We’re excited to announce the launch of AI Extract—a new data extraction capability in Dealpath powered by AI.

All real estate investment firms understand that data is key to decision making. However, a lot of valuable data is trapped inside of PDFs. That means teams either sink hours of time into manual data entry, or that data doesn’t get captured and dies in an inbox.

Now, with AI Extract, you can automatically capture data from every OM or broker listing that crosses your desk, greatly expanding your firm’s access to data and cutting down on manual work for your team.

The end result is that your business will be able to evaluate more deals and build a proprietary database of market intelligence. And with Dealpath, that data isn’t just being captured—it’s also centralized and standardized, so it can be turned into reports that power insights and smarter investment decisions.

How AI Extract Works

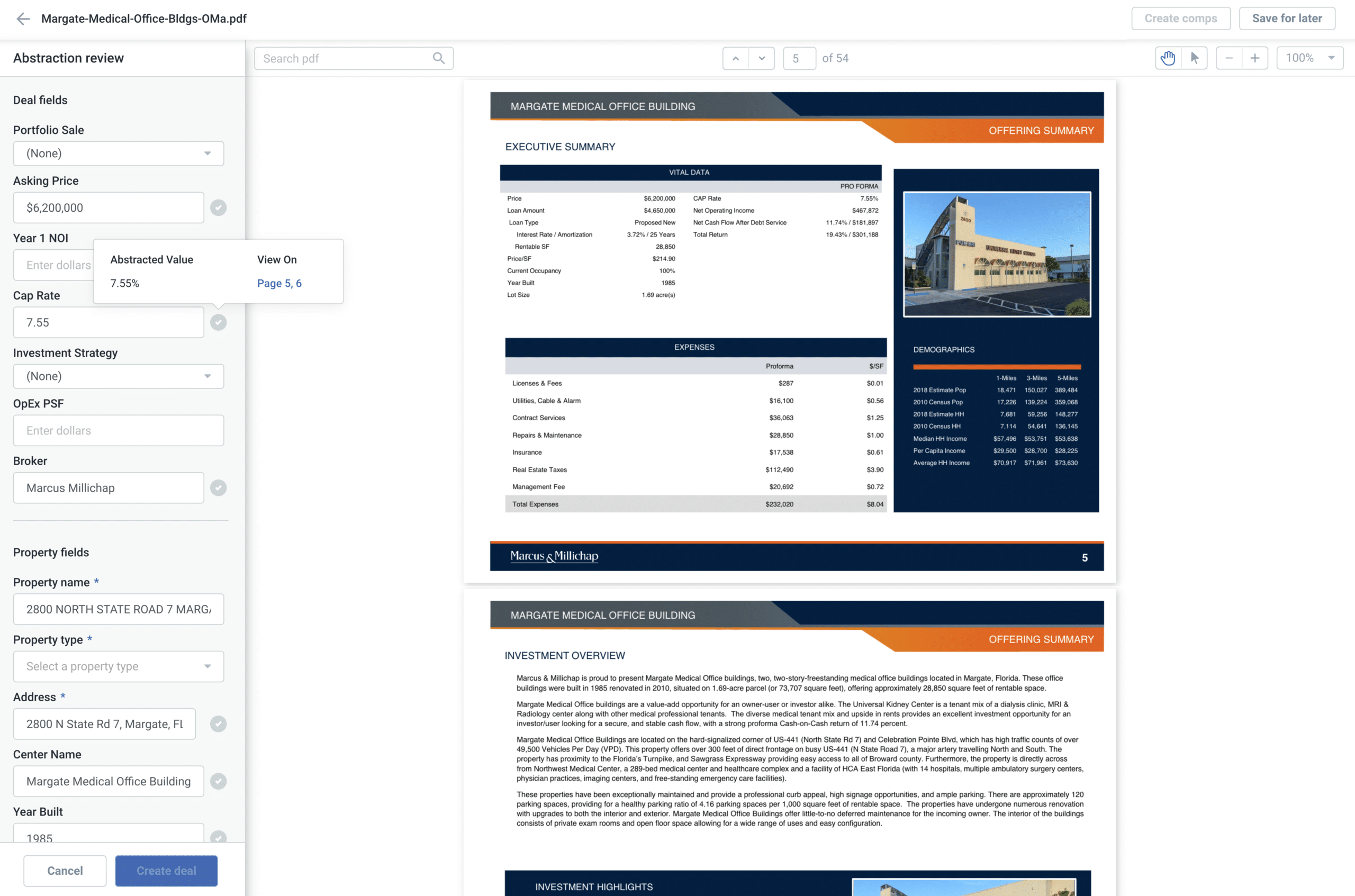

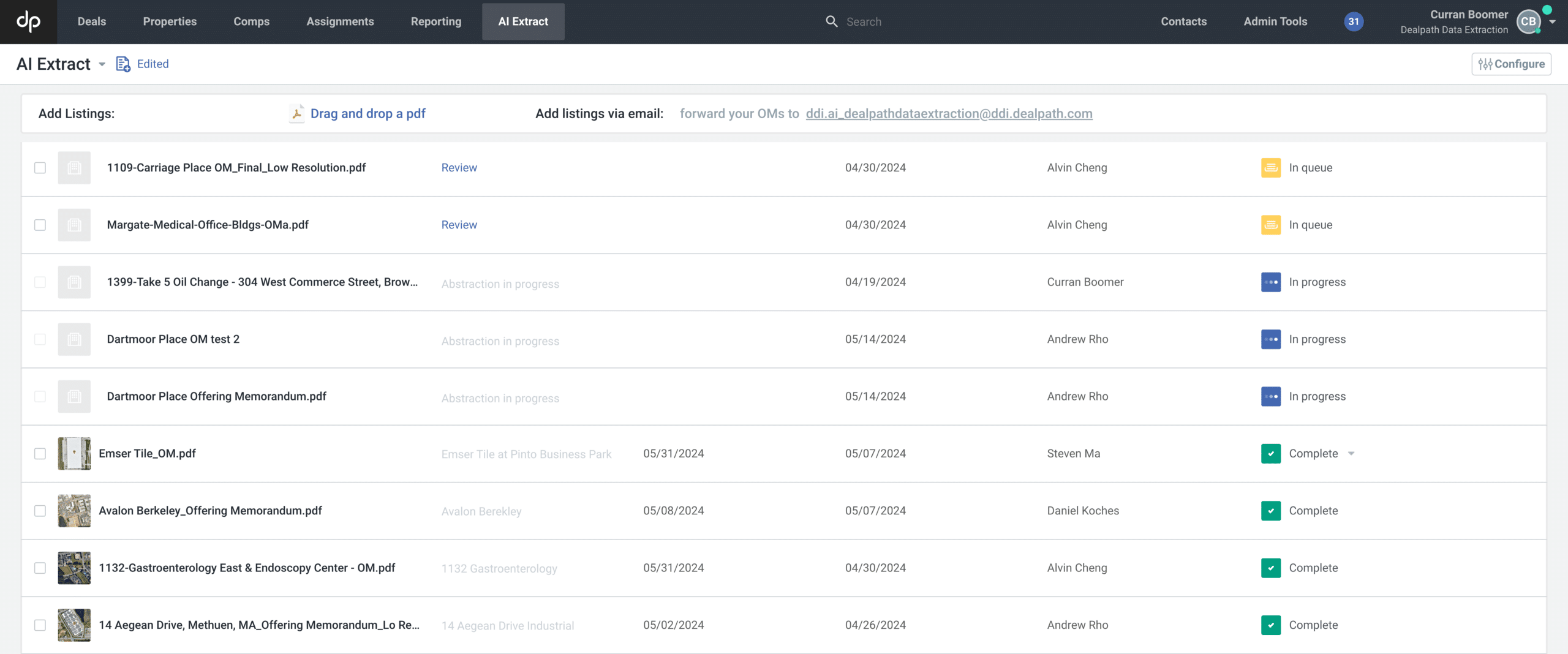

When you receive an OM or broker listing that you want to capture, simply drag-and-drop the PDF into Dealpath, or forward it to a dedicated email address. AI Extract will then extract data from it using proprietary AI technology developed by our in-house team of engineers based in Silicon Valley.

When the data extraction is complete, typically in fifteen minutes or less, you can then review the data pulled from the OM, make any necessary updates, and save it as a deal or a comp inside Dealpath.

Market Intelligence, Without the Manual Effort

AI Extract lets your team capture data from every property or portfolio that crosses your desk—whether you’re interested in pursuing it or not.

Not keen on moving forward? Save that property as a comp inside Dealpath and use it as a reference point when evaluating and underwriting future deals. The larger your database gets, the more precise your decision making.

When it only takes a few minutes to capture hundreds of data points, you can build out a database without investing significant time in data entry.

Evaluate More Deals & Kickstart Deal Execution

With AI Extract, there’s no limit to the number of deals you can evaluate. You no longer have to hunt through dozens of pages to find the data points that you care about. With the help of AI Extract, you can zero in immediately on the most important information and figure out if a deal is worth pursuing.

And when you do come across a deal you’re interested in, you can jump straight into the deal execution process. AI Extract allows you to create a deal in Dealpath with all the basic information fleshed out. That means you can go straight into evaluating a deal, speeding up your deal velocity and giving you a better shot at crafting a winning offer.

Preparing for the AI Revolution

For the last few years, we’ve all heard a lot about AI, but it’s hard to separate the hype from the concrete applications that can actually make an impact on your business.

At Dealpath, we’re committed to bringing the power of AI to the CRE industry. We’ve applied AI to Power Search, our global search engine that lets you search all your data in Dealpath, even inside documents, and now we’re applying that technology to AI Extract.

No one really knows where AI is going, but if you want to take advantage of this paradigm shift, one thing is certain: your firm’s data needs to be centralized, standardized, and structured in a way that AI can actually make use of it. While flexible enough to accommodate unique workflows, Dealpath’s data structure brings consistent organization to your data so you can leverage it for insight, push it out to the rest of your tech stack, and capitalize on whatever AI developments are coming in the future.

With Dealpath, you can be prepared to seize every opportunity. Schedule a demo to learn more about AI Extract and how Dealpath can prepare your data for future AI innovations.

Schedule Demo