monitoring real estate data analytics, driven by pipeline data, will enable you to uncover and act on trends in real time. Consequently, you can beat the competition to the punch when it comes to pursuing emerging opportunities in fast-growing niches.

With Dealpath, for example, your firm could slice and dice data to monitor trends for all deals in Seattle, or drill into multifamily properties. If cap rates began dropping, you would be well-positioned to act on this intelligence before competitors.

5. New Real Estate Market Intelligence & Data Analytics

New markets like life science and self storage hold boundless, untapped opportunity. Penetrating these verticals, though, can be challenging without a foothold. Lacking a trove of historical comps, data analytics for real estate can empower your firm to surface and execute the most profitable deals.

Marrying paid third-party data with proprietary pipeline data from deals you’ve sourced can bring your deal team up to speed quickly on industry benchmarks. Despite a lack of market experience, your firm can deploy capital on deals matching your risk profile with conviction.

The 5 Key Drivers of Modern Real Estate Analytics in Property Technology

Commercial real estate data analytics can take the form of various real estate investment software categories. Across the board, though, insightful analytics that make systematized real estate investment deal analysis possible hinge on key value drivers.

1. Standardized Data

A departure from the previous norm of storing data in various spreadsheets, standardizing data as it’s ingested has become the new norm. Additionally, standardization enables firms to immediately make apples-to-apples comparisons. For example, standardizing the format for purchase prices on multifamily properties creates the opportunity to pull a report of pipeline deals based on that data point. As a result, firms with the right platforms can analyze deals in a more programmatic, scalable manner.

2. Access to Real-Time Data & Insights

How can you confidently evaluate investment decisions based on outdated benchmarks? Centralizing data in real estate analytics software ensures the entire organization, from analysts, to senior leadership and even portfolio managers, can find accurate information in real time.

3. Integrated Third-Party Datasets

Integrating third-party datasets with your proprietary analytics can add valuable market context. Real estate analytics platforms position this crucial data alongside proprietary data, centralizing all relevant intel in one command center. When considering options, be sure to select a solution with an open API, which makes it possible to aggregate data from other platforms.

4. Data Ingestion Partnerships

While every new deal your firm reviews offers valuable intelligence, capturing that data can be challenging. Working with a real estate analytics software solution provider that offers a data ingestion partnership, though, ensures that your firm memorializes intelligence from every deal in your pipeline–even the ones you reject immediately. Consequently, your firm can more easily slice and dice data by market, deal size and other variables to surface relevant comps.

5. Automated Reporting

Traditionally, pipeline reporting is a time-intensive endeavor that requires collaboration and significant data entry. Real estate data analytics platforms like Dealpath have shifted this paradigm, instead allowing stakeholders to keep a real-time pulse on pipeline activity with automated reports. Armed with information tailored to their roles and responsibilities, deal team members and leadership can act faster and more confidently.

The Proptech Companies Powering Commercial Real Estate Analytics

As commercial real estate’s digital transformation continues, proptech companies are ensuring that firms have streamlined access to the information they need. While there are many more, these are some of the proptech companies powering commercial real estate analytics:

- Dealpath: real estate’s most trusted deal management solution that empowers institutional investors to grow top-line revenue and build operational efficiencies with real-time visibility.

- Real Capital Analytics: a CRE database with over $40 trillion in recorded commercial property transactions providing investment management firms and other organizations with actionable data about market pricing, capital flows and investment trends

- Compstak: a crowdsourced platform that provides commercial lease comps, sales comps, and property details to simplify investor decisions

- Cherre: a data platform allowing firms to connect disparate data sources

- Altus Group: a leading data company serving the Canadian market with real-time and historical transactional data, comps, and local market tools

- CoStar: a leading data company serving the U.S. market with extensive comps and transactional data, as well as other data and information products

3 Strategies to Boost Deal Velocity And Grow Your Portfolio of AUM

Closing even a few more deals each year drives meaningful portfolio growth. But to act on deals before the competition, your firm must build data-driven efficiencies when identifying, vetting and proving these investment opportunities. Download the eBook to learn how institutional investors close deals with greater speed, precision and conviction by leveraging purpose-built deal management software.

Download eBook