OM to Insight: Operationalize Commercial Real Estate Comparables

This blog post was last updated on Wednesday, July 16th. Data is the new currency of commercial real estate. But, a comparable is only as valuable as your team’s ability to put it to work for pricing, underwriting, and decision making. In a market where pricing is opaque and timing is everything, a fragmented CRE […]

Building Better Comps by Combining Internal and Market Data

Data is charting the future for the winners and losers in real estate’s next chapter. Winning firms don’t just collect data, they operationalize it to build conviction, act quickly, and adapt their investment strategies. Proprietary data alone is no longer enough to make defensible investment decisions. To succeed, CRE firms must benchmark proprietary deal data […]

Top 8 Real Estate Dashboards for Data-Driven Investors

The more data at your real estate investment management firm’s disposal, the better-positioned you are to maximize returns. But without a centralized database to standardize and analyze this data, your competitive advantage could be locked away in spreadsheets. Leading teams are relying on real estate dashboards in Dealpath to power their investment strategies, from pipeline […]

Why a CRM Alone Isn’t Enough for Commercial Real Estate Teams

For many commercial real estate investment firms, Salesforce has long served as the default tool for managing contacts, relationships, and deal pipelines. But as teams grow, markets shift, and execution becomes more complex, a question often emerges: Can Salesforce really support how our deal team works as a commercial real estate CRM—or is there a […]

7 Expert Insights to Future-Proof Your Data Strategy

It’s no secret that data will dictate the winners in real estate as market conditions shift, deal sourcing evolves, and investors raise expectations. But data alone isn’t enough. To supercharge your competitive edge, you need normalized data standardized within a structured, proprietary database to unlock insights and surface winning opportunities. How can you sift through the noise […]

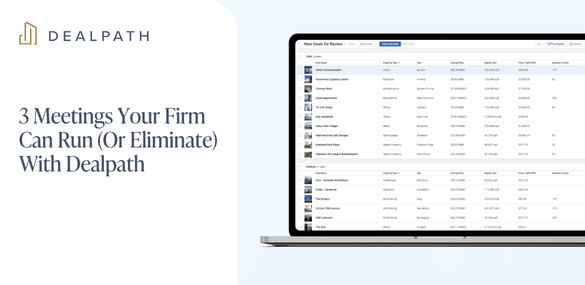

3 Meetings Your Firm Can Run (Or Eliminate) With Dealpath

Managing your deal pipeline, tracking ahead of critical dates and keeping a real-time pulse on next steps is challenging in a rapidly changing market where conditions are shifting and investor expectations are at an all-time high. Relying on manual processes and fragmented tools like spreadsheets, emails, and shared folders can create executional friction for even […]

5 Digital Trends Reshaping Real Estate Acquisitions

Real estate acquisitions are evolving. Amidst shifting market dynamics, executives and LPs are demanding more data to support faster decision-making and hone in on the best deals. Yet, many still rely on fragmented processes, spreadsheets, and manual workflows that slow decisions and execution. The shift to systematized, data-forward acquisitions is unlocking new possibilities in real […]

13 Tips To Kickstart 2025 on Dealpath

This blog post was last updated on Wednesday, January 29th. In 2025, investor expectations are higher than ever as all eyes turn to AI, data-driven decision making and prudent risk management. Simultaneously, many firms are taking strategic steps to capture more proprietary property and investment data, surface stronger insights, and systematize deal execution to effectively […]

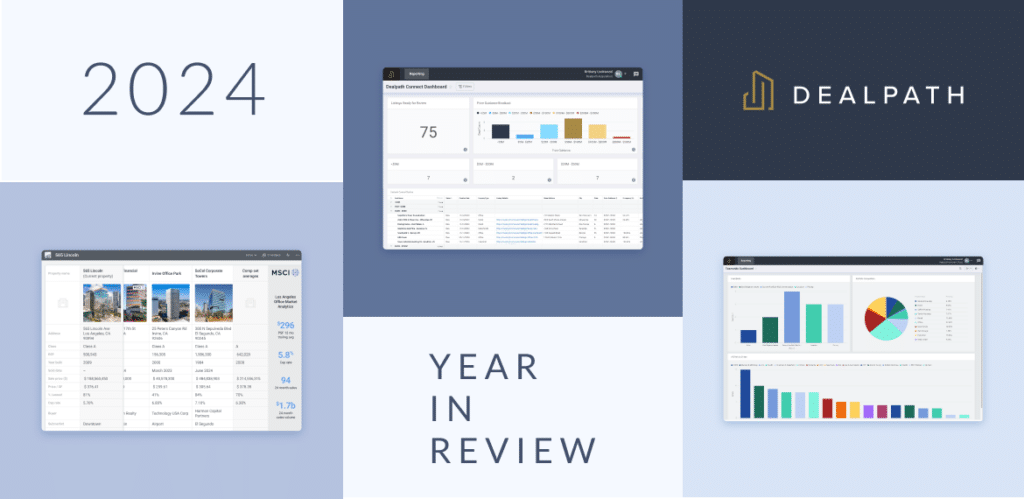

Dealpath’s 2024 Year in Review: Data, Insights & Scale

2024 brought seismic shifts to an already rapidly evolving commercial real estate market landscape. With interest rates beginning to normalize, market activity increasing, and firms mobilizing their data strategies to win in the age of AI, leading players sought new ways to adapt and seize opportunity. Throughout the year, our industry-leading team released numerous features […]

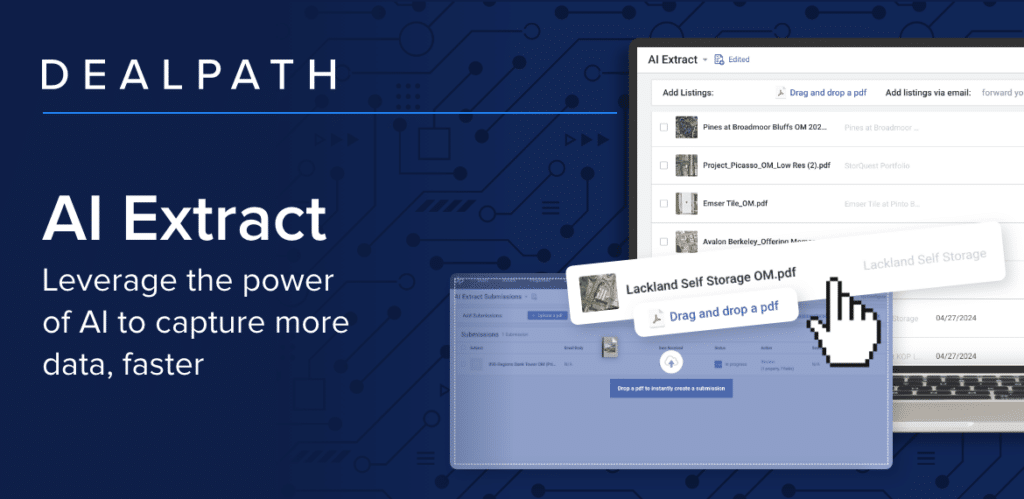

Introducing AI Extract

We’re excited to announce the launch of AI Extract—a new data extraction capability in Dealpath powered by AI. All real estate investment firms understand that data is key to decision making. However, a lot of valuable data is trapped inside of PDFs. That means teams either sink hours of time into manual data entry, or […]