Real Estate Development Software: 6 Factors to Consider

This blog post was last updated on March 1st. Managing development projects involves much more than just ticking off a few boxes. From budget oversight to permit applications, legal reviews, feasibility analyses and, ultimately, delivery, commercial real estate developers face the challenge of remaining organized, aligned and deadline-driven across all projects. As the industry deepens […]

Real Estate Investment Management Software: Complete 2023 Guide

This post was last updated on Wednesday, February 22nd. To outperform competitors and exceed investor expectations, real estate investment managers need a data-driven strategy with seamless execution. As the market responds to a new landscape where speed is a must, competitive strategies powered by real estate investment software have become vital. From historical deal benchmarks […]

3 Meetings Your Firm Can Run (Or Eliminate) With Dealpath

For real estate deal teams seeking to compete in a cutthroat $18 trillion market, collaborating in lockstep from source to close is vital. While simple in theory, alignment can be difficult to achieve when teams are managing their pipelines with spreadsheets, emails and post-it reminders. Even slight confusion on details like closing dates or underwriting […]

What Is Proptech? Understanding Commercial Real Estate Technology

This blog post was last updated on Wednesday, February 8th. It’s no surprise that real estate, as the world’s largest asset class, offers ample opportunity for institutional investors and individuals willing to pursue it. Even as new trends emerge, like the shift to remote and hybrid working, real estate maintains its importance as a fixture […]

2 CRE Experts Discuss Navigating a Challenging Market in 2023

It’s no secret that inflation, rising interest rates, supply chain issues and global market volatility have forced institutions to reevaluate, pivot and reprioritize investment strategies. Commercial real estate retreated from record-breaking transactional volume in 2021 to the safety of tighter criteria in 2022, as recessionary signals, a 4.5% increase in interest rates and global market […]

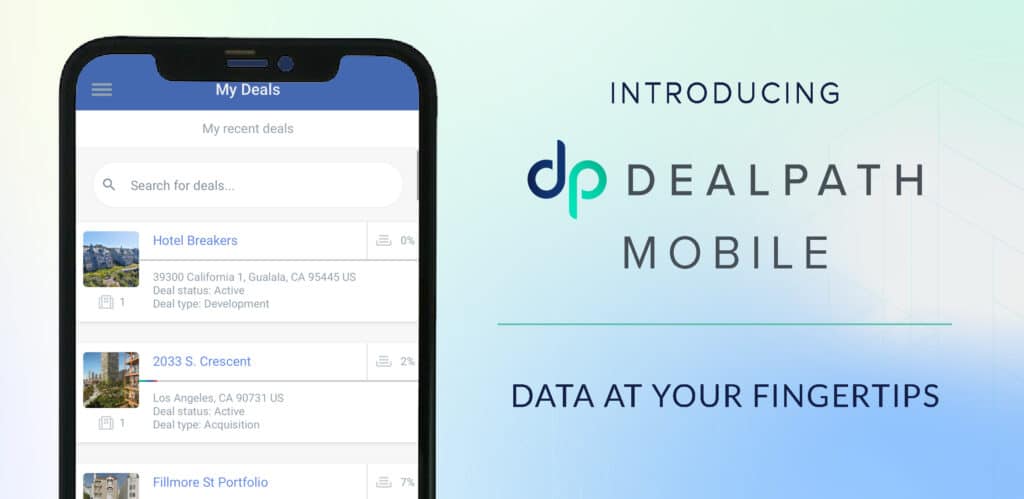

Introducing Dealpath Mobile: Manage Your Deals On The Go

In the fast-moving commercial real estate industry, you can’t afford to miss the latest pipeline updates–even when you’re away from your desk. We’re thrilled to announce the launch of Dealpath Mobile, which will allow you to manage your pipeline wherever you are! Deal teams can now track, manage, screen, analyze and update deals on the […]

Real Estate Data Analytics: 5 Key Investment Insights & Value Drivers

This blog post was last updated on Thursday, February 9th. In recent years, real estate investment managers have transacted at a higher volume and velocity than ever before. Ever-growing access to data–and powerful new platforms to harness this competitive intelligence–have played no small role in this transformation. Armed with real estate data analytics software driven […]

Overcoming Dirty Data: 5 Tips to Achieve Clarity & Integrity

Every investment should be guided by data, but is the data you rely on to deploy millions in capital accurate? Dirty data, or inaccurate reporting stemming from miskeyed information and technology inconsistencies, has plagued the commercial real estate industry for decades. A Gartner study showed that bad data can cost companies 15% of their revenue, […]

What Is a Net Lease in Real Estate? [Definition & Complete Guide]

From thoughtful underwriting to comprehensive due diligence, real estate investors employ a number of tactics and strategies to surface profitable deals with the right risk profile. Net lease real estate agreements, in which credit tenants take on some property ownership costs, are a popular method for institutions to generate stable, low-risk cash flow over the […]

Income Approach Appraisal: Direct Capitalization Method Explained

Quickly and precisely appraising a property’s value early on in your deal evaluation is critical to keeping pacing in today’s market environment. The income approach to appraisal allows investors to calculate a property’s market value based on the income it’s currently generating. An informed understanding of a property’s current cash flow enables investors to more […]