We take pride in driving innovation across the commercial real estate industry by shaping our product roadmap with insights from our industry-leading customers. In 2023, we launched more enhancements and features than ever before to empower institutional investors to maximize value creation.

2023 drove the commercial real estate industry to reconsider their investment strategies by strengthening data-driven decision making, reducing manual work to prioritize impact, and upleveling risk management.

Throughout 2023, we invested tens of millions in product development, orienting our product roadmap and our team of 50+ Silicon Valley engineers to solve for these challenges by helping our customers:

- Elevate firmwide visibility into deal pipeline and investment performance

- Improve operational efficiencies by automating repeatable tasks

- Strengthen underwriting with a clearer view into how market conditions impact performance

Read on to learn about the most impactful new features that make Dealpath the real estate industry’s most trusted deal management solution.

Jump to:

- Newly Enhanced Comps Database

- Streamlined Model Comparison

- Automated Data Ingestion

- Integrated Document Creation

- Tools for Debt and Asset Teams

- Dealpath Mobile

- Approval Tracking

- AI-Powered Search

- Conversations & Reporting Dashboards (Coming Soon)

- AI-Powered Investment Summary & Memo Generation (Coming Soon)

- Supporting Institutional Investors Across the Globe

Looking Back on Innovations and New Releases in 2023

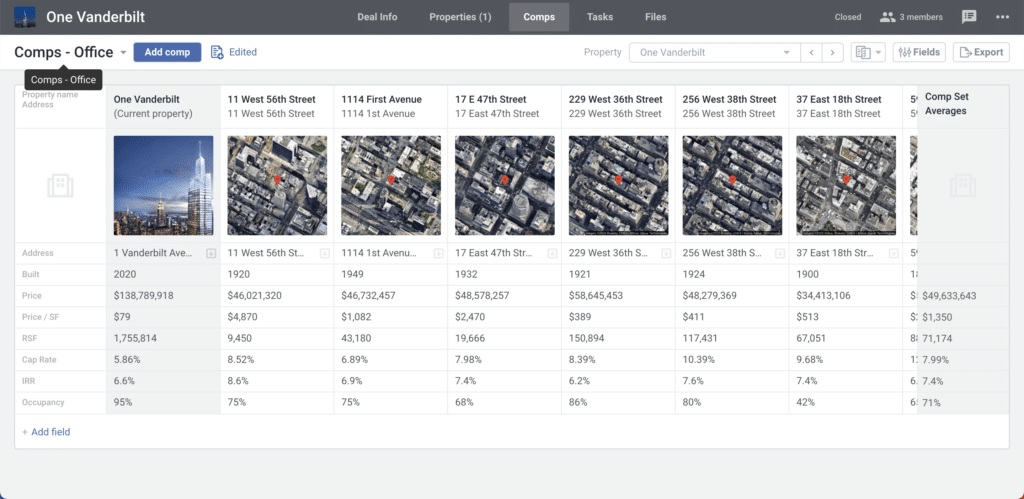

Newly Enhanced Comps Database

Referencing sales comps is an essential part of your deal evaluation process, so it shouldn’t be difficult or time-consuming. The more streamlined your comps sourcing process is, the faster you can underwrite and prioritize the best deals.

We enhanced Comps in Dealpath in 2023, enabling users to leverage existing properties and historical deals to create comps for more informed decisions. Every Comp you create becomes part of a proprietary database aggregating your team’s unique market intelligence for an unrivaled competitive edge.

Learn how to build a CRE comps database with OMs

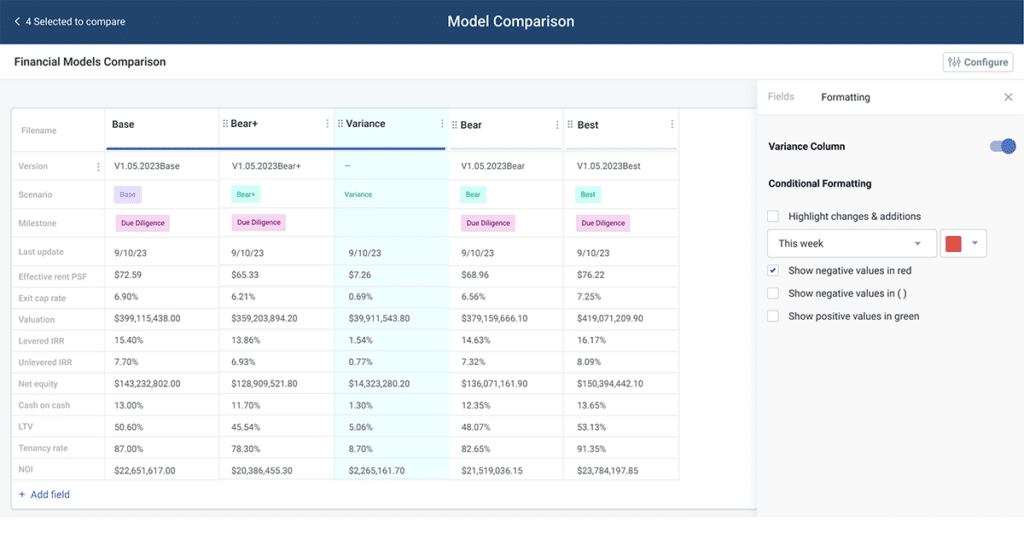

Streamlined Model Comparison

Even if your team has financial modeling down to a science, it’s hard to make informed decisions without visibility into how return profiles change with market conditions.

Dealpath’s easy-to-use model comparison tool helps teams quickly identify which deals pencil out, even if the most challenging scenario comes to fruition.

Every model version can be viewed, filtered and sorted by milestone, creator, date and more, making it clear which scenarios are being compared and which information is most up-to-date. Hand-pick the comparison metrics, dashboards and mappings for each property type for a focused and curated underwriting process.

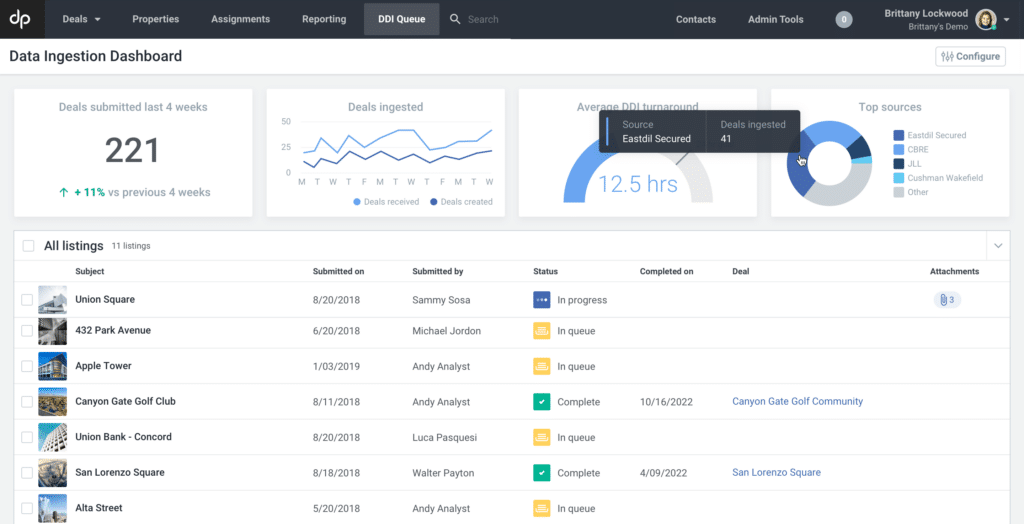

Automated Data Ingestion

Dealpath Data Ingestion (DDI) gives teams a streamlined and effortless way to capture new deals in Dealpath, taking the strain of cumbersome manual data entry off of your already limited resources.

As you receive new listings, DDI eliminates manual, time-consuming work and seamlessly creates new pipeline opportunities. This means you can prioritize deal analysis while building a proprietary deal database to help inform the most important investment decisions.

In 2023, we introduced a DDI dashboard, giving teams an easy jumping-off point to track and kickstart analysis on all the deals that come across their desk–whether they become viable opportunities or simply market intelligence. A new version of DDI, supercharged by AI, is currently in beta testing with plans for general release to existing customers early next year.

Schedule a meeting to learn more and join the beta

Integrated Document Creation

Document creation is an essential part of the day-to-day work of commercial real estate teams. Documents must be professional, include company colors and logos and, most importantly, be accurate when presented to internal and external stakeholders. But creating them is time-consuming–especially when you have to enter data points one-by-one.

Dealpath’s add-in for Microsoft Word enables teams to instantly pull Dealpath data like asking price, IRR and more into documents like LOIs, IC memos and PSAs without spending time on manual entry or double-checking accuracy.

Learn 5 CRE document types you can streamline with Dealpath for Word

Tools for Debt and Asset Teams

We expanded Dealpath’s capabilities for debt investment teams, allowing for further customization, tracking and reporting of various loan types. This provides even deeper insight into your debt pipeline, particularly when various debt instruments are part of the same transaction.

We also introduced more tools to support the transfer of knowledge from deal teams to asset management teams, further breaking down data silos and preserving accurate historical reporting for all transactions.

Learn how to harness proprietary data to inform debt investment decisions

Dealpath Mobile

At the beginning of the year, the newest version of the Dealpath mobile app was released, enabling on-the-go decision making with data at your fingertips. That means no more waiting to get to a computer to enter new deals, make key updates to in-flight projects or pull up valuable market data.

Learn more about on-the-go dealmaking with Dealpath Mobile

Approval Tracking

A streamlined approval process is essential for moving quickly on the right deals and managing risk at scale, so we introduced enhancements that give approvers more contextual data at their fingertips for mission-critical decisions. This includes deal summaries and approval comments that become part of an automated record the moment the approval process is complete, creating a zero-effort audit trail.

Learn how to request, approve and track tasks in Dealpath

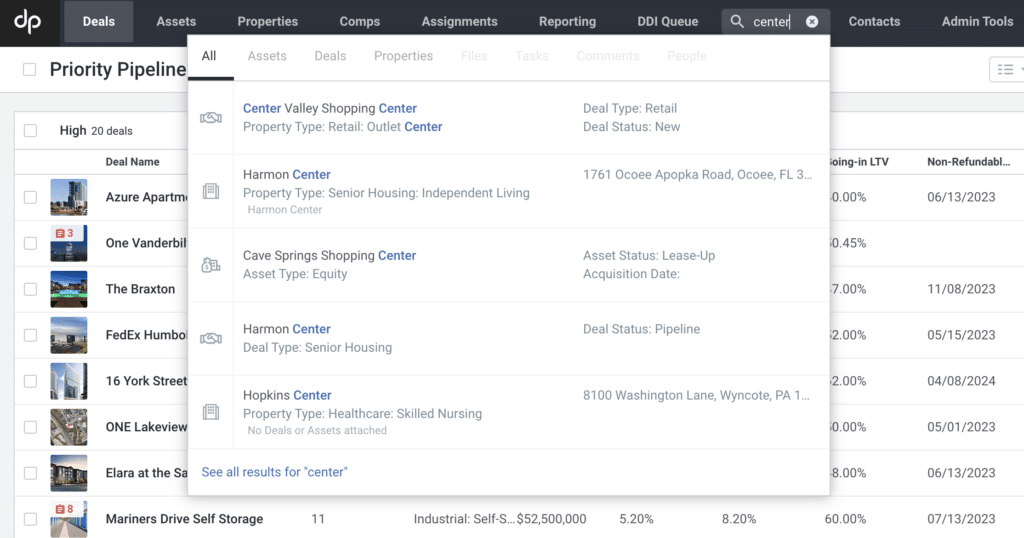

AI-Powered Search

First launched in 2022, Power Search in Dealpath leverages machine learning technology to put everything that was once frustratingly unsearchable or difficult to find at your fingertips, with recent AI-powered enhancements. Instantly surface the most accurate results within your deal database, including text within images and PDF documents, to maximize time savings with a smart search interface.

Learn how to surface relevant deals and information with Power Search in Dealpath

Conversations & Reporting Dashboards (Coming Soon)

Arriving early in 2024, conversations will help teams have a focused dialogue about a particular data point or aspect of a given deal, while reporting dashboards will provide even more sophisticated visualizations of pipeline and investment performance.

AI-Powered Investment Summary & Memo Generation (In Development)

Fueled by the contents of an OM or flyer, users will soon be able to generate a clear, concise deal summary highlighting the merits and risks of a deal to rapidly identify if the deal is aligned to the investment strategy.

Schedule a meeting to learn more

Supporting Institutional Investors Across the Globe

Our commitment to ongoing product innovation has yielded demonstrable results, including thousands of new users and expansions across hundreds of accounts. The Dealpath Leadership Team traveled to Dallas, Toronto, London, San Francisco and New York for roundtable discussions on the future of AI-powered real estate investment management to inform our product roadmap.

In addition to innovating new solutions for existing clients like Principal Real Estate, Nuveen Real Estate, Bridge Investment Group, UBS and other top institutional investors, we were proud to welcome a groundswell of new clients.

In 2023 alone, we completed over 75 unique implementations for institutional clients, including CBRE Investment Management, Gaw Capital, LaSalle Investment Management, DWS, Newmark, Sumitomo, Essex Property Trust, and Centurion, with headquarters ranging from Milan, Italy, to Toronto, Canada, to the U.K., and across over 40 cities in the U.S.

Each client received a bespoke configuration, and included professional consulting services to create alignment with key goals, KPIs and investment strategies. Following this implementation, these customers continue to enjoy white-glove customer service from our team of 20+ customer success professionals based in North America that specialize in CRE. Our post-implementation NPS score was 70.

Dealpath proudly supports 7 of the top 10 institutional investors globally, and is ranked the #1 Real Estate Deal and Portfolio Management Solution for:

- Acquisitions

- Dispositions

- Development

- Loan Origination

Industry Awards & Office Expansions

Over the course of the year, Dealpath and its leadership team continued to receive broad recognition for category-defining solutions that have transformed the real estate investment management industry, including:

- Built In 50 Best Startups to Work for In San Francisco 2023

- Business Insider Hottest Proptech List

- Connect CRE Next Generation Awards

- Crain’s Notable Leaders in Real Estate

- GlobeSt. Best Places to Work 2023

- GlobeSt. Tech Influencers 2023

- NYREJ Women in Real Estate Spotlight

- Proptech Breakthrough Awards

- Realcomm Digie Awards

- San Francisco Business Times Largest Greater Bay Area Proptech Companies

We also opened new, expanded offices in New York, Toronto and Austin, in addition to our San Francisco headquarters.

Schedule a Meeting About the Future of AI-Powered Deal Management

From OM ingestion to portfolio management, Dealpath offers real estate investment managers the most innovative suite of end-to-end tools to build operational efficiencies and supercharge data-driven decision making. To modernize your firm’s processes and maximize value creation in 2024, schedule a meeting.

Schedule Meeting