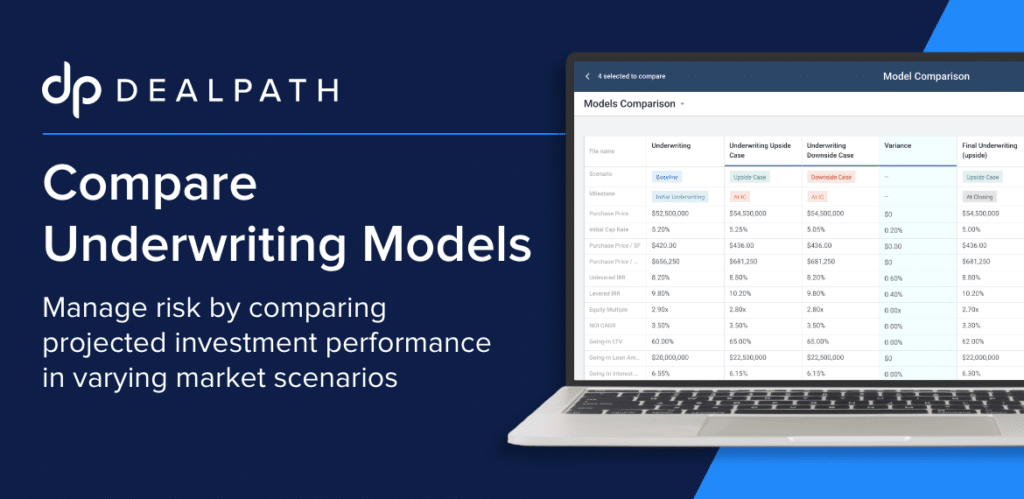

Compare Underwriting Models Side-By-Side in Dealpath

From double-checking the accuracy of your data to validating assumptions, well-informed underwriting lays the groundwork for every prudent investment decision. When you layer in inevitable shifts in market conditions, though, determining whether or not the deal will pencil can become challenging. We introduced a new underwriting model comparison feature back in November to help our […]

Dealpath’s 2023 Year In Review: AI, Precision & Efficiency

We take pride in driving innovation across the commercial real estate industry by shaping our product roadmap with insights from our industry-leading customers. In 2023, we launched more enhancements and features than ever before to empower institutional investors to maximize value creation. 2023 drove the commercial real estate industry to reconsider their investment strategies by […]

3 Reasons to Adopt Real Estate Deal Management Software

This blog post was last updated on Wednesday, November 29th. In today’s digital-first world of proptech, emails, spreadsheets and physical documents simply can’t offer the accuracy or agility required by modern deal teams. Speed, precision and scale can make the difference between capturing emerging opportunities and following the market’s lead. Real estate deal management software […]

Night of the Living Data: 5 Dead Deal Report Insights

There’s nothing spookier for CRE investment professionals than dusting the cobwebs off of an old spreadsheet or email to find dirty data, or that it simply disappeared into darkness. Rapid, granular data insights are now table stakes in the highly competitive CRE industry. Beyond real-time analytics and reporting, however, one largely untapped channel to fuel […]

How to Build a Commercial Real Estate Comps Database With OMs [Guide]

This blog post was last updated on Wednesday, September 13th. Investor intuition and market knowledge are invaluable as your firm evaluates deals, but data must be the bedrock of multi-million dollar investment decisions. Every real estate offering memorandum (OM) you review can add value to your investment decision-making–and more broadly, your institutional data advantage– in […]

From Implementation to ROI: Dealpath Customer Success Webinar Recap

Your data-driven real estate investment strategy is only as strong as the technology supporting it. Choosing a deal management solution provider is more than picking software off the shelf–it’s a strategic, long-term business decision that directly impacts your firm’s ability to harvest intelligence and build efficiencies. Back in June, the Dealpath team hosted a webinar […]

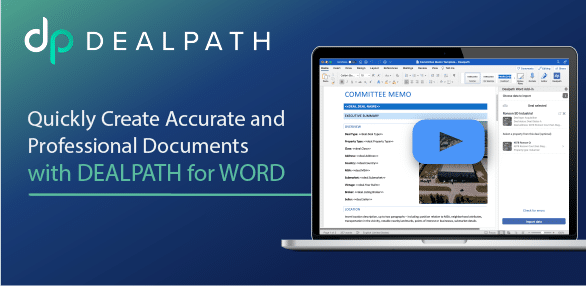

5 Real Estate Documents You Can Streamline With Dealpath for Word

Document creation can be time-consuming, cumbersome and error-prone. Dealpath for Word makes it easier and faster, leaving your team with higher-quality documents. Creating documents like investment memos and commitment letters is an essential part of the day-to-day work of commercial real estate investment and development firms. From sharing data to formalizing a loan agreement, these […]

The 4 Types of Commercial Real Estate Investment Strategies [Guide]

Institutional investors share the common goal of generating revenue by building a portfolio with compounding value, but different investors accomplish this in various ways. Depending on risk tolerance, fund specifications and expertise, there are several types of real estate investment, as well as real estate investment strategies, that investment managers can employ. Each strategy presents […]

3 Reasons to Reevaluate Your CRE Debt Origination Process

Siloed data and information often complicates the debt origination process, leaving teams to navigate challenging workflows fraught with friction and, ultimately, delaying closings. As the real estate industry undergoes a digital transformation with proptech, though, new deal management software has empowered firms to accelerate deal turnaround times and gain a competitive advantage. Rising capital costs […]

From Excel Jockey to Dealmaker: Prioritizing Strategy and Negotiation

Balancing repetitive weekly tasks with urgent, ad-hoc requests from leadership leaves real estate deal teams with minimal time to tackle strategic priorities. At the end of the day, the most important thing is that your pipeline is on track and leadership, whether that means the VP of Acquisitions or Managing Director, can see deals are […]