From cap rates to yield on cost, CRE investment managers measure their pipelines and portfolios with numerous metrics. None, however, offer more direct insight into a deal’s profitability than the internal rate of return. The internal rate of return is a metric that investors rely on to understand the rate at which an investment’s value will appreciate. As a percentage, the IRR offers a clear lens through which investors can make “apples to apples” comparisons. In this blog post, we’ll explain what IRR is, how to find internal rate of return, and tips for tracking it.

Definition: What Is The Internal Rate of Return (IRR)?

The internal rate of return (IRR) is a type of discount rate or discounted cash flow analysis that investors calculate when screening deals. Higher IRRs signal that investments will generate greater returns, breaking even on the initial outlay faster. Because the IRR is a direct expression of profitability, it’s one of the most telling bottom-line metrics during evaluations.

Many investment strategies hinge on holding assets for several years, which means that investors must think beyond returns from the next year alone. Unlike comparable projections, it also accounts for fluctuations in the value of money. The internal rate of return offers a holistic lens through which investors can measure returns over the course of several years. In doing so, it illustrates how an investment’s value is projected to grow over time.

By calculating the IRR, investors can compare the profitability of several deals in the pipeline, then prioritize one or several to pursue.

Advantages & Disadvantages of IRR

The IRR is best used as a comparison point, measuring projected returns against initial costs, as well as other deals. When the internal rate of return is higher than the firm’s target threshold, also called the hurdle rate, the investment is considered worthwhile.

While the IRR can be insightful, there are a few important caveats to remember. First, IRR is, at best, a projection. Consequently, actual returns are subject to lease cancellations, ever-changing market conditions and other unpredictable factors.

Investors typically pair the internal rate of return with net present value, which analyzes cash inflows and outflows. Because IRR is expressed as a percentage, it’s a valuable comparison point, but won’t necessarily offer insight into total revenue. For this reason, investors typically look at IRR alongside other metrics that yield more concrete numbers.

Beyond the IRR, investors must also weigh other factors, like risk. For example, a high potential for setbacks–and delayed revenue–might make one deal less attractive, even if it boasts a higher IRR.

IRR Formula: How to Calculate the Internal Rate of Return

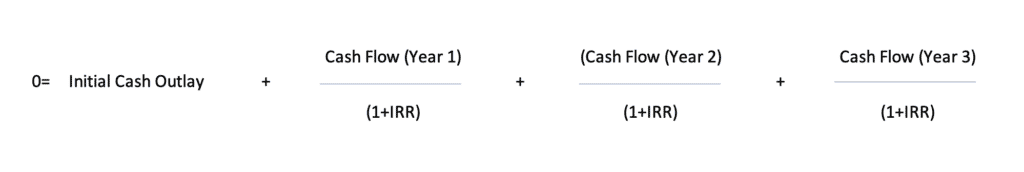

The formula for calculating the internal rate of return on a real estate or other investment is:

As mentioned above, the formula assumes that the net present value is equal to zero. This is because investors must lay out cash for an investment deal. Investors also start this process with relevant projections.

In short, you calculate the internal rate of return by adding the initial cash outlay to the inflows for every year included in the projection. The equation above assumes that you are only including data for three years, but you can include projections from as many years as available. Like other financial calculations, Excel makes calculating IRR simple with a dedicated calculation option, given the formula’s complexity.

From time to time, investors might want to revisit previously calculated internal rates of return on deal comps. While Excel might be the best tool to calculate the internal rate of return, it’s not the best solution to track, memorialize or compare this data. For this reason, institutional investors track this data in a deal management platform, which provides real-time access to centralized data.

IRRVs. Compound Annual Growth Rate & Return on Investment

Internal rate of return, compound annual growth rate and return on investment are all financial metrics used to measure success. They accomplish this, however, in different ways.

Like the IRR, compound annual growth rate is measured over a defined period of time. However, it only factors in the investment’s beginning and ending values. The IRR, on the other hand, accounts for year-to-year

- Internal rate of return: The IRR is a percentage that measures the profitability of an investment over several years, with cash flows changing each year.

- Compound annual growth rate: Like the IRR, the CAGR of an investment is measured over a defined period of time. It accounts for compounding values. However, it only factors in the beginning and end values of the investment. Unlike IRR, the CAGR does not account for varying returns over the years.

- Return on investment: The ROI measures the total growth of the investment, from start to finish. Notably, ROI does not factor in year-to-year fluctuations in returns. It’s an informative snapshot of growth, but may not always be helpful for long-term measurement or projections. IRR and ROI are rarely equal, except when IRR figures are isolated within one year.

Internal Rate of Return Example

Let’s look at an example of an internal rate of return calculation with two deals: deals A & B. Deal A initially cost an equity investment of 1,200,000, while deal B cost 2,000,000. Investors utilized projections to account for year-to-year changes in revenue for each building.

| Values | Deal A | Deal B |

| Initial Cost of Capital | 1,200,000 | 2,000,000 |

| Year one cash flow | 379,000 | 440,000 |

| Year two cash flow | 402,000 | 452,000 |

| Year three cash flow | 396,000 | 465,000 |

| Year four cash flow | 404,000 | 459,000 |

| Year five cash flow | 410,000 | 467,000 |

| IRR | 19.391% | 4.537% |

From the figures above, we can see that deal A has an IRR of 19.391%, and deal B has an IRR of 4.537%.

Considering the IRR alone, deal A is the more lucrative option. That being said, investors rarely consider IRR in a vacuum. Before making a decision, they typically evaluate analytics, risk factors and other variables that could compel them to favor one deal over another.

3 Reasons To Systematize Due Diligence Processes In A Cloud-Based Tool

As deals move through the pipeline, staying tightly aligned around real-time deal information and timelines is critical. Download our eBook, 3 Reasons To Systematize Due Diligence Processes In A Cloud-Based Tool, to learn how leading deal teams rely on cloud-based deal management software to collaborate in lockstep and close more deals.