This post was last updated on March 15, 2022.

To build conviction to act before the competition and close deals faster, deal teams must prioritize the most lucrative pipeline deals while keeping stakeholders informed. Unfortunately, your data is only as valuable as it is accurate. Managing, tracking, and updating data within disparate spreadsheets complicates manual reporting, creating time-consuming work that could yield questionable results. To overcome these challenges in an increasingly data-driven market, modern deal teams have turned to real estate reporting software within a deal management tool.

Managing your firm’s pipeline in a deal management tool creates a significant competitive advantage, unifying deal teams around real-time data at their fingertips. Automating these reports based on programmatic data flow enables dealmakers to make decisions in real time, all while evaluating more deals. Read on to learn about the six reports leading institutional investors automate in real estate investment management software, as well as best practices for creating actionable reports.

- Actionable, Reliable Real Estate Reporting Is Essential in Today’s Competitive Market

- The Top 6 Reports Investors Should Automate With Real Estate Reporting Software

- More Burning Questions Your Firm Can Answer With Real Estate Reporting Software

- Commercial Real Estate Reporting Software Best Practices: Simple and Scalable

Actionable, Reliable Real Estate Reporting Is Essential in Today’s Competitive Market

Whether you’re screening new deals in your pipeline or searching for data to back your investment thesis, real estate reporting software has become an essential tool. Deal management platforms like Dealpath that track deal data in real time open a new world of possibilities for sophisticated deal teams. Slicing and dicing real-time data analytics makes it possible to turn that data into answers in seconds or minutes–even in the middle of an Investor Committee meeting.

The right real estate reporting software can make all the difference in how you analyze deals, monitor your pipeline, and mitigate risk as part of your investment strategy.

The Top 6 Reports Investors Should Automate With Real Estate Reporting Software

What information does your deal team and senior management need to keep a real-time pulse on your pipeline and other strategic priorities? Whether your deal team includes 10 or 100 people, automating reports builds powerful efficiencies, enabling your firm to act with competitive intelligence at its fingertips.

Before selecting real estate reporting software, confirm that the solution can programmatically create these reports.

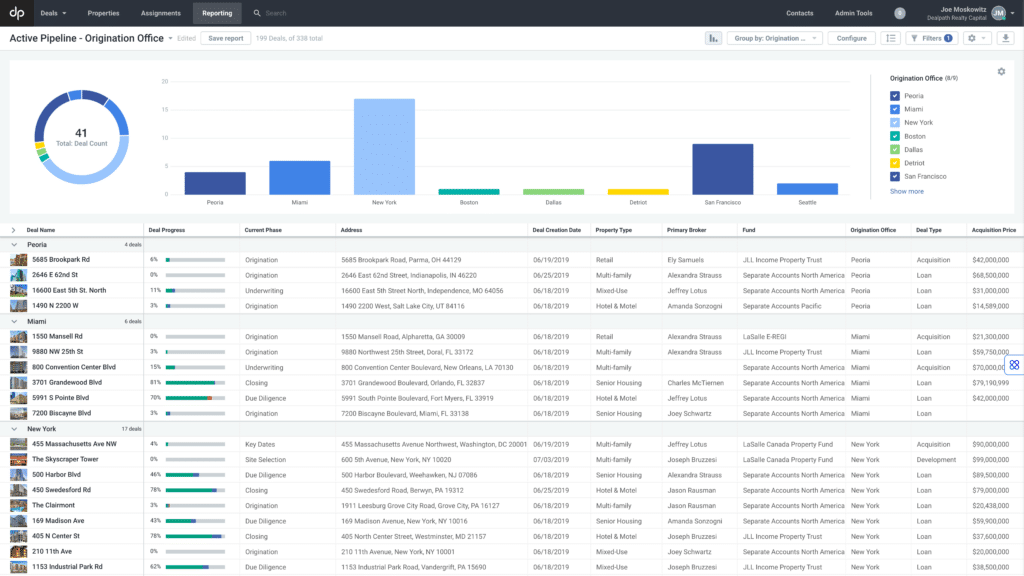

1. Pipeline Report

The Bottom Line: Pipeline reports provide a snapshot of current deals in progress and where they stand

Because pipeline reports provide a quick glimpse into currently active deals, many teams run weekly meetings based on them. Reviewing key details like deal progress, type, property type, bid date, square footage, price/unit, and financial metrics like cap rates simplifies apples-to-apples comparisons.

Automated pipeline reports in Dealpath’s real estate reporting software can be tailored to specific stakeholders with only relevant information. They can also be broken down with a secondary grouping, like the region, which is another method of curating relevant data for stakeholders.

2. Critical Dates Report

The Bottom Line: Critical dates reports provide a high-level overview of upcoming and past action items for deals in your pipeline

Pipeline reports illustrate current deals, but how can you view the work remaining for each one? Rather than digging into each deal to uncover upcoming milestones, many teams utilize critical dates reports to visualize and understand current and future priorities. Building critical dates reports for historical deals can also showcase a typical deal lifecycle.

Firms can assign critical dates for every deal directly to users in Dealpath, ensuring important work never slips through the cracks.

3. Deal Lifecycle Tracking Report

The Bottom Line: Deal lifecycle tracking reports help you uncover operational metrics to analyze deal flow and adjust investment strategies

Beyond real-time updates, real estate reporting software can also help investment leaders to better strategize and align their efforts by answering questions. How long does it typically take for a deal to move from sourcing to closed, or until the letter of intent is submitted? Does that timeframe vary among retail, multifamily and industrial deals?

Deal lifecycle tracking reports help firms understand operational metrics related to deal flow, allowing them to identify gaps in their processes and adjust investment strategies accordingly. Some timeframes that deal lifecycle reports should track include:

- Time to close

- Deal creation to LOI submission

- Deal creation to bid

- LOI submission to bid

- LOI submission to contract

In Dealpath, firms can precisely control which metrics are included to build the most insightful reports possible.

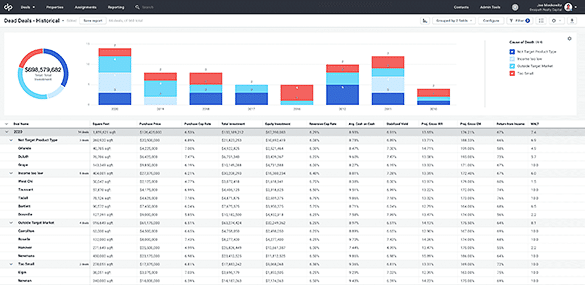

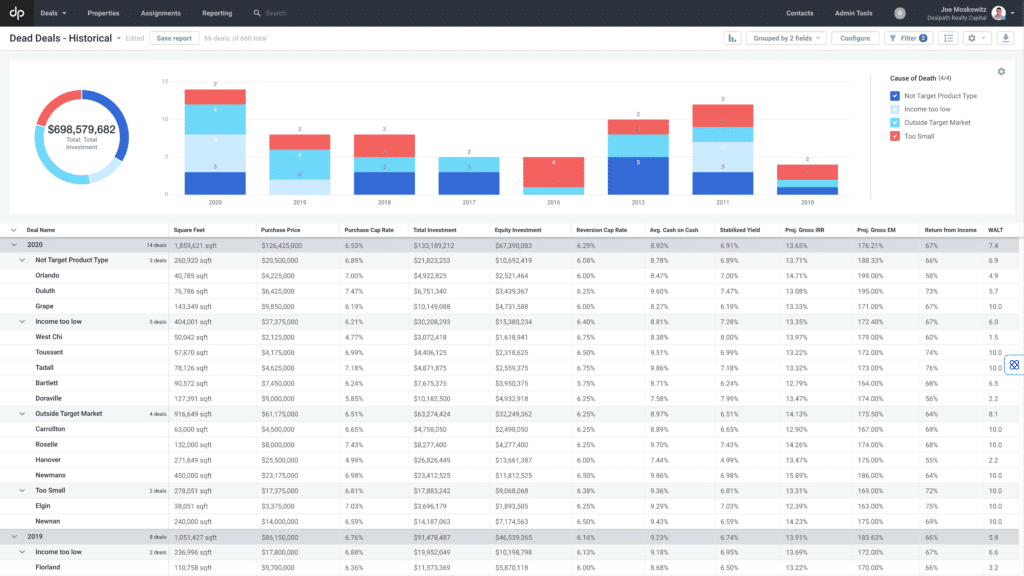

4. Dead Deal Analysis Report

The Bottom Line: Dead deal analysis reports help firms determine which deal types die sooner or more often than others, and analyze why

As deals in your pipeline move to dead, including a “dead reason” about why the deal died in Dealpath allows you to generate a dead deal analysis report. When your firm’s investment strategy involves a diverse range of property types, regions, and other variables, dead deal analysis reports help you uncover insights about which deals die most often, fastest, and overall, note trends about why certain deals die.

Analyzing dead deals allows your firm to hone in on the opportunities best aligned to your investment strategy. For example, the data might show that retail properties in the Midwest tend to die much earlier than comparable properties in the Southeast. Consequently, your firm can allocate more resources toward properties in the Southeast.

5. Staffing Workload Tracker Report

The Bottom Line: Staffing workload tracker reports help decision makers understand team workloads to allocate resources and delegate new deals accordingly

Which team members are currently at maximum capacity? Who can take on new deals, or help other team members with high-priority deals? Staffing workload tracker reports help decision makers to visualize their team’s workload and evenly delegate responsibilities.

If certain deals are approaching a critical date and the assigned team member needs support, managers can find a solution. Including anticipated deal closing dates in this report also helps firms identify when team members will regain bandwidth.

6. Development Budgeting Report

The Bottom Line: Development budgeting reports help teams maintain oversight into development deals and corresponding costs as projects progress

Throughout ongoing development projects, new, unanticipated costs often affect projected budgets. Real estate reporting software can help your firm to stay abreast of overages before they become problematic.

Teams that use Dealpath frequently create development budgeting reports that include total budgeted costs, actual project costs, and the difference, highlighting any discrepancies or overages. Based on these numbers, your firm can adjust its budget accordingly.

More Burning Questions Your Firm Can Answer With Real Estate Reporting Software

Capturing and preserving data in real estate reporting software also presents other new opportunities for deal teams to tap into these insights. Beyond automated reporting, deal teams can also answer questions based on institutional knowledge:

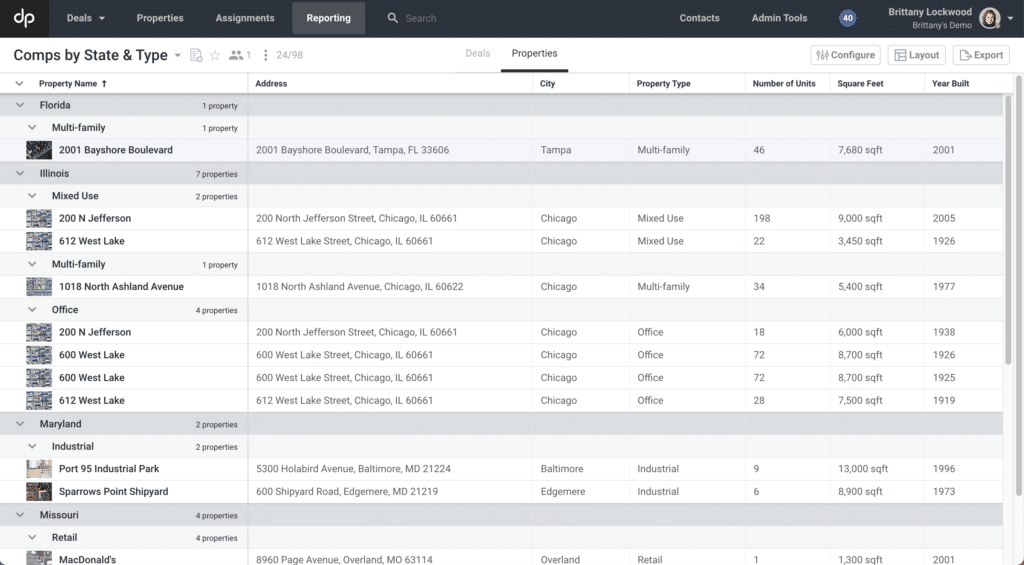

- Relevant comparables: search your proprietary deal database to surface relevant comps based on certain details to compare apples to apples

- Annual deal volume: set quantifiable goals as your firm sources more deals to build even greater investment optionality

- Strongest broker relationships: view your pipeline or closed deals to determine which broker sources the most profitable deals

- Dead deal reasons: capture “dead reasons” for every deal in your pipeline and preserve this institutional knowledge

- Pipeline stage length: identify potential bottlenecks in your pipeline and modify deal processes to overcome them

Commercial Real Estate Reporting Software Best Practices: Simple and Scalable

Leverage Consistent, Standardized Data

Standardizing the way you organize data empowers your firm to analyze information in a more systematic manner. As institutions turn to data-led strategies, managing this in Excel is no longer scalable.

To derive maximum value from real estate reporting software, reconsider which data points are valuable in every deal. Capturing this data ensures that you can create valuable reports that answer all questions, all while building your proprietary deal database.

Use Dropdown Fields To Create Team-Wide Alignment

Dropdown fields can be a powerful tool for enforcing data hygiene, which can otherwise fall by the wayside. Requiring team members to select from designated options eliminates the possibility of misspellings or various acronyms. For example, some team members may classify office properties as “Class A”, while others could input “A” or “CL A”.

With uniform naming conventions, your team can freely filter deal data and group deals in a dashboard or report without concern for inaccuracies.

Seamlessly Ingesting Deals and Capturing All Relevant Information

Selecting a deal management platform that offers seamless data ingestion eliminates manual data entry, while also ensuring that all relevant information is captured for posterity. This mitigates the risk of inaccurate or incomplete data, which could otherwise hinder competitive intelligence in the future.

Building a Competitive Advantage With Real Estate Reporting Software

Leveraging every fragment of data your firm collects throughout the investment process is critical for building a competitive advantage, but rarely simple. Real estate reporting software and tools within deal management software can empower you to turn data into answers with real-time pipeline visibility, as well as the ability to slice and dice data in seconds.Watch our webinar to learn how your firm can lead with data at every stage of the investment lifecycle, from sourcing through closing.

Watch Webinar On-Demand