This blog post was last updated on Wednesday, July 9th.

Across the commercial real estate landscape, firms are evolving the way they execute deals—and due diligence is no exception. For institutional investment teams juggling multiple acquisitions, development, and debt deals, tracking documents and deadlines in spreadsheets, emails, and shared folders can quickly become a liability.

Without a systematized approach, teams risk delays, oversights, and a lack of clarity that can stall execution. Leading teams are evolving their process; rather than simply managing checklists, they’re digitizing them by building standardized, collaborative workflows that reduce risk, streamline execution, and scale with their investment strategy.

In this post, we’ll explore how leading firms are scaling execution by turning their due diligence process into a structured, repeatable, and collaborative workflow. We’ll also walk through what a real estate due diligence checklist typically includes to support that transformation.

The Problem With Manual Real Estate Due Diligence

Nearly all investment teams have deep expertise in due diligence, from identifying the necessary checklist steps to ticking them off. The challenge, however, is execution on a long checklist of tasks that could vary from deal to deal.

When due diligence workflows rely on siloed tools and tracking systems, teams encounter significant problems, such as:

- Lack of repeatable processes, requiring teams to reinvent the wheel each time

- Unclear task ownership, creating execution gaps and sowing doubt among stakeholders

- Inefficient and duplicative collaboration, both internally and with third parties

- Missed steps that introduce financial, legal, or reputational risk

- No visibility into the latest deal documents

- Compliance gaps due to scattered documents

In a competitive environment where speed and accuracy are everything, these process gaps make it harder to scale.

From Static Checklists to Automated, Scalable Real Estate Due Diligence Execution

Even the best real estate due diligence checklist falls short without clear ownership, efficient workflows, and real-time visibility. That’s why high-performing firms are moving from manual processes to digitized systems that standardize execution at scale.

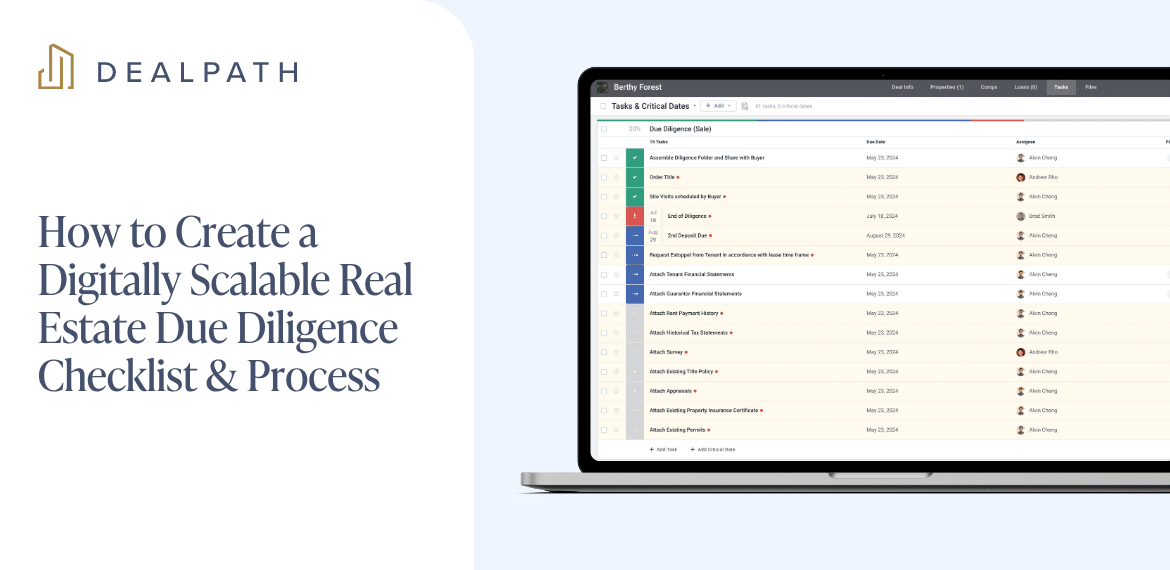

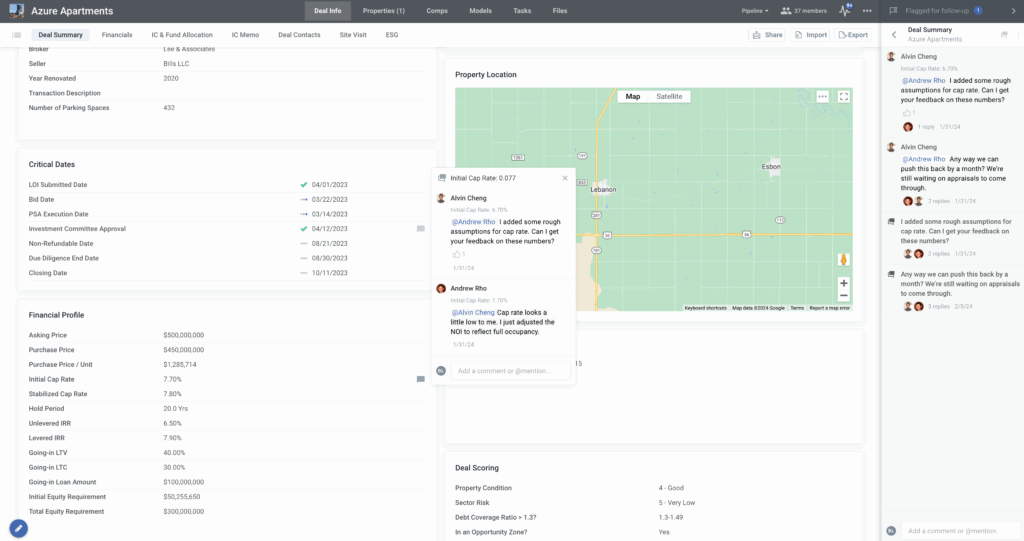

With Dealpath, firms can streamline execution by automating workflows like due diligence, keeping every task, document, and update centralized in one firmwide platform.

Reduce Risk With a Structured, Repeatable Process

Before digitization: Teams rebuild their process from scratch for every deal, depending on memory and outdated or untailored checklists—often missing key steps.

After digitization: Teams follow a structured, repeatable workflow that guides them through every step, ensuring consistency even under tight timelines.

Without a purpose-built system, teams often reinvent their diligence process for each deal—losing time and consistency along the way. That lack of structure not only slows things down, it opens the door to real risk—whether it’s a missed task, an outdated document, or an approval that was never formalized.

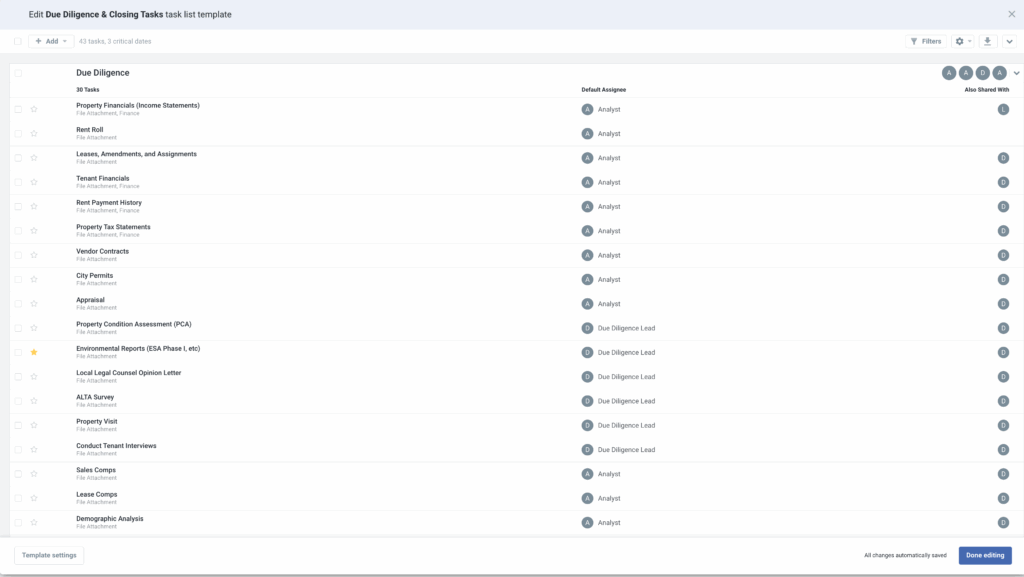

Standardizing your diligence process in Dealpath means your team follows a proven playbook for every deal. Role-based task templates ensure your team never misses another checklist item, and automated workflows keep teams on task without manual inputs.

As your team grows, these templates help new employees ramp quickly, parlaying institutional knowledge and ensuring reliable execution from day one.

Execute With Accountability and Speed

Before digitization: Teams lack clear task ownership, miss deadlines, and chase updates across spreadsheets and inboxes.

After digitization: Teams clearly define responsibilities, and maintain real-time visibility into diligence timelines to keep deals moving without bottlenecks.

When teams juggle dozens of checklist items across functions, small execution gaps can create big setbacks. Without a standardized approach to task management, it’s easy for responsibilities to blur and critical steps to fall through the cracks.

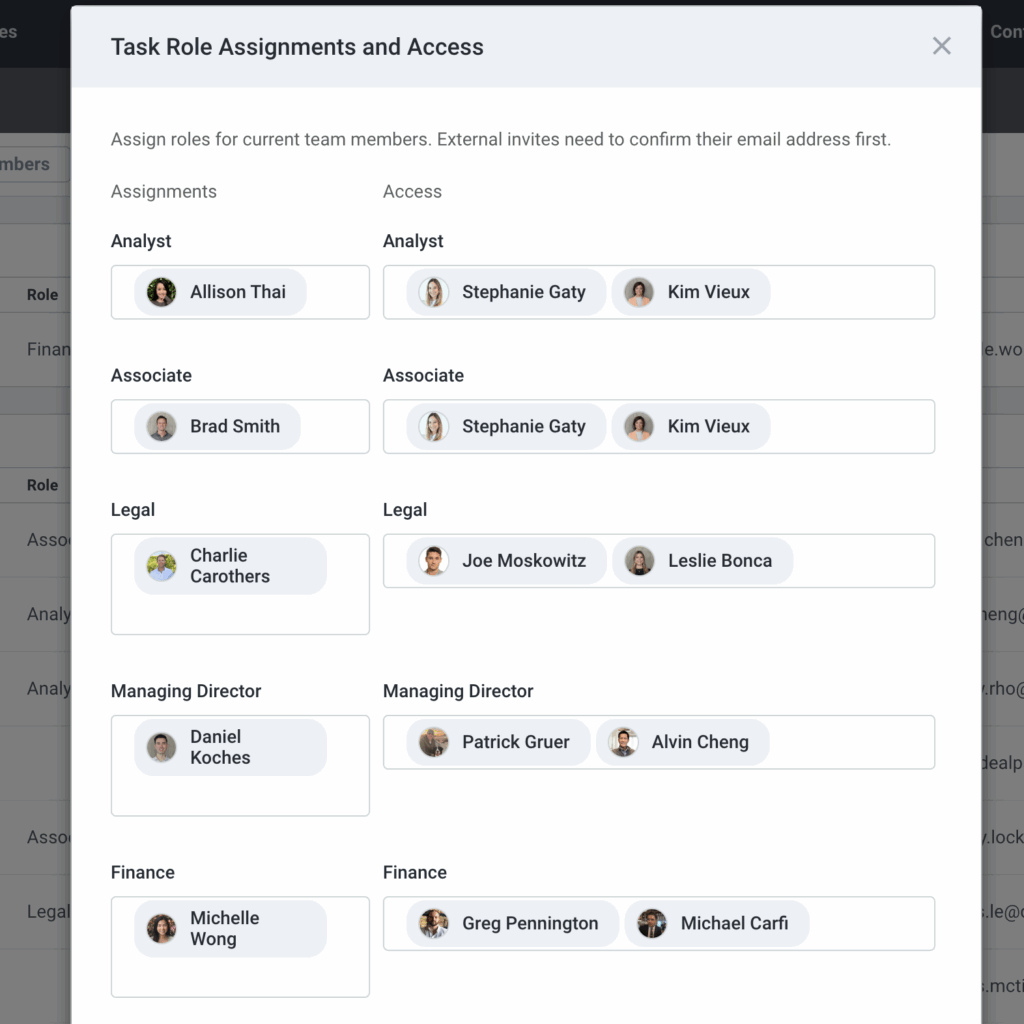

Systematizing due diligence with Dealpath brings clarity and control. Role-based workflows automatically assign tasks based on team member roles, establishing accountability from day one. Smart notifications and reminders help team members stay on top of critical dates and deliverables without requiring manual check-ins.

Just as importantly, real-time visibility into every deal allows leaders to spot blockers early and act decisively. The result is a faster, more responsive deal process that gives your team a competitive edge—especially when your team has a pipeline of deals waiting to be prioritized.

For example, an analyst responsible for ordering a zoning report would receive an automated reminder in Dealpath, keeping the task visible and trackable for the entire team.

Collaborate Seamlessly—Internally and Externally

Before digitization: Teams manage collaboration across silos like emails, spreadsheets, and meetings, making it difficult to stay aligned and up to date.

After digitization: Teams communicate in one centralized platform, collaborating in real time with internal stakeholders and external partners—always with the right context and controls in place.

In traditional spreadsheet or email workflows, updates trickle in slowly, causing deal information to be scattered across multiple platforms. Internal teams struggle to align, while outside parties—like attorneys, consultants, and environmental specialists—can only access outdated documents with incomplete context. These silos create delays, duplicative work, and costly confusion.

With Dealpath, collaboration happens in real time and with complete context. Teams and leadership can comment directly on tasks or data, view and update the latest documents, assign work with full visibility, and track progress without leaving the platform. External stakeholders can be granted controlled access to specific fields, documents, or workflows—ensuring they contribute without creating risk.

Digitized collaboration leads to a faster, more transparent process that keeps everyone on the same page. With all details logged in one place, teams can streamline–or even eliminate–due diligence tracking meetings.

Maintain a Clear Audit Trail of Decisions and Approvals

Before digitization: Teams struggle to memorialize approvals, comments, and context, making it difficult to retrace steps or defend decisions.

After digitization: Teams document every decision in Dealpath, creating a clear trail of who did what—and when—so nothing is lost to time or turnover.

Institutional memory shouldn’t hinge on one employee’s inbox. But too often, key decisions are made over email, logged in trackers, or not captured at all. That creates problems down the line—whether you’re trying to onboard new team members, revisit an old deal, or audit historical activity.

Dealpath records every task, comment, approval, and document version in a centralized location. This not only simplifies compliance and governance—it also makes your team more agile as they execute deals and respond to questions. When institutional knowledge is preserved by the platform, you can move forward faster, with full confidence in the decisions behind you–without exerting time specifically on conserving information.

Real Estate Due Diligence Checklist [Sample Template]

While every real estate firm’s due diligence checklist varies, the items below are among the most commonly required. This list is intended as a reference—depending on your strategy and buy box, there may be additional items to verify.

Legal & Title Due Diligence

- Review the title report: Confirm current legal ownership and identify any liens or claims

- Evaluate use restrictions: Identify covenants, conditions, restrictions, and reservations that govern how the property can be used

- Examine the ALTA survey: Map property boundaries and locate easements or encroachments based on topographical surveys

- Verify zoning compliance: Interview local municipality to ensure land use aligns with local regulations

- Collect certificates of occupancy: Confirm that buildings meet code requirements

- Identify easements and encroachments: Assess access rights or conflicts with neighboring properties

- Confirm entity documentation: Validate legal structure and standing of buyer and seller

Financial Due Diligence for Commercial Real Estate

- Analyze the rent roll: Understand leases, tenant mix, and rental income

- Review historical operating statements: Evaluate revenue, expenses, and NOI trends

- Check real estate tax bills: Assess current and potential property tax exposure

- Audit utility bills: Review historical costs and ensure continuity of service

- Validate budget and CapEx plan: Confirm assumptions for upcoming capital improvements

- Reference recent appraisals: Compare current deal valuation to prior assessments

- Review current insurance policies: Understand existing coverage and any filed claims

- Evaluate service contracts: Identify cancellation clauses and potential penalties

- Research area demographics: Assess population, income, and employment trends

- Perform a competitive analysis: Benchmark nearby assets and leasing activity

- Compare deal comps: Evaluate selling price against recent comparable transactions

- Benchmark lease terms: Compare financials to similar leases in the market

- Analyze year-over-year cash flow: Track performance trends and identify anomalies

Environmental, Structural & Insurance Due Diligence

- Conduct a Phase I ESA: Assess environmental risks, ESG flags or contamination concerns

- Review the PCR: Evaluate property condition and deferred maintenance

- Obtain an appraisal: Confirm valuation and compare against market benchmarks

- Audit insurance coverage: Verify policy details and identify potential gaps

Tenant & Lease Due Diligence

- Summarize lease abstracts: Highlight key terms, options, and tenant obligations

- Collect estoppel certificates and SNDA agreements: Validate lease details, ensure there are no material disputes, and verify protection of tenant rights in foreclosure scenarios

- Examine arrears report: Identify late payments and tenant risk exposure

- Request tenant profiles and financial records: Review tenant credit ratings, business health, sales reports, aged receivables, security deposit details, and operating history

- Interview current tenants: Surface potential operational or maintenance issues early

- Evaluate CAM obligations: Understand how tenants contribute to building maintenance fees and shared costs

Documents and Final Legal, Financial & Investment Approvals

- Review the letter of intent and client authorization letter: Ensure mutual understanding of deal terms and authorization to proceed

- Review the purchase agreement: Confirm finalized terms, pricing, and contingencies

- Review the property’s legal description: Validate legal boundaries and consistency with other documents

- Identify pending or active litigation: Surface legal issues that could impact future ownership

- Review loan documents: Confirm debt structure, covenants, and lender terms

- Submit the IC memo: Summarize diligence findings and investment rationale

- Complete the final closing checklist: Ensure all documents are signed and funds are ready to close

A well-maintained checklist is more than a compliance box—it’s a strategic safeguard that empowers teams to stay aligned, drive accountability, and complete diligence with confidence.

See How Dealpath Powers Efficient, Scalable Due Diligence

As real estate transactions grow more complex, due diligence execution has become one of the biggest opportunities for teams to elevate operations. Legacy tools like Excel and email may have worked, but they weren’t built to support the agile strategies that many firms are executing today.

Dealpath offers a modern, purpose-built solution for streamlining execution—bringing structure, visibility, and accountability to your investment process.

With Dealpath, your team can:

- Execute deals using standardized, role-based workflows

- Collaborate with internal and external stakeholders in one platform

- Track every task, comment, and document in real time

- Create a clear audit trail for approvals and compliance

Dealpath empowers your team to take control of the due diligence process with a system designed to eliminate friction, standardize execution, and move deals forward with precision. Request a demo to learn why industry leaders like Blackstone, Nuveen, CBRE IM, MetLife, and LaSalle Investment Management trust Dealpath to power their investment strategy.

Request Demo